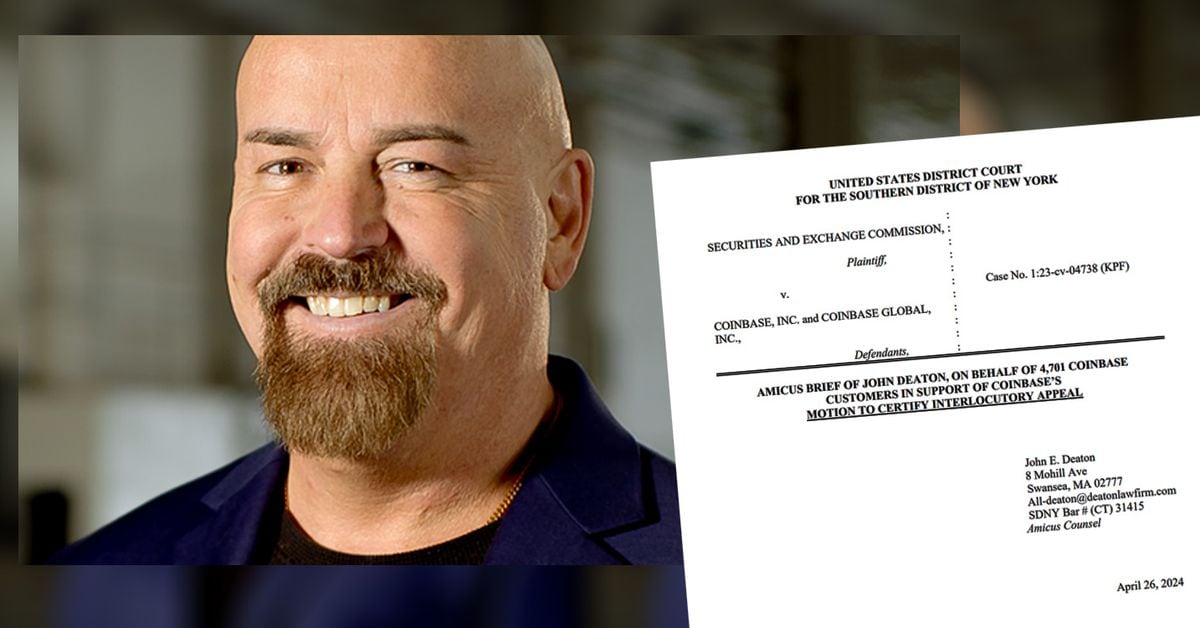

Crypto Tax Exemptions in the U.S: The world of cryptocurrency has rapidly evolved, attracting both innovation and scrutiny from governments and regulators across the globe. One of the most debated topics surrounding cryptocurrency is its taxation, and in the U.S., this has sparked considerable conversation among lawmakers, industry experts, and investors alike. John Deaton, a well-known lawyer and advocate for the crypto community, has been vocal in addressing the issue of crypto tax exemptions, urging lawmakers to consider more favorable policies for digital assets Solana Makes a Bullish Move with Technical Indicators.

The Growing Interest in Crypto Tax Exemptions

As cryptocurrencies like Bitcoin and Ethereum grow in popularity, the U.S. regulatory system has struggled to keep up. Lawmakers have been slow to establish clear rules for taxing crypto, leaving investors and companies uncertain.

One key issue raised by John Deaton is the need for tax exemptions or better tax treatment for certain crypto activities, especially long-term holdings and innovations. Many crypto investors see the current tax rules as a barrier to industry growth. Deaton believes the U.S. should adopt a more progressive tax approach, similar to those in other countries.

The Case for Crypto Tax Exemptions

Deaton argues that the current tax system hinders crypto innovation and investment. Right now, cryptocurrencies are treated as property, so any sale or exchange is taxed as a capital gain. This means investors pay taxes on any increase in value, even if they haven’t sold the asset.

Deaton believes this discourages long-term investment in crypto and slows industry growth. He suggests offering tax exemptions for activities like holding crypto for a certain period or reinvesting profits into other digital assets. Such measures could create a more favorable environment for innovation and growth in the crypto sector.

Countries like Switzerland and Singapore have already adopted tax policies that benefit crypto investors. These countries offer tax exemptions or reduced rates for long-term crypto holdings, helping their crypto ecosystems thrive. Deaton urges the U.S. to follow suit to remain competitive globally.

The Potential Impact on the U.S. Economy

Deaton’s push for crypto tax exemptions isn’t just about helping individual investors. He believes it could benefit the U.S. economy as a whole. By encouraging investment in crypto and blockchain technology, the U.S. could see significant growth in this emerging sector.

Deaton’s push for crypto tax exemptions isn’t just about helping individual investors. He believes it could benefit the U.S. economy as a whole. By encouraging investment in crypto and blockchain technology, the U.S. could see significant growth in this emerging sector.

Blockchain technology, which underpins cryptocurrencies, has the potential to transform industries like finance, healthcare, and supply chain management. By fostering a supportive tax environment for crypto, the U.S. could attract more startups and entrepreneurs, leading to job creation, technological advances, and a stronger position in the global digital economy.

The Road Ahead

While Deaton’s advocacy for tax exemptions has gained support from parts of the crypto community, it’s still unclear whether U.S. lawmakers will act on it. The government has shown interest in regulating crypto, but tax reform details remain uncertain.

Deaton continues to push for a balanced tax approach—one that supports innovation while ensuring compliance with financial regulations. As the crypto industry evolves, tax exemptions will likely play a key role in shaping its future in the U.S.

Conclusion

John Deaton’s call for crypto tax exemptions highlights a growing movement within the crypto community to create a more favorable regulatory environment. Whether U.S. lawmakers will act on this remains to be seen, but the future of crypto taxation in the U.S. will significantly impact the industry’s growth for years to come.