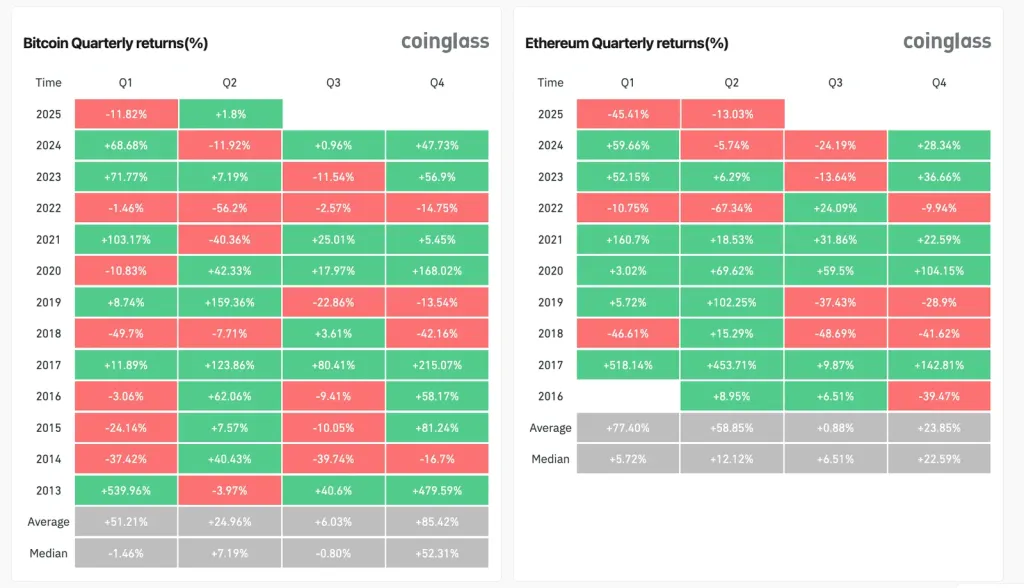

Crypto’s Q2 Recovery: The cryptocurrency market had a rough first quarter of 2025, and this was not expected. Bitcoin (BTC) and Ethereum (ETH), two of the largest digital currencies by market capitalization, fell by 11.82% and 45.41%, despite Q1 being one of the strongest historically.

CoinGlass data indicate that, on average, since 2013, Q1 has yielded 51.2% gains for Bitcoin, making it the second-best quarter for the asset, while Ethereum claimed the spot of the best quarter as it averages 77.4%. But 2025 was different as it brought the weakest Q1 in years.

According to Matt Hougan, Chief Investment Officer of Bitwise, it was dubbed as the “best worst quarter in crypto’s history”. Nonetheless, Matt and other analysts were optimistic for Q2 as they laid out four large catalysts that may drive the market recovery.

1. Global Monetary Policy Shift: A Return to Liquidity

It is being backed by some data at this time-historical into April 14 when analyst Colin Talks Crypto observed: “Global M2 has held put at an all-time high (ATH) for three days straight.”

This is significant because, as noted by financial expert Alden in a report from September 2024, bitcoin price movements correlate, according to M2, about 83% of the time. If central banks increase liquidity into markets, the crypto community might rebound strongly by Q2.

2. Clearer U.S. Crypto Regulations: Institutional Confidence Grows

Regulatory uncertainty has historically posed a challenge for the adoption of cryptocurrencies. 2025 may turn out to be a different story with more policymakers in the U.S. willing to support clear crypto regulation. Hougan pointed out, “That is the long-term impact of clearer regulations that no one is talking about, and it’s just starting.” One such regulatory framework could:

– Make institutions big players in crypto markets (more hedge funds, ETFs, and corporate treasuries entering crypto).

Propel adoption within Traditional Finance (TradFi) (banks and payment firms integrating crypto services). Provide less fear of market manipulation, thus attracting more retail investors. If the regulators keep up this momentum, we would likely regain confidence in the crypto markets come Q2.

3. Stablecoin Growth: Fueling the Next Crypto Bull Run

The entirety of the stablecoin market—cryptocurrencies pegged to assets like the US dollar—has now become the ideal benchmark for measuring market health. By the end of Q1 2025, the total aggregate stablecoin market capitalization stunned global observers, skyrocketing to an unprecedented $218 billion. Coin E Tech highlights how this surge signals a massive capital inflow into the broader crypto ecosystem, reinforcing stablecoins’ pivotal role in the financial landscape.

Hougan, who explains:

“Adoption of stablecoins will keep growing in support of surrounding industries such as DeFi and other crypto platforms.”

Why is that important?

More stablecoins mean more liquidity for trading and DeFi protocols. They are then used as fast settlement and hedging tools by institutional players with a use case for stablecoins. Emerging markets are using stablecoins to access dollar liquidity during currency instability. And it could be that stablecoin adoption is taking place rampantly to serve as an engine for more widespread growth of the entire crypto market in the second quarter.

4. Geopolitical Uncertainty: Bitcoin as a Hedge

Definitely, geopolitical tensions are stirring worldwide, Crypto’s Q2 Recovery being the most recent being that which followed the inauguration of Donald Trump in 2025, along with the new trade tariffs. Such instability always results in people seeking other alternative hedging assets such as bitcoin against:.

Currency devaluation (inflationary or economic sanctions).

Banking crises (as previous experiences show in the case of today’s regional bank failures).

As per Bitwise’s report, investors around the globe are rethinking their portfolios and making Bitcoin’s scarcity and decentralization an attractive haven for them. This corresponds with the bold prediction made by Hougan on Bitcoin prices, which states that: “Bitcoin could probably appreciate some 138% from its current price by the end of the year – $84,080.” Bitwise even predicted that by the end of the year in December 2024, it will reach $200,000-a-coin, as well as Hougan, still believing that is possible.

Conclusion: A Turning Point for Crypto in Q2?

While it seems that Q1 of 2025 may be disappointing for crypto investors, Crypto’s Q2 Recovery could mean a strong recovery for the market. These four catalysts- global monetary easing movement, regulatory advancements, stablecoin growth, and geopolitical uncertainty- combined at one point, would truly have the potential to throttle bullish momentum once again. Coinbase recently declared: When the mood changes, it will probably happen very fast, and we remain positive about the second half of 2025. Continuing trends into Q2 may just mean that instead of joking about their being the “best worst quarter,” crypto will move again into a very powerful rebound sometime later in the coming months.

Disclaimer: The information provided here is purely for educational purposes and not intended to be financial advice. Always conduct your own research and consult a financial advisor before investing.