CryptoQuant Warns: From the beginning, Bitcoin (BTC), the world’s first cryptocurrency, has undergone long and severe volatility cycles. However, the latest insights from CryptoQuant, the forefront of on-chain analytics firms, suggest that the market may joyously pull off the most significant price swing ever. Amid the uncertainty with fluctuating macroeconomic factors, Bitcoin hangs just above some strong resistance levels, leaving traders and investors on alert for a period that could harbor volatile movements.

In this article, we will consider:

- Why CryptoQuant warns of imminent volatility

- Significant on-chain and market indicators hinting at an impending price swing

- Historical scenarios for spikes in Bitcoin volatility

- How traders can prepare for abrupt market movements

Why CryptoQuant Predicts a Volatility Surge

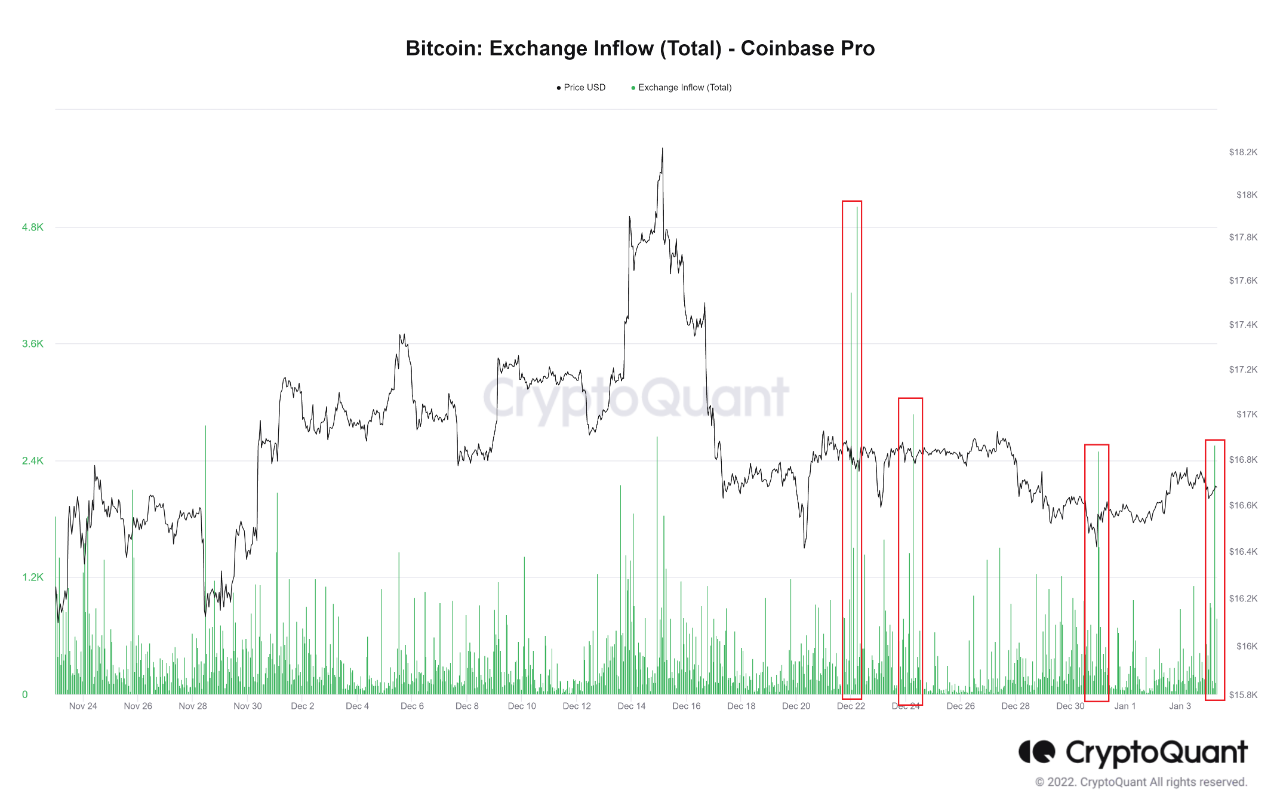

1. Bitcoin Exchange Reserves Are Rising

An increase in exchange reserves of Bitcoin is one of the readily observable signals of potential volatility. When large amounts of BTC move into exchanges, it usually indicates that investors intend to sell. Reports from CryptoQuant indicate that BTC deposits into major exchanges have been on the rise recently, implying that selling pressure could intensify shortly.

2. Whale Activity is Spiking

Bitcoin whales (large holders) have been making significant moves recently, and activities have notably increased, causing a positive alert for these major players to reposition their portfolios. Historical precedents suggest such whale activity spikes signal significant price movement- upward or downward.

3. Funding Rates Turn Negative

The never-ending future funding rates are being negative in some exchanges, leading the traders to pay their dues without holding short positions. Although this makes it for a bearish outlook, extreme negative funding rates are usually seen on the verge of a short squeeze that leads to a steep price spike.

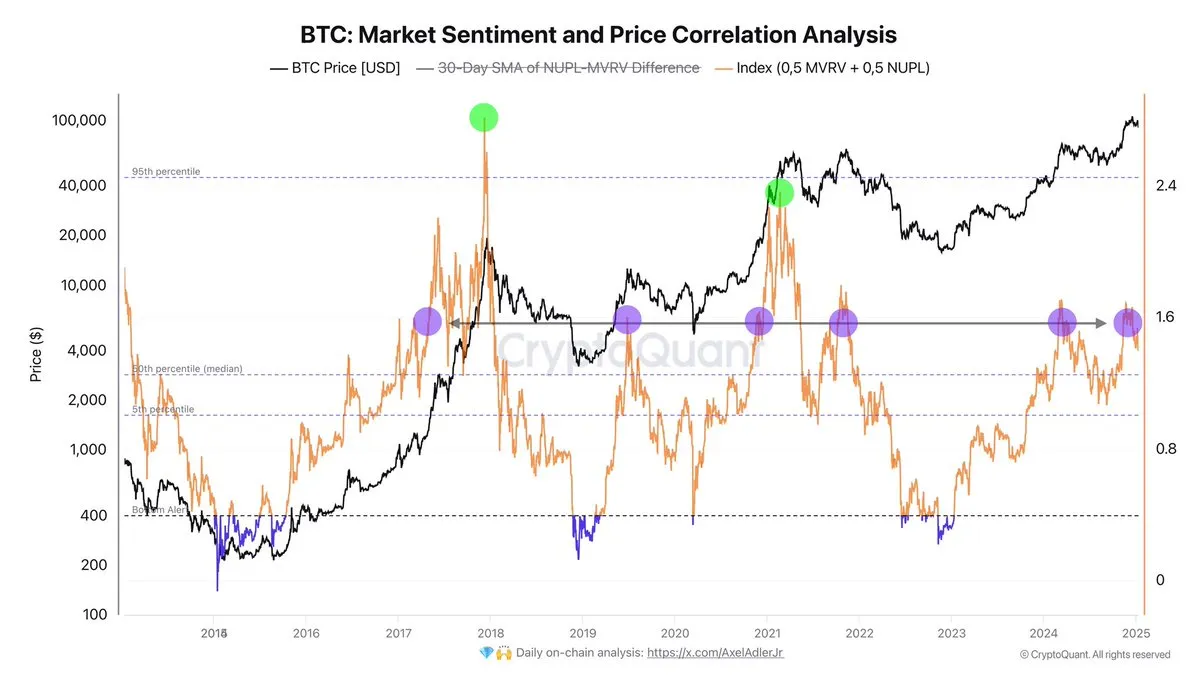

4. Cycle of Historical Volatility for Bitcoin

Bitcoin goes through periods of consolidation developed by explosive volatility. Currently, after trading around a pretty narrow range, BTC was expected to break through-or down.

Key Market Indicators to Watch

Beyond on-chain data, several macroeconomic and technical factors could amplify Bitcoin’s volatility:

1. Federal Reserve Policy & Inflation Data

Interest rates by the U.S. Federal Reserve will always be one of the most critical drivers for sentiment in the cryptocurrency market. If they indicate a delay in rate cuts, Bitcoin may find itself burdened with downward pressure; if they point any dovish hints at all, a rally may well explode.

2. Bitcoin ETF Flows

One of the most excellent movers for spot Bitcoin ETFs has been in 2024, with record inflows at the beginning of this year. However, should this ETF demand weaken with accelerated outflows, BTC could see some form of a correction.

3. Technical levels: 72K resistance

Bitcoin is currently being sandwiched between two critical price levels:

- Support-$60000; a breach would trigger panic selling.

- Resistance-$72000; a break could trigger a fresh all-time high.

- A decisive move in either direction could result in swift price swings.

Historical Precedents: What Past Volatility Spikes Tell Us

– Q1 2023: The SVB Collapse & Bitcoin’s 40% Rally

When Silicon Valley Bank collapsed in March 2023, Bitcoin initially dipped but surged 40% in weeks as investors sought alternatives to traditional finance.

– 2021 Bull Run: From

30Kto

30Kto69K

After months of sideways trading, Bitcoin broke out in late 2021, skyrocketing to an all-time high near $69,000—only to crash 50% weeks later.

– 2020 COVID Crash & Recovery

On the one hand, sharp increases are followed by sharp drops. In March 2020, Bitcoin fell 50% on pandemic fears and then entered a historic bull run, gaining more than 1,000% in 18 months. Such is the brutality of volatility.

How Traders Can Prepare for a Volatility Spike

With Bitcoin’s next big move looming, here’s how traders and investors can stay ahead:

1. Set Stop-Losses & Take-Profit Levels

- If you’re long on Bitcoin, protect your downside with stop-loss orders.

- If you expect a breakout, lock in profits at key resistance levels.

2. Watch Liquidation Levels

- Large liquidations can accelerate price movements. Monitoring liquidation clusters (via platforms like Coinglass) can help anticipate volatility.

3. Hedge with Options

- Buying put options can protect against downside risk.

- Call options can position you for a potential breakout.

4. Keep an Eye on Macro News

- Fed meetings, CPI data, and geopolitical events can all trigger sudden market shifts.

Conclusion: Brace for Impact

Multiple on-chain and market signals support CryptoQuant’s prediction of an impending volatility spike in Bitcoin. However, whether it will turn bearish with sharp corrections or bullish with an explosive upside is still to be seen. One apparent fact remains: some good big moves are coming.

This is to say that traders must remain alert, disciplined, and ready for rapid price action. For longer-term investors, this volatility is just another event in the life of Bitcoin – often, through such volatility, when a market shakes out the weak hands, good opportunities arise. Will Bitcoin reach new highs or undergo a steeper correction? Only time will tell; one thing is clear: the coming weeks will be vital for BTC’s direction.