Ethereum (ETH), the second-largest Cryptocurrency Market capitalization, breached a key trend line and gave the crypto community hope. Since the trend line breach suggests increasing momentum, some analysts believe Ethereum could reach $3,000 soon. Though technical graphs support this positive view, several factors should be considered before making decisions. This post discusses process risks, Ethereum trend line break meaning, and analyst forecasts.

Ethereum Trend Line Breakthrough

In technical analysis, a trend line is a crucial price level for which the price of a cryptocurrency has failed to exceed during a given period. Based on the direction of price movement, the trend line serves either as support or opposition. A fresh price movement—either upward or downward—dependent on the direction of the breakout is indicated when the price crosses this trend line.

When Ethereum’s price broke above a noteworthy resistance level, its latest trend line break happened. Many have read this action as a positive indication that the bitcoin might be about to surge. Now, a major concern is whether this breakthrough would cause a continuous rise toward the $3,000 level—which many experts think could be within reach given specific criteria are satisfied.

Ethereum Price Surge

Ethereum’s trend line deviation has been discussed by several cryptocurrency specialists. Michael van de Poppe, a popular crypto researcher, predicts that ETH might reach $3,000 if it keeps rising and breaks the next major obstacle at $2,650. Van de Poppe says the market is set for a sustained gain, especially if Ethereum exceeds these key levels.

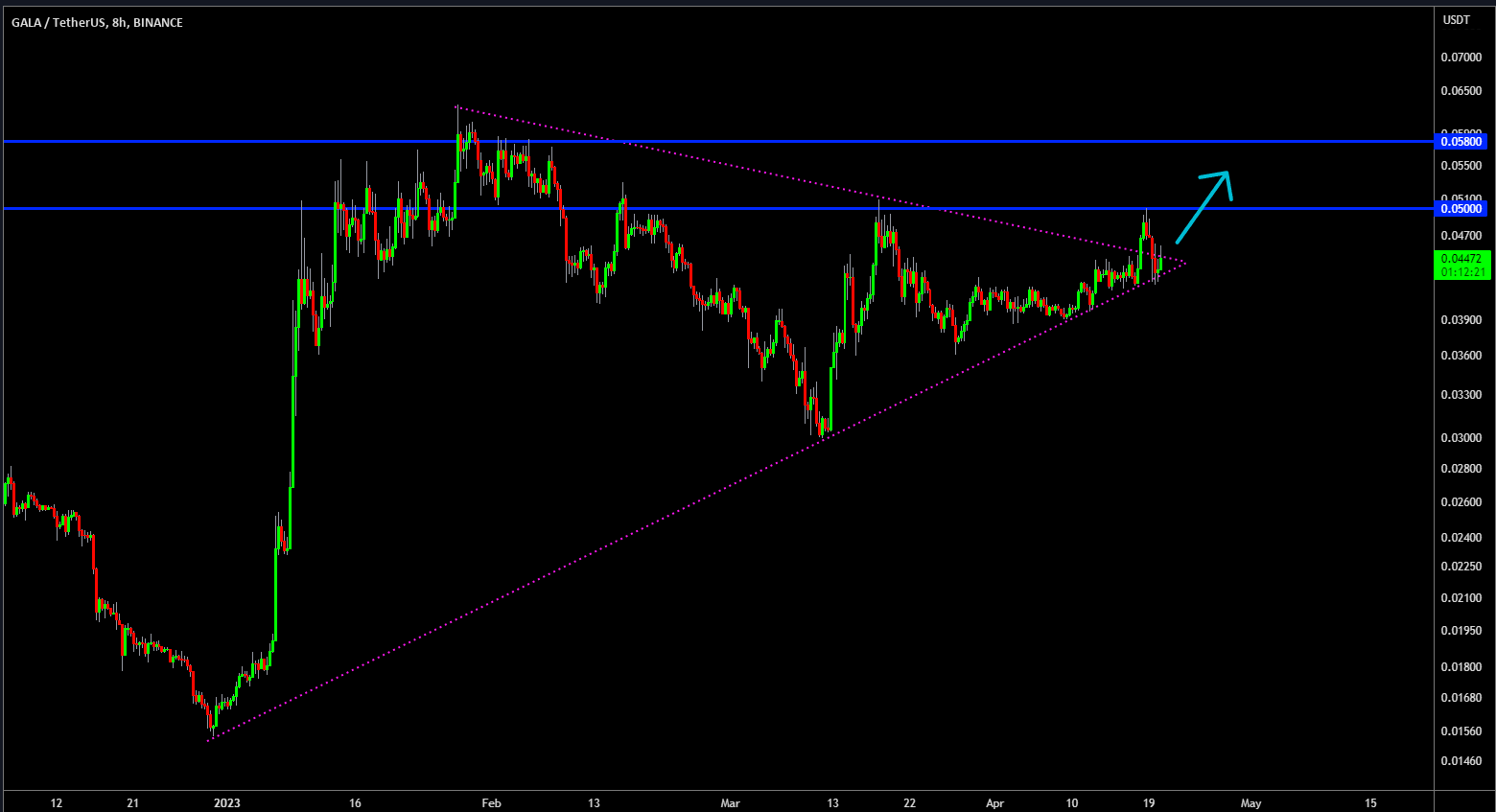

Furthermore, experts have noted that the recent price movement of Ethereum fits the development of optimistic chart patterns including rising triangles. Usually signaling that the price is ready to break out to the upward, these trends are sometimes regarded as a forerunner of major price swings. Given this technical configuration, many think Ethereum might hit fresh highs should the present market mood remain bullish.

Ethereum Market Optimism

Beyond the technical analysis, institutional investment and market optimism have raised Ethereum hopes. As Ethereum evolves, especially with Ethereum 2.0 and its proof-of-stake consensus mechanism, institutional investors are interested. Ethereum is a better investment now that this transition has improved sustainability and scalability.

Altcoins like Ethereum can thrive after the trend line break since Bitcoin and other major cryptocurrencies are rising in price. If the market keeps rising, Ethereum may see more buyers, pushing its price closer to $3,000.

Particularly with relation to Ethereum staking, projected legislative certainty is supposed to boost institutional confidence even further. A possible change toward a more crypto-friendly legal climate could provide Ethereum greater chances for expansion. With some projecting ETH might reach $8,000 this year and perhaps $14,000 by 2025 based on ongoing institutional adoption and good market circumstances, analysts are hopeful about Ethereum’s future success.

Ethereum Price Risks

Though institutional interest is rising and the technical indications show promise, There are still various factors that can keep Ethereum from reaching $3,000 in not too distant future. A main risk is market volatility, which defines the bitcoin scene. Although Ethereum’s breakthrough seems encouraging, the bitcoin market moves quickly and price adjustments are not rare. A strong fall might push ETH back to less levels, so postponing the $3,000 target or perhaps reversing price action.

Furthermore impacting Ethereum’s price can be macroeconomic elements and legal issues. Government policies that change—such as tougher rules on cryptocurrencies or environmental sustainability worries—may affect investor attitude and market liquidity. Moreover, global economic elements like inflation or growing interest rates could have a more general impact on risk assets like cryptocurrencies.

Another question is whether Ethereum Price can keep its upward slope. Though the actual test will come in the form of price consolidation above the critical resistance levels, the present trend line break may be a bullish indication. Should Ethereum fall short of these benchmarks and undergo a down correction, the $3,000 target might be postponed even more.

Final thoughts

Ethereum’s breach from a major trend line has sparked speculation that it could hit $3,000. Ethereum’s price may grow as analysts predict more positive momentum and institutional interest. Like every bitcoin investment, though, there are hazards associated. Ethereum’s price motion could be challenged by volatility, market corrections, and outside events including legislation.

For now, investors and traders should watch Ethereum’s price, especially major support and resistance levels. ETH might reach $3,000 if it maintains its optimism and passes the next major resistance point. However, the crypto world is volatile, so investors should be prepared.