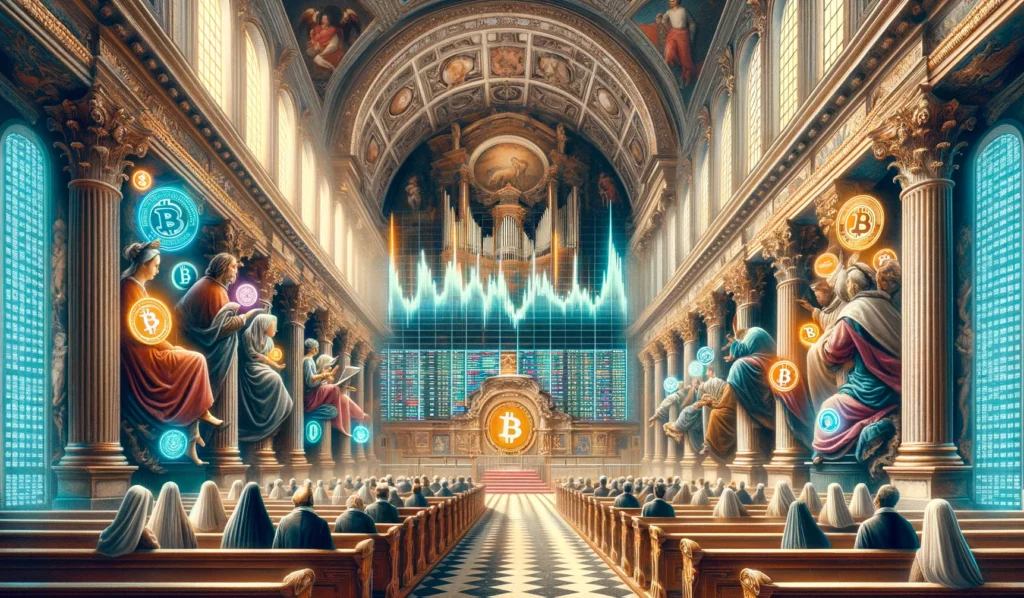

The price of Bitcoin has skyrocketed as of May 2025, nearing Rp1.74 billion (about $102,681 USD). For the Cryptocurrency Market, this represents a significant turning point that generates a lot of curiosity about its future course. The increasing acceptance of digital assets, macroeconomic considerations, and changing legal contexts have greatly aided this upward tendency. In this post, we will investigate the elements driving Bitcoin’s rise, examine the technical patterns, and discuss the difficulties Bitcoin confronts going forward.

Bitcoin Price Surge

The rising institutional acceptance of cryptocurrencies is a primary reason for the price rise of Bitcoin. More financial institutions, hedge funds, and asset managers have included Bitcoin in some of their portfolios over the last several years. The late 2024 release of Bitcoin-backed Exchange-Traded Funds (ETFs) offers institutional and retail investors a controlled investment platform. Demand has grown significantly, which drives prices higher. Moreover, the U.S. government’s creation of a Strategic Bitcoin Reserve in early 2025 denotes acceptance of Bitcoin as a valid national asset, strengthening the validity of the Bitcoin market.

Bitcoin and Inflation

The macroeconomic status of the world is another crucial element fueling Bitcoin’s recent explosion. Many areas still have intense inflationary pressure, and conventional fiat currencies still lose buying value. Among these economic unknowns, Bitcoin has attracted interest as an inflation hedge. Historically, Bitcoin has been compared to gold as a store of value; with many central banks still printing money to boost development, its scarcity—capped at 21 million coins—appeals to those looking for assets not vulnerable to inflationary threats.

Moreover, Bitcoin’s distributed character renders it impervious to any central bank or government’s laws. Many investors view Bitcoin as a safer alternative, as worries about the stability of conventional financial systems are driving the price closer to Rp1.74 billion.

Retail Investor Surge

Apart from institutional curiosity, retail investor involvement has increased noticeably. Many people now view cryptocurrencies—especially Bitcoin—as a means of making profits in an environment where low interest rates and stagnant stock markets rule ever more.

Younger generations of retail investors are drawn to the volatility and possible large profits that Bitcoin presents, usually via trading platforms and smartphone apps that simplify purchase and selling.

Bitcoin Price Outlook

The direction of Bitcoin’s recent price movement points to optimism. Technical indications show a continuous increasing trend as Bitcoin approaches the Rp1.74 billion threshold. Currently above 70, the Relative Strength Index (RSI) gauges whether an asset is overbought or oversold, suggesting that Bitcoin can be temporarily overbought. This implies a correction could follow if the investor mood cools or other variables like regulatory issues take front stage.

Bitcoin’s next significant resistance mark is around Rp1.8 billion, or over $107,000. Should the price surpass this level, the next considerable goal might be $120,000, a new all-time high. On the other hand, a downturn could be seen in the future if the market suffers any setbacks, such as macroeconomic events or regulatory changes.

Bitcoin’s Key Challenges

Bitcoin Regulatory Challenges

Regulatory ambiguity is one of the most significant issues confronting Bitcoin. While many nations are starting to take more definite positions on digital assets, others are still struggling with how best to control cryptocurrencies. Agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have clashed over jurisdiction and control of Bitcoin-related goods in the United States.

While nations like Japan and Switzerland have embraced cryptocurrencies more favorably, others, particularly China, have set tight rules limiting Bitcoin mining and trade. Constant worldwide regulatory uncertainty can erode investor trust and cause market volatility, therefore endangering the price increase of Bitcoin.

Bitcoin Scalability Challenges

The scalability of Bitcoin still presents a continuous difficulty. Without three to seven transactions per second (TPS), the network can manage significantly less than conventional payment systems like Visa, which can process hundreds of transactions per second. As the user base increases, the network has suffered microtransaction delays and excessive fees during congestion.

Bitcoin Price Volatility

Bitcoin’s price volatility is well-known. Driven partly by speculative activity, the Cryptocurrency Market has seen tremendous swings over the past few years. Though its price has soared, Bitcoin is still quite sensitive to macroeconomic changes, news events, and market mood.

The speculative character of Bitcoin also draws long-term investors and short-term traders who try to profit from transient price swings. Rapid price corrections resulting from this volatility can often be erratic and challenging to control.

Final thoughts

Rising to Rp1.74 billion in May 2025, Bitcoin’s ascent is a result of institutional acceptance, macroeconomic conditions, and growing retail interest combined. Still, Bitcoin remains in danger from problems including market volatility, scalability problems, and regulatory uncertainties. Investors and market players must be alert and ready for possible swings as Bitcoin approaches new price levels and monitor the larger scene of digital money control and technological advancement.