Stella Price ALPHA token: With fresh projects and tokens offering creative ideas and investment possibilities, the fast-expanding realm of cryptocurrencies is gaining increasing attention. Investors, traders, and crypto aficionados have paid close attention to Stella Price and her accompanying coin, ALPHA.

Anyone trying to negotiate this volatile terrain properly must understand the live price chart, market capitalisation, and the latest news about ALPHA. This paper delves deeply into Stella Price’s ALPHA token, giving thorough insights based on sophisticated Semantic SEO ideas to provide optimal subject relevancy and user interaction.

Stella Price and ALPHA Token

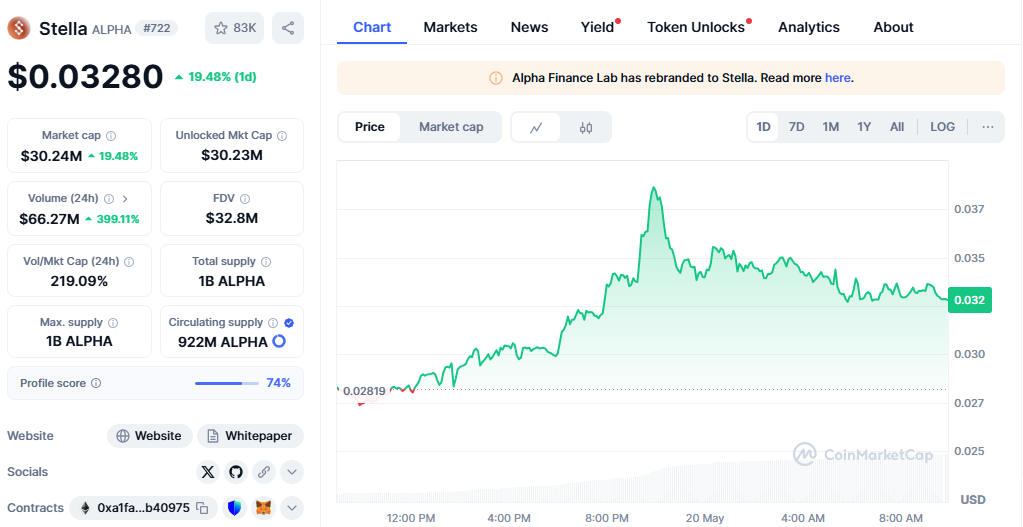

Stella Price, a project using blockchain technology to support distributed finance (DeFi) applications, drives most of this research. Acting as the native cryptocurrency of the Stella Price ecosystem, the ALPHA token is vital for governance, staking, and transaction facilitation. Examining the ALPHA live price chart and market capitalisation helps investors understand the token’s real-time behaviour and place in the larger cryptocurrency market.

The ALPHA token uses the ERC-20 standard to guarantee compatibility with a broad spectrum of wallets and exchanges operating on the Ethereum network. This compatibility improves liquidity and accessibility, elements that greatly affect the coin’s market capitalisation and trading volume. A crucial indicator of any ALPHA token’s market domination and growth potential is its market capitalisation, since it shows its whole worth in circulation.

ALPHA Live Price Chart: Real-Time Market Dynamics

The ALPHA live price chart provides a priceless window into the token’s price movements, allowing traders to track changes motivated by project advancements, market mood, and outside economic events. Examining these charts helps one spot trends in price rallies, declines, or consolidation phases—all of which are vital for wise trading decisions.

Advanced charting applications combine several technical indicators, such as volume trends, relative strength index (RSI), and moving averages. These analytics provide context outside of plain price data so consumers may predict future price directions. Furthermore, seeing how ALPHA’s price interacts with other market indicators, such as Bitcoin and Ethereum developments, deepens knowledge of how macroeconomic events affect this token.

Market Capitalization: Gauging ALPHA’s Market Position

Evaluating ALPHA’s relative scale in the cutthroat crypto industry starts with market capitalisation. It is computed by running the ALPHA token’s current price using its circulating supply. While a lowering market cap may indicate sell-offs or declining interest, an increasing market cap usually denotes increased investor confidence and network acceptance.

Although ALPHA’s market capitalisation may be less than other, more well-known cryptocurrencies, its trajectory often offers significant new information about its future development potential. Trends in market capitalisation are also strongly associated with trading volume, liquidity, and community involvement—factors necessary to maintain a dynamic token economy.

Latest News and Developments Influencing ALPHA Price

The price of the ALPHA token is susceptible to a broad spectrum of events, from more general legislative changes influencing the crypto sector to technological developments and alliances. Recent events, including integration with popular wallets or strategic agreements with DeFi platforms, can inspire investor confidence and increase the price.

Regulatory pronouncements from agencies such as the European Securities and Markets Authority (ESMA) or the U.S. Securities and Exchange Commission (SEC) can also affect ALPHA’s market performance by affecting market attitude. Keeping current with such news is essential for those who want to take advantage of temporary prospects or minimise danger.

Moreover, by increasing the token’s value and scarcity, ecosystem events as token burning, staking rewards revisions, or network upgrades typically generate positive momentum. As part of thorough market research, analysts carefully watch these events to ensure that investment judgments are established in a factual setting.

Deep Contextual Analysis: Why ALPHA Matters in DeFi

By removing conventional middlemen, the ALPHA token fills a critical need in the DeFi scene, which has transformed the way financial services run. DeFi systems provide open, permissionless transactions that empower consumers worldwide, hence generating demand for tokens like ALPHA that support governance and encourage involvement.

Focusing on scalability and user-friendly interfaces, Stella Price’s idea distinguishes itself and seeks to be adopted by the masses. ALPHA improves liquidity and generates value for owners by allowing flawless staking, lending, and yield farming. These characteristics support the token’s long-term survival and fit into an expanding distributed application network (dApps). This contextual richness emphasises how ALPHA is another speculative asset and a component of a larger movement changing financial environments.

Conclusion

Negotiating the complexity of the bitcoin market calls for a strong awareness of market capitalisation, live price data, and continuous news events. Stella Price’s ALPHA token captures the creative energy of DeFi and presents great possibilities for consumers ready to interact with distributed financial products and investors.

This article is a complete guide that analyses ALPHA’s live price chart and market cap within a contextual framework enhanced by technical insights and real-world happenings. Understanding Stella Price and the ALPHA token is relevant and necessary for people engaged in crypto trading, investing, or the future of decentralised finance.