Core (CORE) has become a major actor in the quickly changing field of blockchain technology since it is meant to combine scalability with decentralization. Staying current with the Core price today, the CORE to USD live price, and the current market cap have become critical for investors, developers, and fans, with rising user interest. This paper thoroughly analyzes Core’s current price action, historical performance, market trends, and more general consequences in the crypto ecosystem.

Built on the Satoshi Plus consensus mechanism, Core DAO is a layer-one blockchain that is an original hybrid combining the scalability of Delegated Proof of Stake (DPoS) with the security of Bitcoin’s Proof of Work (PoW). This synthesis aims to simultaneously achieve decentralization, scalability, and security, addressing the blockchain trilemma.

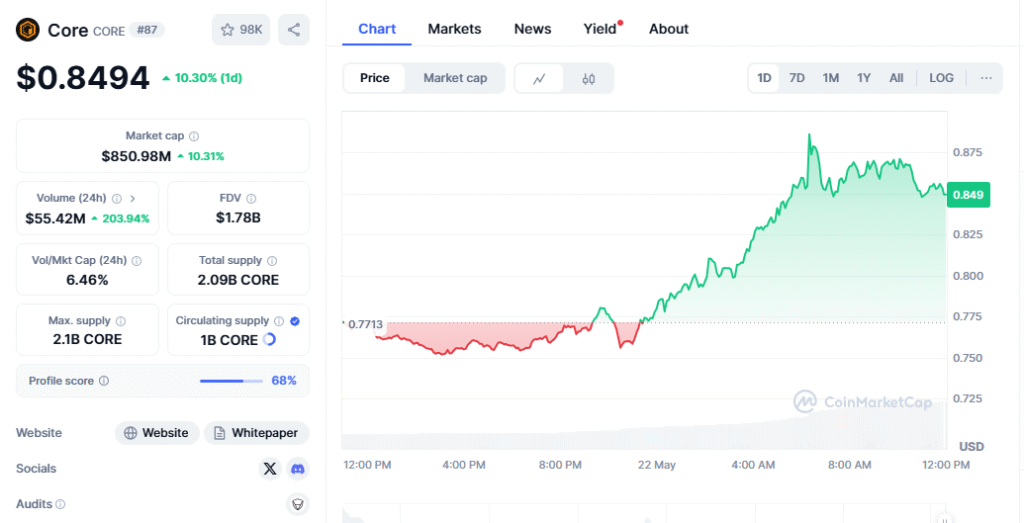

Live Core Price and Real-Time Market Analysis

Driven by supply and demand, investor attitude, and more general macroeconomic variables, the CORE to USD live price shows active market movements, as shown by the most recent figures on worldwide cryptocurrency exchanges, including Binance, OKX, and Gate.io. Unlike traditional assets, CORE trades 24/7. Trade volume, network activity, staking incentives, and Core DAO governance proposals all affect the price of Core.

Real-time charts displaying candlestick patterns, moving averages, and relative strength indices (RSI) help one appreciate live core price data best. These instruments allow traders to predict future price movements and guide their actions. Websites such as CoinMarketCap, CoinGecko, and TradingView are best for accessing up-to-date statistics such as market capitalization, circulating supply, and historical highs and lows.

Core’s Economic Indicators: Market Capitalization and Circulating Supply

The Core market capitalization is a critical indicator of the overall value of all the CORE tokens in use. It is computed by running the current CORE price using the circulating supply. This number places Core DAO amid other elite cryptocurrencies, providing investors with a view of its relative market domination.

Unlike some coins with aggressive inflationary models, Core DAO has instituted a well-calibrated token distribution schedule that fits long-term sustainability and community expansion. Being a distributed company, Core DAO lets its community vote on tokenomics upgrades, strengthening openness and confidence.

Core Price Variability and History

Core’s price history reveals quick acceptance and speculative momentum. Like other developing digital assets, CORE has had notable price variations since its introduction. Hype around the token’s Bitcoin-aligned consensus mechanism and airdrop approach, which drew a large user base, drove its first ascent. Core has, meanwhile, also seen retracements during adverse market cycles, much like many cryptocurrencies.

Analyzing past price behavior in relation to world events, including Federal Reserve interest rate decisions, legislative crackdowns, and significant exchange listings, helps one understand CORE’s price volatility. These events usually cause price swings or declines as traders respond to perceived opportunities or hazards.

Core Against Other Layer-One Currency

Direct competitors of core DAO include various layer-one blockchains such as Avalanche (AVAX), Solana (SOL), and Ethereum ( ETH). Core distinguishes itself with a Satoshi Plus consensus, providing the ideal mix of decentralization and throughput.

High gas prices have long plagued Ethereum, driving users to look for substitutes like Core that offer quicker transactions and lower expenses. Solana, with its speed, has experienced network stability problems; hence, Core has an advantage in dependability. Core’s capacity to link the finest of Bitcoin and Ethereum sets it apart in the market.

Analyst Outlook and Future Price Forecasts

Generally speaking, analysts remain optimistic about Core’s long-term value proposition, especially if it follows its road map and supports community development. Because of its creative architecture and expanding ecosystem, some crypto influencers—including those from Bankless and Coin Bureau—have identified Core as a possible breakthrough project.

Short-term price projections, however, are somewhat erratic and should be handled carefully. Before deciding what to invest in, one should consider more general market trends and mix fundamental analysis with technical indicators.

Core DAO Ecosystem: Resources and Practical Uses

DeFi protocols, NFT platforms, and distributed apps (dApps) created on the Core DAO network are driving the expansion of this ecosystem. Developer tools such as the Core Wallet, CoreScan (block explorer), and MetaMask integration give smooth access for both consumers and developers. Using applications in distributed banking, gaming, and governance, Core has transcended mere cryptocurrencies to become a fundamental layer for developing the next generation of Web3 apps.

Final Thought

Core DAO stands out for its fresh approach to consensus, expanding ecosystem, and rising community support among the more fascinating initiatives in the blockchain scene nowadays. Core demands your attention whether your interests are those of an investor assessing its market cap, a trader looking for real-time information on the CORE to USD live price, or a developer investigating innovative systems. For ongoing insights, think of connecting internally to instructions on layer-one blockchain comparisons, utilizing Core Wallet, or tutorials on safely purchasing CORE tokens.