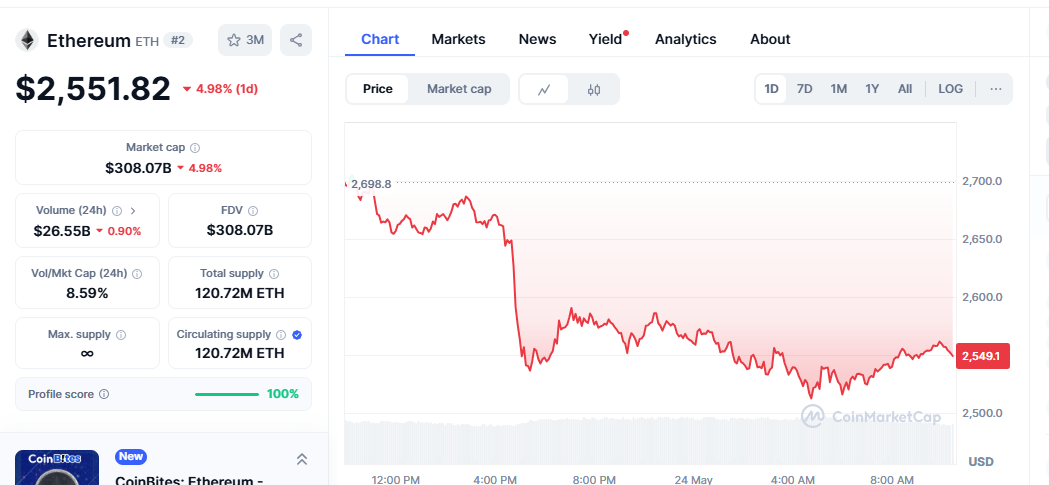

Ethereum Price Nears $4K Once again, making news as its price path points toward the much-awaited $4,000 milestone, is Ethereum (ETH), the second-largest cryptocurrency by market capitalization behind Bitcoin. Ethereum’s on-chain metrics are likewise quite active within a rowing market, with hope. Most importantly, transaction fees on the Ethereum network—gas fees—have skyrocketed to their highest levels in three months, indicating a fresh wave of user interaction and network congestion.

The price surge and rising Ethereum gas fees show a complicated interaction of market dynamics. Investors, traders, and participants in distributed finance are closely watching whether this momentum is long enough to propel Ethereum above the crucial psychological threshold of $4K (DeFi).

Rising Ethereum Gas Fees Signal Network Surge

On the Ethereum blockchain, transaction fees serve as a proxy for network utilisation. Ethereum gas fees usually mean that on-chain transaction demand—that of DeFi exchanges, NFT minting, and smart contract interactions—is accelerating. Data from Etherscan and Glassnode show that average gas fees have reached 80 gwei, a figure not observed since early February.

Several elements have driven this increase. One of the most important is the comeback of NFT minting events on markets like OpenSea, Blur, and Magic Eden, which mainly depend on Ethereum’s Layer 1 network. Transaction volume has also surged with the rise in DeFi apps like Aave, Curve Finance, and Uniswap. This growing demand strains the Ethereum Virtual Machine (EVM), driving higher brilliant contract execution costs.

Additionally, the forthcoming Ethereum Cancun-Deneb upgrade, projected to increase data availability and Layer 2 interoperability, is creating speculative activity. Developers and early adopters are actively testing Ethereum Improvement Proposals (EIPs), which are helping to explain the increase in network utilisation and gas consumption.

Ethereum Poised for Bullish Breakout Momentum

Technically, Ethereum’s price chart is creating a convincing positive framework. Initially, after a multi-week consolidation pattern, the coin has broken out above essential support levels close to $3,500. Positive divergent indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), point to the momentum continuing in favour of buyers.

Volume profiles display accumulation zones between $3,300 and $3,600, suggesting high buyer interest at these levels. Should Ethereum firmly break through the $3,800 barrier, the path to $4,000 may be open, perhaps testing new year-to-date highs. On-chain metrics like active addresses, network value to transaction (NVT) ratio, and total value locked (TVL) across DeFi systems support this optimistic view.

Ethereum’s Rise Fueled by Institutional Demand

Additionally, the larger crypto industry is riding a wave of fresh hope. Recent testing of Bitcoin at $70,000 raised altcoins, including Ethereum. Though recent patterns indicate that Ethereum is finding its own story, notably with the Ethereum ETF proposals under examination by the U.S. Securities and Exchange Commission (SEC), Ethereum has traditionally demonstrated a significant correlation with Bitcoin.

Growing interest in Ethereum-based financial products by institutional companies such as BlackRock, Fidelity, and ARK Invest helps validate ETH as a long-term investing tool. The Grayscale Ethereum Trust (ETHE) has also experienced declining discounts, implying institutional investors expect positive legislative results.

Rising search trends for “Ethereum price prediction” and “how to buy Ethereum” also point to retail interest. Rising trading volumes in ETH pairs on platforms such as Coinbase, Binance, and Kraken point to a revived retail FOMO—fear of missing out.

Ethereum’s Role in Web3 and Price Outlook

Ethereum drives the most extensive and varied ecosystem available on the blockchain; it is more than just a digital asset. From DeFi apps to NFTs, from Layer 2 rollups like Arbrollups, Optimism, and zkSync, to corporate adoption through ConsenSys and the corporate Ethereum Alliance (EEA), Ethereum remains at the core of Web3 invention.

The rising gas prices also sparked the discussion on Ethereum’s scalability. High gas rates still represent the cost of decentralised security Ethereum offers, even as decentralisation progressively shifts transaction load off the mainnet. Expected to drastically lower transaction costs on rollup, the rollup’s so-danksharding (EIP-4844) might fundamentally change user and developer interaction with Ethereum.

Risks and Considerations: What Might Trip the $4K Moment? Despite the positive signals, Ethereum’s price behaviour encounters various challenges. Macroeconomic uncertainty is still a significant concern since the U.S. Federal Reserve’s interest rate choices might affect the crypto markets. Furthermore, government inspection of staking operations and Ethereum’s security classification in some countries influence investor mood.

Technical resistance around $4,000 might also encourage profit-taking, particularly for short-term traders. If gas fees keep rising unbridled, users may become annoyed with high transaction prices and seek cheaper options such as Solana, Avalanche, or Polygon.

Ethereum Price Forecast: Can ETH maintain the increasing momentum? Momentumists are still split about Ethereum’s short-term direction. While some say ETH will consolidate close to $3,800 before reaching new highs, others warn that a correction might follow if Bitcoin dominance rises again. Still, the long term is bright.

Companies such as VanEck and Standard Chartered have published optimistic Ethereum predictions; some estimate values between $4,000 and $5,500 over the next six months, particularly if Ethereum ETFs are legalised and two adoption picks up speed.