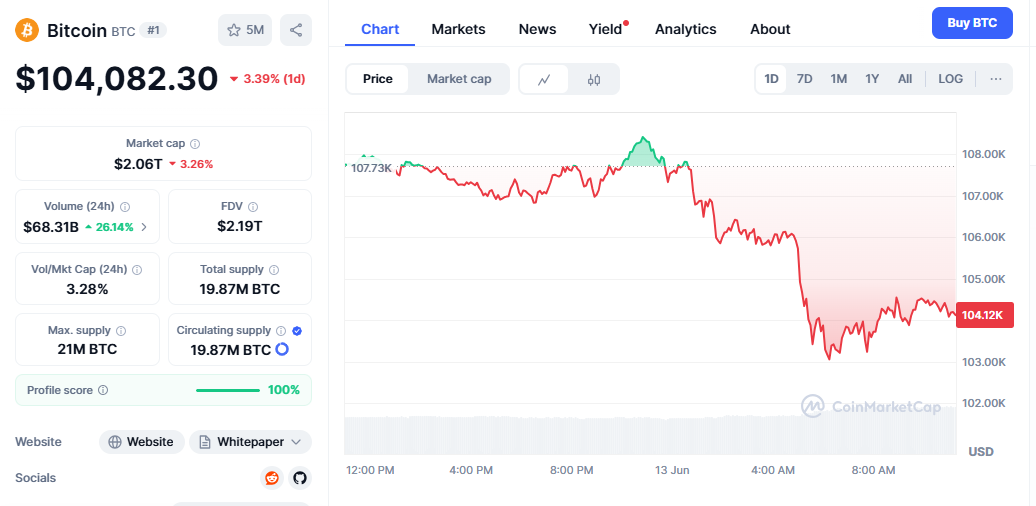

Bitcoin Price Analysis 2025 Bitcoin’s remarkable journey through 2025 has captured the attention of investors worldwide as the cryptocurrency approaches key technical milestones and price levels that could shape its future. BTC hit a new all-time high of $111,980, but then some people booked profits at higher levels, causing the price to collapse by almost 10.35% to $100,382. Market watchers are closely monitoring these areas of support and resistance for potential breakout possibilities, given the market’s volatility.

Current Market Dynamics and Price Action

As Bitcoin settles at historically essential price levels, the cryptocurrency market has become more volatile. The asset found support at the psychologically important level of $100,000 and then rebounded to $110,000. However, the bulls are struggling to maintain the pace at these high levels, which makes it difficult to predict the market’s next direction.

Technical analysis indicates that Bitcoin’s recent price movements exhibit both strength and weakness simultaneously. The fact that the price can find support at the psychologically key $100,000 level indicates a bullish mood. At the same time, the difficulty in breaking through resistance zones suggests that both institutional and retail investors are taking profits.

People in the market are paying particular attention to volume patterns, which often precede significant price changes. The balance between buying pressure and selling resistance at current levels is at a crucial point that may determine whether Bitcoin continues to rise or experiences a more significant decline.

Key Technical Levels According to Top Analysts

Several key price levels have been identified by professional traders and market experts that are likely to impact Bitcoin’s price fluctuations in the short and medium term. Strong support is at $101,400, which is backed up by the 50-day moving average. Immediate resistance is at $109,465, a level that has been challenged before and needs to be broken for further gains. Next Price Target: $110,800—if BTC closes over $109,465 with a lot of volume

The $101,400 support level is fundamental right now because it aligns with the 50-day moving average, a technical signal that many institutional traders use to confirm trends. If market sentiment is high, this combination of technical factors provides a strong foundation for potential upward movements.

Resistance levels are just as crucial for traders and investors to think about. The immediate barrier at $109,465 is a level that has been challenged before and from which selling pressure has historically originated. If the price breaks above this level with significant volume, it may indicate that bullish momentum is returning and that algorithmic purchasing could occur from momentum-based trading methods.

Bitcoin cryptocurrency is likely to reach the next resistance level of 110000.00, which was a resistance level in May. If current support levels remain strong, this analysis suggests that the $110,000 level, which was previously a resistance level, could become the next target for bullish market action.

Market Structure and Trend Analysis

Even though Bitcoin prices have been fluctuating significantly lately, the overall market structure remains stable. If the price remains above $101,400, the current bullish bias will persist, and a further correction that could test lower support zones is unlikely.

Moving average research provides us with more information about how the cryptocurrency’s trend is evolving. The way different moving averages are positioned about the current price action can give you an idea of what might happen in the future and how strong the existing trends are.

Long-term technical trends indicate that Bitcoin’s current consolidation period may be preparing for another significant surge. Historical price patterns suggest that periods of sideways movement often precede significant directional breaks. This makes the current levels crucial for market participants to monitor closely.

Institutional Sentiment and Market Catalysts

The world of cryptocurrencies has undergone significant changes, with an increasing number of institutions becoming involved and more explicit regulations in various jurisdictions. These factors help keep the price of Bitcoin stable and provide it with a strong foundation for higher prices over time.

Bitcoin’s supply and demand are continually influenced by exchange-traded fund inflows, corporate treasury allocations, and sovereign wealth fund investments. These institutional flows often cause price changes that last longer than those caused by retail activity.

Macroeconomic factors, including decisions about monetary policy, inflation predictions, and the state of global liquidity, also significantly impact the price of Bitcoin. The relationship between cryptocurrencies and traditional financial markets has evolved, necessitating that analysts consider new factors when making price predictions.

Risk Management and Trading Considerations

When trading Bitcoin, it is essential to pay close attention to risk management rules, especially during periods of high market volatility. The current price environment presents both advantages and disadvantages for individuals entering the market at different times.

When trading Bitcoin, professional traders emphasize the importance of position sizing, placing stop-loss orders, and strategies for taking profits. Because the cryptocurrency often makes big moves in both directions, you need to be diligent about how you allocate your wealth and manage your risk.

When the market is volatile, it’s crucial to consider how liquid the market is. Prices may fluctuate significantly when there are few traders and the market is quiet. This sometimes occurs in Bitcoin exchanges.

Future Price Projections and Scenarios

The Bitcoin price prediction for June 2025 suggests a likely trading range between $100,000 and $120,000, as BTC consolidates above key EMAs while maintaining a bullish long-term structure. If Bitcoin breaks above $112,000, it may rise to $120,000 or higher by the middle or end of June.

These predictions are based on the technical analysis methodology that many expert traders use to determine potential price targets. When prices remain above exponential moving averages for an extended period, it typically indicates that the trend will persist.

Long-term pricing projections indicate even higher targets for Bitcoin. For 2025, the goals are between $100,000 and $200,000. For 2030 and beyond, long-term models, such as the exponential moving average or stock-to-flow, suggest that bitcoin to reach $1M is possible if demand grows.

These extended forecasts incorporate various fundamental factors, including Bitcoin’s fixed supply schedule, institutional adoption trends, and potential changes to the monetary system that could drive increased demand for digital assets.

Conclusion

Bitcoin’s current position around local highs is a key point for the cryptocurrency market. Leading experts have identified certain technical levels that can help us understand how prices may evolve over the next few weeks and months.

Support at $101,400 and resistance near $109,465 provide a trading range that many in the market will watch intently. A clear break in either direction could signal the start of the next significant phase in Bitcoin’s price discovery process.