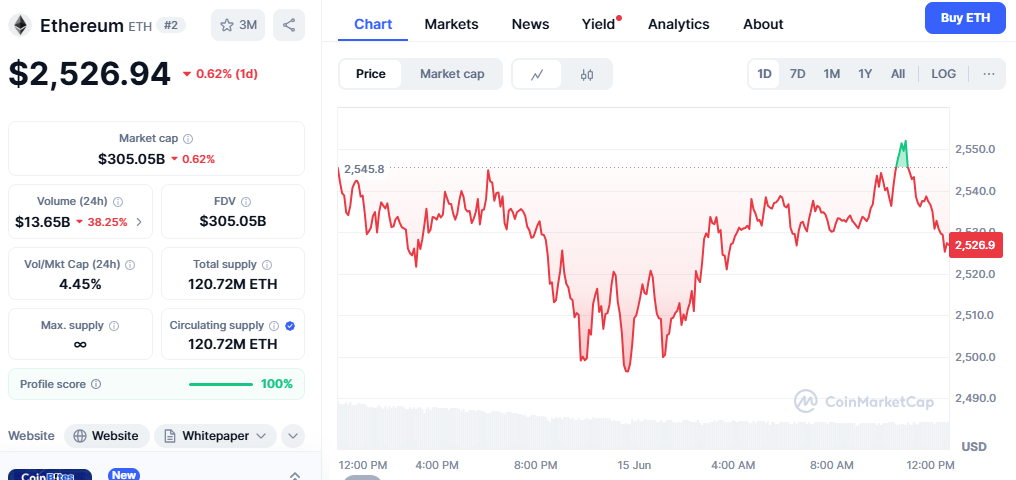

Ethereum Falls Below $25k: The cryptocurrency market is experiencing significant turbulence as Ethereum (ETH), the world’s second-largest digital asset by market capitalisation, has fallen below the critical $2,500 threshold. Bitcoin drops to $104,060, Ethereum falls to $2,553, XRP declines to $2.16, and Dogecoin plummets 9.86% to $0.1976. This dramatic price movement reflects broader market sentiment and highlights the ongoing volatility that continues to characterise the digital asset landscape in 2025.

Current Market Conditions and Ethereum’s Performance

The recent decline in Ethereum’s price represents a concerning development for investors and market participants who have been closely monitoring the cryptocurrency’s performance throughout 2025. The cryptocurrency market experienced downward pressure in June 2025 due to several interconnected factors, creating a perfect storm of selling sentiment. This downturn comes despite earlier optimistic projections that suggested Ethereum could maintain stronger price levels throughout the year.

Technical analysis reveals that Ethereum’s current price action is testing crucial support levels that have historically served as significant psychological barriers for traders and institutional investors. The breach of the $2,500 level carries substantial implications for the broader altcoin market, as Ethereum often serves as a bellwether for alternative cryptocurrency performance. Market analysts are now closely watching for signs of stabilisation or further deterioration in price momentum.

The selling pressure has been intensified by various macroeconomic factors that extend beyond the cryptocurrency space itself. Global economic uncertainties, regulatory developments, and the behaviour of institutional investors have all contributed to the current market environment. Understanding these interconnected dynamics is crucial for anyone seeking to comprehend the full scope of Ethereum’s recent price decline.

Factors Contributing to the Market Decline

Several key factors have converged to create the current bearish environment affecting Ethereum and the broader cryptocurrency market. Stalled US-China trade negotiations have emerged as the primary catalyst, with Treasury Secretary Scott Bessent confirming that talks have reached an impasse, creating uncertainty across global financial markets.

The impact of macroeconomic policy decisions on cryptocurrency valuations is significant and cannot be overstated. When traditional financial markets experience stress due to geopolitical tensions or policy uncertainties, digital assets often experience amplified volatility as investors seek to reduce their exposure to perceived risk assets. This flight-to-safety mentality has historically affected cryptocurrencies disproportionately compared to traditional asset classes.

Consumer Price Index data releases have also played a significant role in shaping market sentiment. Bitcoin price initially surged above $110,000 following cooler-than-expected U.S. Consumer Price Index (CPI) data, but subsequently retreated to close at $106,687, marking a 1.4% decline. This pattern of initial optimism followed by selling pressure demonstrates the complex relationship between economic indicators and cryptocurrency valuations.

The cascade effect of liquidations has further exacerbated the downward pressure on prices. Data from CoinGlass shows that 364,596 traders were liquidated in the last 24 hours, with total liquidations reaching $1.34 billion, highlighting the leverage-driven nature of many cryptocurrency positions and the rapid unwinding that occurs during periods of high volatility.

Technical Analysis and Ethereum Price Predictions

From a technical perspective, Ethereum’s breach of the $2,500 level marks a significant development that market analysts have been closely monitoring. Historical price action suggests that this level has served as both support and resistance in previous market cycles, making its breach particularly noteworthy for traders employing technical analysis strategies.

According to technical analysis of Ethereum prices expected in 2025, the minimum cost of Ethereum is predicted to be $2,345.26, according to some market predictions, suggesting that further downside potential may exist if current market conditions persist. However, it’s important to note that cryptocurrency price predictions carry inherent uncertainty due to the volatile nature of digital asset markets.

The Elliott Wave analysis framework provides additional insights into potential price movements. Because of the highly extended wave five, it is unlikely that Ethereum’s price will fall below $2,060 without invalidating the count. This technical perspective suggests that while near-term volatility may continue, there are structural support levels that could provide stabilisation points for the cryptocurrency.

Market participants are also closely monitoring moving averages, relative strength indicators, and volume patterns to gauge the strength of the current selling pressure. The confluence of technical indicators will play a crucial role in determining whether Ethereum can establish a sustainable base for recovery or if further declines are likely in the coming weeks.

Impact on the Broader Cryptocurrency Ecosystem

The decline in Ethereum’s price extends far beyond the cryptocurrency itself, given Ethereum’s central role in the decentralised finance ecosystem and the non-fungible token (NFT) markets. As the foundation for thousands of decentralised applications and smart contracts, Ethereum’s price performance often correlates with activity levels across various blockchain-based protocols and services.

Top altcoins, including Ethereum, Solana, XRP, and BNB, have also suffered, with falls of between 5% and 12%. This widespread decline illustrates the interconnected nature of cryptocurrency markets and how selling pressure in a significant asset, such as Ethereum, can ripple throughout the entire digital asset ecosystem.

The implications for decentralised finance protocols are particularly significant, as many DeFi applications rely on Ethereum’s network for their operations. Lower ETH prices can impact the economics of yield farming, liquidity provision, and other DeFi activities that have become integral parts of the cryptocurrency landscape. This ripple effect extends to token valuations across various DeFi protocols, influencing user behaviour and capital allocation decisions.

Non-fungible token markets have also felt the impact of Ethereum’s decline, as the majority of NFT transactions occur on the Ethereum blockchain. The relationship between Ethereum Price Surge and NFT market activity has been well-documented, with periods of price weakness often corresponding to reduced trading volumes and declines in the floor price of popular NFT collections.

Dynamics Drive Modern Cryptocurrency Market Movements

Institutional investor behaviour has become increasingly influential in cryptocurrency market movements, and their response to Ethereum’s recent decline will likely shape near-term price action. The maturation of cryptocurrency markets has led to increased correlation with traditional financial markets and institutional investment flows.

Exchange-traded fund flows, particularly for Ethereum-based products, provide insight into institutional sentiment. The approval and launch of spot Ethereum ETFs has created new avenues for institutional exposure to the cryptocurrency, but also introduces additional complexity in terms of market dynamics and price discovery mechanisms.

Custody solutions and institutional infrastructure have evolved significantly, enabling larger capital allocations to cryptocurrencies like Ethereum. However, this institutional participation also means that cryptocurrency markets are increasingly subject to the same risk-on, risk-off dynamics that affect traditional asset classes during periods of market stress.

The role of algorithmic trading and quantitative strategies has also expanded within cryptocurrency markets, potentially amplifying price movements in both directions. Understanding how these institutional dynamics interact with retail investor behaviour is crucial for comprehending the full scope of market movements, such as Ethereum’s recent decline.

Regulatory Evolution and Market Impact on Cryptocurrencies

The regulatory landscape surrounding cryptocurrencies continues to evolve, with policy developments in major jurisdictions having significant implications for market sentiment and price performance. Recent regulatory clarity in some regions has provided support for institutional adoption, while uncertainties in others have contributed to market volatility.

The ongoing development of central bank digital currencies and their potential impact on cryptocurrencies, such as Ethereum, remains a topic of significant interest among market participants. While CBDCs serve different purposes than decentralised cryptocurrencies, their development and implementation could influence the broader digital asset landscape.

Environmental, social, and governance considerations have also become increasingly important factors in institutional cryptocurrency adoption. Ethereum’s transition to a proof-of-stake consensus mechanism has addressed many ecological concerns; however, broader ESG considerations continue to influence institutional investment decisions and market sentiment.

Cross-border payment regulations and anti-money laundering requirements continue to shape how cryptocurrencies are perceived and utilised globally. These regulatory developments can have both direct and indirect effects on cryptocurrency valuations and market dynamics.

Future Outlook and Recovery Potential

Despite the current market challenges, several factors could contribute to Ethereum’s recovery and long-term growth prospects. The continued development of Ethereum’s ecosystem, including scaling solutions and protocol improvements, maintains the fundamental value proposition that has driven adoption and investment interest.

ETH price, with a potential surge, could reach $5,925 in 2025. While such projections should be viewed with appropriate caution given current market conditions, they reflect the underlying belief among some analysts that Ethereum’s technological advantages and ecosystem development could drive significant value appreciation over time.

The growing adoption of decentralised applications and the expansion of use cases for innovative contract platforms provide fundamental support for Ethereum’s long-term value proposition. As blockchain technology continues to mature and find new applications across various industries, Ethereum’s position as a leading innovative contract platform could drive increased demand for the cryptocurrency.

Market cycles in cryptocurrency have historically been characterised by periods of significant volatility followed by recovery and growth phases. Understanding these cyclical patterns, while acknowledging the unique characteristics of each market environment, is crucial for investors and market participants seeking to navigate the current landscape.