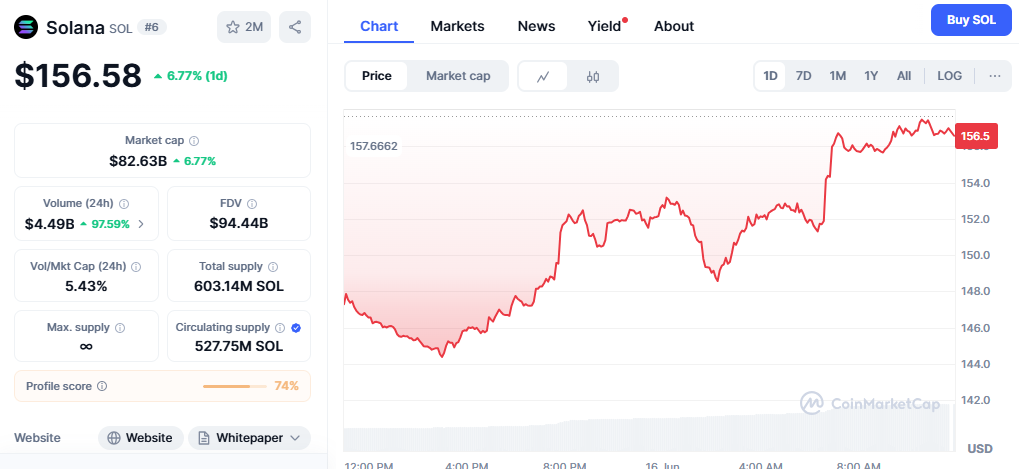

The Solana price analysis (SOL) cryptocurrency market presents compelling technical analysis signals as the digital asset approaches a critical juncture near the $155 price level. Current market dynamics suggest that this retest could provide an optimal entry point for bearish traders looking to capitalise on potential downward momentum. Understanding the intricate technical patterns and market sentiment surrounding Solana’s price action becomes crucial for traders seeking profitable short positions in today’s volatile cryptocurrency landscape.

Current Market Analysis of Solana’s Price Action

Solana is currently consolidating between key support and resistance levels, with mixed indicators signalling potential volatility, as the RSI at 38.84 indicates weakening momentum and approaches oversold territory. The cryptocurrency’s struggle to maintain its position above critical moving averages indicates underlying bearish pressure that technical analysts are closely monitoring.

The $155 price level has emerged as a significant technical marker for SOL, representing a confluence of various support and resistance factors. This zone aligns with the lower Bollinger Band midline and the ascending trendline that formed after the June 5 reversal, making it a crucial area for predicting future price direction.

Market participants should note that the failure to hold the 20-day SMA at $159 suggests bears are in control, providing additional confirmation for bearish sentiment. This technical breakdown represents a fundamental shift in market structure that savvy traders can exploit through strategic short positioning.

Technical Indicators Supporting Bearish Outlook

The technical landscape for Solana reveals multiple bearish confluence factors that strengthen the case for short positions. Based on technical indicators, with 20signallinggg bearish signals, SOL’s short-term 50-day SMA is estimated to reach $154.57 by July 14, 2025. This downward trajectory in moving averages provides a strong technical foundation for bearish positioning strategies.

Furthermore, the 50-day moving average is falling, suggesting a weakening short-term trend, while the 200-day moving average has been falling since June 12, 2025, indicating a weak longer-term trend. These dual-timeframe confirmations create a compelling technical narrative for traders considering short positions.

The relative strength index’s positioning near oversold territory, combined with declining moving averages, creates a technical environment where bounces toward resistance levels, such as $155, often fail to sustain momentum. This dynamic provides strategic entry opportunities for bearish traders who can time their positions effectively around these key technical levels.

Strategic Short Entry at $155 Resistance Level

Traders evaluating short opportunities should focus on the $155 retest as a high-probability entry zone. The convergence of multiple technical factors at this level creates an asymmetric risk-reward scenario favouring bearish positions. Understanding proper entry timing becomes crucial for maximising profit potential while minimising downside risk.

The ideal short entry strategy involves waiting for confirmation signals such as rejection candles at the $155 resistance level, accompanied by increased selling volume. These confirmation signals help validate the technical thesis while providing more precise risk management parameters for position sizing and stop-loss placement.

Risk management protocols should incorporate the understanding that if the $139 level breaks, further downside toward $125 is possible, providing substantial profit targets for well-timed short positions. However, traders must also acknowledge potential bounce scenarios that could retest higher resistance levels.

Bearish Sentiment Drives Solana Market Correction Signals

The broader cryptocurrency market sentiment continues to influence Solana’s price trajectory, with technical indicators suggesting that the current market sentiment is bearish at 71%, as indicated by a Fear & Greed Index score of 60 (Greed). This divergence between technical bearishness and greed sentiment often precedes significant price corrections.

Institutional positioning and whale behaviour patterns indicate an increase in short interest, with bearish sentiment intensifying and short positions reaching a monthly high. This institutional alignment with bearish technical signals provides additional confidence for retail traders considering similar positioning strategies.

The macroeconomic environment affecting cryptocurrency markets includes factors such as regulatory uncertainty, institutional adoption rates, and broader financial market conditions. These fundamental considerations support the technical bearish thesis while providing context for understanding the potential duration and magnitude of price declines.

SOL Technical Analysis: Downside Targets and Risk Assessment

Technical analysis suggests multiple downside targets for SOL, with the primary support zone around $139 representing the first major objective for short positions. According to forecasts, the price of Solana is expected to increase by 6.36% over the next month, reaching $152.67 by July 14, 2025. However, this bullish projection may be challenged by the current bearish technical momentum.

Secondary price targets extend toward the $125 level, which represents a significant confluence of support from previous market cycles. This extended target provides substantial profit potential for traders who can maintain positions through intermediate bounces and consolidation periods.

The risk-reward ratio for short positions initiated near $155 offers attractive asymmetric opportunities, with potential profits exceeding 20-25% if price targets are achieved. However, traders must implement proper position sizing and risk management protocols to protect against unexpected bullish reversals.

Risk Management Considerations

Effective risk management becomes paramount when executing short positions in volatile cryptocurrency markets. Stop-loss placement above key resistance levels, specifically around $165-$ 170, protects against significant adverse moves while allowing positions sufficient room to develop.

Position sizing should reflect individual risk tolerance and account size, with most professional traders recommending exposure levels between 1% and 3% of the total portfolio value per trade. This conservative approach ensures survival during unexpected market volatility while preserving capital for future opportunities.

Monitoring broader market conditions, Bitcoin correlation patterns, and overall cryptocurrency market sentiment provides additional context for managing Solana short positions. These macro factors often override individual technical analysis, making continuous market assessment essential for successful trade management.

Long-term Outlook and Strategic Implications

The current technical setup for Solana represents part of a broader consolidation pattern that may persist for several weeks or months. Understanding this longer-term context helps traders adjust their expectations and position sizing accordingly, while remaining flexible in response to evolving market conditions.

Blockchain fundamentals for Solana, including network activity, developer adoption, and institutional partnerships, provide essential context for assessing whether current bearish technical signals represent temporary corrections or more significant structural shifts in market sentiment.

Future resistance levels around $180-$200 may provide additional shorting opportunities if the current bearish momentum fails to sustain itself. However, traders should remain prepared for potential trend reversals that could invalidate current technical assumptions.

Conclusion

The Solana price prediction scenario centring around the $155 retest presents compelling opportunities for experienced traders seeking short exposure to cryptocurrency markets. The confluence of bearish technical indicators, declining moving averages, and negative market sentiment creates a high-probability setup for profitable short positions.

However, successful execution requires disciplined risk management, proper position sizing, and continuous monitoring of evolving market conditions. Traders who can combine technical analysis with sound risk management principles, while remaining flexible to changing market dynamics, are best positioned to capitalise on these opportunities.