Ethereum vs Little Pepe: The cryptocurrency market presents investors with compelling opportunities as two distinct digital assets capture attention for their ambitious price targets. Ethereum, the world’s second-largest cryptocurrency by market capitalization, faces predictions of reaching $5,000, while the emerging meme coin Little Pepe targets an ambitious $0.50 price point. Understanding the fundamental differences, technical analysis, and market dynamics surrounding these tokens becomes crucial for making informed investment decisions.

Ethereum’s Path to $5,000: Technical Foundation and Market Catalysts

Ethereum’s journey toward $5,000 represents more than speculative trading; it reflects the maturation of decentralized finance (DeFi) and the broader blockchain ecosystem. The Ethereum network, initially conceived by Vitalik Buterin in 2015, has evolved into the backbone of decentralized applications, smart contracts, and non-fungible tokens (NFTs). Recent price predictions suggest that ETH could reach as high as $5,925 by 2025, with some analysts forecasting even more aggressive targets.

The technical foundation supporting Ethereum’s price appreciation includes the successful transition to Ethereum 2.0, which implemented proof-of-stake consensus mechanisms. This upgrade significantly reduced energy consumption while improving transaction throughput and scalability. Layer 2 solutions like Polygon, Arbitrum, and Optimism have further enhanced Ethereum’s capabilities, addressing longstanding concerns about network congestion and high gas fees.

Institutional adoption serves as another catalyst driving Ethereum toward the $5,000 threshold. Major corporations and financial institutions increasingly recognize Ethereum’s utility beyond simple value transfer. The network’s role in facilitating decentralized finance protocols, yield farming opportunities, and innovative contract execution positions it as essential infrastructure for the digital economy.

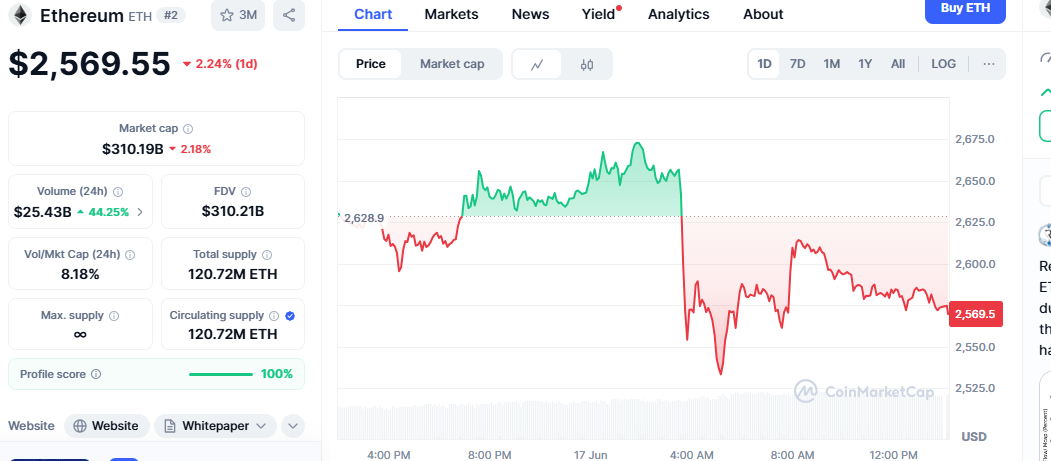

Market sentiment surrounding Ethereum remains predominantly bullish, with technical indicators showing a “cup and handle” pattern that historically precedes significant price movements. The Fear and Greed Index currently displays a score of 61, indicating greed among investors and potential upward momentum. Ethereum’s dominance in the altcoin market, combined with its first-mover advantage in smart contract functionality, creates a compelling case for sustained growth.

Meme Coins Meet DeFi: The Case of Little Pepe

Little Pepe represents a new generation of meme cryptocurrencies that attempt to combine internet culture with legitimate blockchain utility. Unlike its predecessors, LILPEPE introduces a Layer 2 blockchain network that integrates decentralized finance features with meme-driven community engagement. The token’s presale launch in June 2025 has generated significant attention, with early investors drawn to the potential for exponential returns.

The $0.50 price target for Little Pepe would require substantial market capitalization growth from its current presale valuation. Meme coins historically demonstrate extreme volatility, with successful projects like Dogecoin and Shiba Inu achieving astronomical gains during favorable market conditions. Little Pepe’s ecosystem approach, combining meme appeal with practical DeFi applications, differentiates it from purely speculative tokens.

Community-driven growth represents the primary catalyst for Little Pepe’s success. The project’s marketing strategy leverages social media platforms, particularly Twitter and TikTok, to create viral momentum. Meme coin success often depends on cultural relevance, timing, and the ability to capture public imagination during market euphoria. Little Pepe’s connection to the popular Pepe meme provides built-in recognition and cultural cachet.

However, the path to $0.50 faces significant challenges. The meme coin market remains highly speculative, with most projects failing to maintain long-term value. Regulatory scrutiny of meme tokens continues to increase, potentially limiting mainstream adoption. Additionally, the market’s attention span for meme coins tends to be brief, requiring continuous innovation and community engagement to sustain momentum.

Comparative Analysis: Risk Profiles and Investment Considerations

Ethereum and Little Pepe represent fundamentally different risk-reward propositions. Ethereum’s established market position, robust development ecosystem, and institutional recognition provide stability and predictable growth patterns. The network’s utility extends beyond speculative trading, creating intrinsic value through transaction fees, staking rewards, and ecosystem participation.

Little Pepe operates in the high-risk, high-reward category typical of meme coins. While the potential for dramatic price appreciation exists, the probability of total loss remains significant. The project’s early-stage nature means limited liquidity, uncertain regulatory compliance, and dependence on community sentiment for value creation.

Diversification strategies become crucial when evaluating these opportunities. Ethereum serves as a foundation holding for cryptocurrency portfolios, providing exposure to blockchain technology’s growth while maintaining relative stability. Little Pepe functions as a speculative position, suitable only for investors comfortable with the potential total loss in exchange for outsized returns.

Market timing plays a critical role in both scenarios. Ethereum’s price targets depend on continued institutional adoption, successful network upgrades, and favorable regulatory developments. Little Pepe’s success requires capturing market attention during periods of heightened speculation and meme coin enthusiasm.

Technical Analysis and Price Prediction Methodology

Ethereum’s price analysis incorporates multiple technical indicators and fundamental metrics. Moving averages, support and resistance levels, and trading volume patterns provide insights into potential price movements. The current bullish sentiment reflected in the Fear and Greed Index suggests favorable conditions for upward momentum.

Fibonacci retracement levels indicate key support zones for Ethereum, with $2,500 serving as crucial psychological support and $3,000 representing significant resistance. Breaking above $3,000 would likely trigger algorithmic buying and institutional accumulation, potentially accelerating movement toward $5,000.

Little Pepe’s technical analysis remains limited due to its early-stage nature. Presale pricing and initial trading patterns will establish baseline metrics for future study. The token’s price discovery process depends heavily on initial market reception and community adoption rates.

Market Conditions and External Factors

Macroeconomic conditions significantly influence both Ethereum and Little Pepe price trajectories. Interest rate policies, inflation concerns, and traditional market performance affect cryptocurrency valuations. The current regulatory environment, particularly in the United States and European Union, shapes institutional participation and retail investor confidence.

Ethereum benefits from clearer regulatory pathways, with many jurisdictions recognizing it as a utility token rather than a security. This classification provides legal certainty for institutional investors and reduces regulatory risk. Little Pepe faces uncertain regulatory treatment, with meme coins often subject to increased scrutiny and potential classification as securities.

Competition within the cryptocurrency space continues to intensify. Ethereum competes with other innovative contract platforms like Solana, Cardano, and Binance Smart Chain. Little Pepe faces competition from established meme coins and numerous new entrants seeking to capture market attention.

Investment Timeline and Strategic Considerations

Ethereum’s path to $5,000 likely unfolds over a 12-18 month timeline, assuming continued favorable market conditions and successful network development. The gradual nature of institutional adoption supports sustained price appreciation rather than explosive short-term gains.

Little Pepe’s timeline to $0.50 depends on viral adoption and market sentiment. Meme coin success often occurs rapidly during favorable market conditions, but can collapse equally quickly. The project’s ability to maintain community engagement and deliver on promised utility features determines long-term viability.

Portfolio allocation strategies should reflect risk tolerance and investment objectives. Conservative investors might allocate 70-80% to established cryptocurrencies like Ethereum while reserving 20-30% for speculative positions. Aggressive investors might increase speculative allocations but should maintain strict risk management protocols.