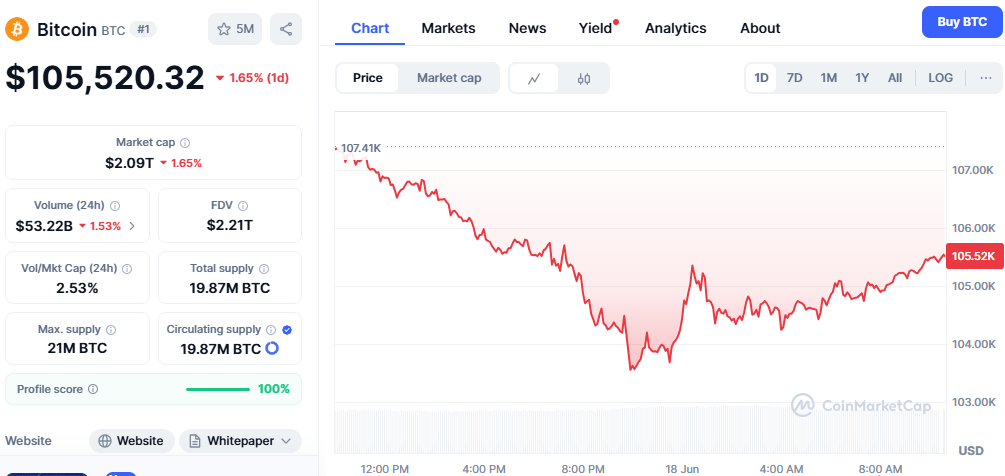

Bitcoin double top pattern analyst Jason Pizzino has emerged as a notable voice, maintaining Bitcoin optimism despite the identification of concerning technical patterns, including potential double-top formations. As markets navigate the volatile landscape of 2025, Pizzino’s analysis offers a unique perspective that combines technical caution with long-term bullish sentiment.

Double Top Pattern: What It Means for Bitcoin

The Technical Setup

A double top pattern occurs when an asset reaches a high price point, declines, then rallies back to a similar high before declining again. This formation typically signals a potential shift from a bullish to a bearish trend. Jason Pizzino has identified the emergence of a possible short-term double top pattern in Bitcoin prices, raising questions about the cryptocurrency’s immediate trajectory.

Historical Context and Market Implications

However, experts are dismissing 2025 Bitcoin double top fears, citing strong fundamentals like ETFs, institutional buying, and on-chain metrics. This contrasts sharply with the 2021 market cycle, where similar patterns preceded significant corrections.

Pizzino’s Bullish Long-Term Vision

Cycle Peak Predictions

Cryptocurrency analyst and trader Jason Pizzino is leaning bullish on Bitcoin (BTC) over the short to medium term. His analysis extends beyond immediate technical concerns to encompass broader market cycles and institutional adoption trends.

Price Targets and Timeline

According to Pizzino, “Bitcoin has at least $120,000 in it for this cycle, whether this cycle means 2025 is the end of 2026”. This ambitious target represents significant upside potential from current levels, despite short-term technical headwinds.

Technical Analysis: Navigating Support and Resistance

Critical Levels to Watch

According to Pizzino, Bitcoin will retain its bullish prospects if the Privacy Coins Surge Crypto king manages to hold above key support levels. The analyst emphasises that May 2025 was particularly crucial for determining Bitcoin’s trajectory, with the potential for “floodgates to open” if support were to hold.

Breakout Signals and Momentum Indicators

In a recent analysis, Pizzino noted that “Bitcoin broke March’s monthly high, which cancelled the macro bearish signal,” suggesting that technical momentum remains favourable despite concerns about a double top.

Market Dynamics and Institutional Factors

The ETF Effect

The introduction of Bitcoin ETFs has fundamentally altered market dynamics. Unlike previous cycles, institutional infrastructure now provides a foundation for sustained price appreciation, potentially invalidating traditional technical patterns, such as double tops.

Geopolitical Influences

Jason Pizzino examines the influence of geopolitical tensions on financial markets, demonstrating how macroeconomic factors can supersede short-term technical patterns in cryptocurrency markets.

Risk Assessment: Balancing Optimism with Caution

Potential Downside Scenarios

In February 2025, Pizzino warned that “probabilities of a crash continue to increase” for Bitcoin and other crypto assets, demonstrating his willingness to acknowledge bearish scenarios despite overall optimism.

Market Volatility Considerations

Pizzino has noted that the crypto market is “not playing ball” so far in 2025, acknowledging the unpredictable nature of cryptocurrency price movements even within bullish frameworks.

Comparative Analysis: Bitcoin vs. Altcoins

Altcoin Outperformance Potential

Pizzino has suggested that altcoins could outshine Bitcoin this year as crypto markets anticipate bullish catalysts. This perspective adds nuance to his Bitcoin analysis, suggesting a more complex market dynamic.

Portfolio Allocation Strategies

The analyst’s multi-asset approach provides investors with a framework for navigating both Bitcoin’s potential double top pattern and broader cryptocurrency market opportunities.

Expert Insights and Market Sentiment

YouTube Following and Influence

With 350,000 YouTube subscribers, Pizzino’s analysis reaches a significant audience of cryptocurrency investors and traders. His balanced approach to technical analysis has earned him recognition in the crypto community.

Methodology and Approach

Pizzino’s analysis combines traditional technical analysis with cryptocurrency-specific factors, creating a hybrid methodology that accounts for both classical chart patterns and the unique characteristics of digital asset markets.

Looking Forward: Key Catalysts and Timeline

Short-Term Catalysts

The remainder of 2025 presents several potential catalysts that could validate Pizzino’s bullish outlook despite double top concerns:

- Continued institutional adoption

- Regulatory clarity developments

- Macroeconomic policy shifts

- Technological improvements in Bitcoin infrastructure

Long-Term Outlook Through 2026

Pizzino’s extended timeline through 2026 provides flexibility for his price targets while acknowledging that cryptocurrency cycles may be evolving beyond traditional four-year patterns.

Investment Implications and Strategic Considerations

Risk Management

Investors following Pizzino’s analysis should consider:

- Position sizing is appropriate for volatility

- Dollar-cost averaging strategies

- Technical stop-loss levels

- Diversification across crypto assets

Market Timing Considerations

The tension between short-term double top patterns and long-term bullish outlooks highlights the importance of investment horizon in cryptocurrency markets.

Conclusion

Jason Pizzino’s analysis of Bitcoin’s potential double top pattern demonstrates the complexity of modern cryptocurrency markets. While traditional technical analysis identifies concerning patterns, fundamental factors, including institutional adoption, regulatory developments, and evolving market structure, may override classical signals.

His assertion that “optimism around Bitcoin continues despite ongoing skepticism” encapsulates the current market sentiment, where long-term believers maintain conviction despite short-term technical challenges.

For investors, Pizzino’s framework offers a balanced approach that acknowledges both technical risks and fundamental opportunities. The key lies in understanding that cryptocurrency markets may be transitioning beyond traditional technical analysis paradigms, requiring new frameworks for evaluation and decision-making.