Bitcoin Reserve Creation: In a move that could reshape the future of digital assets and corporate finance, Amazon shareholders are now calling on the e-commerce giant to create a Bitcoin reserve. This request, which comes amid the growing mainstream acceptance of cryptocurrencies, reflects the increasing interest from investors in how tech giants like Amazon can integrate digital currencies into their business strategies. Pi Network Price Prediction: PI Coin Forecast for 2024 With Bitcoin’s rise as a store of value and potential hedge against inflation, could Amazon be poised to make the leap into the crypto space?

1. Why Are Amazon Shareholders Pushing for a Bitcoin Reserve?

Shareholders are urging Amazon to build a Bitcoin reserve for several key reasons:

a) Bitcoin as a Store of Value

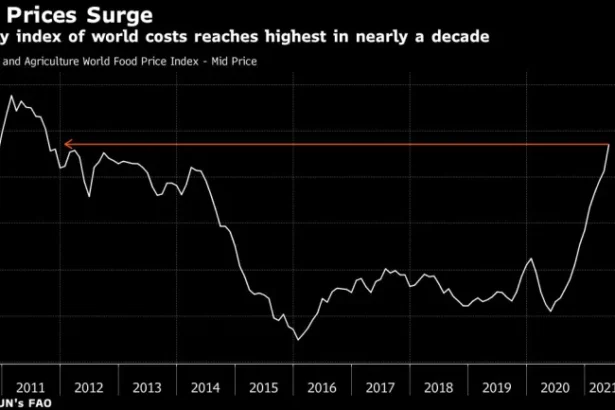

Bitcoin, often referred to as “digital gold,” has increasingly been seen as a store of value, particularly in times of economic uncertainty. With inflationary pressures and concerns over traditional currency devaluation, Bitcoin has become an attractive option for institutional investors. By adopting a Bitcoin reserve, Amazon could benefit from the appreciation of the cryptocurrency over time, potentially boosting its financial position.

b) Diversification of Assets

Amazon, as one of the world’s largest companies, is constantly looking for ways to diversify its holdings and strengthen its balance sheet. A Bitcoin reserve would add another layer of diversification, offering an asset that is not tied to traditional financial systems. Given Bitcoin’s relatively low correlation to traditional equities, it could help Amazon weather economic downturns and provide a hedge against market volatility.

c) Boosting Brand Image and Investor Confidence

As cryptocurrencies become more mainstream, companies that embrace digital assets stand to gain a competitive edge in the eyes of both investors and consumers. By adopting Bitcoin as part of its reserve strategy, Amazon could position itself as a forward-thinking, innovative company that is ready to take advantage of emerging technologies. This move could also attract institutional investors who are already bullish on Bitcoin and want to see companies take a more progressive approach to digital assets.

2. What Would a Bitcoin Reserve Mean for Amazon’s Financial Strategy?

If Amazon were to create a Bitcoin reserve, it would be a significant shift in its financial strategy. The implications could be far-reaching:

a) Enhanced Financial Flexibility

A Bitcoin reserve could provide Amazon with additional liquidity and financial flexibility. Bitcoin’s growing acceptance as a store of value means that, in times of crisis, the company could sell or use its Bitcoin holdings for cash or other assets if needed. This could help Amazon mitigate risks associated with currency fluctuations, especially in countries where inflation is a concern.

b) Impact on Balance Sheet

Bitcoin’s price volatility presents both opportunities and risks. A rise in the price of Bitcoin could increase Amazon’s overall valuation, while a sudden drop could have the opposite effect. However, given Amazon’s size and its capacity to absorb such fluctuations, this may not pose a significant threat. Moreover, if Amazon were to hold Bitcoin as part of its long-term strategy, it would be signaling to investors that it believes in the long-term potential of the digital currency.

c) Tax Implications

One important consideration is the tax treatment of Bitcoin. In many jurisdictions, including the U.S., Bitcoin is considered a property for tax purposes. This means that Amazon could face capital gains taxes on any Bitcoin it holds, depending on price fluctuations. The company would need to carefully manage its holdings and track any potential tax liabilities as it builds its Bitcoin reserve.

3. The Potential Benefits of a Bitcoin Reserve

For Amazon, the potential benefits of creating a Bitcoin reserve are significant:

a) Hedge Against Inflation

Bitcoin is often seen as a hedge against inflation, especially when fiat currencies lose purchasing power. In the face of increasing government debt and expanding monetary policies, many investors view Bitcoin as a more reliable store of value compared to traditional fiat currencies. By holding Bitcoin, Amazon could protect its value from potential inflationary pressures on the U.S. dollar or other national currencies.

b) Attracting a New Demographic

By embracing Bitcoin, Amazon could tap into a new demographic of customers and investors who are passionate about cryptocurrency. This group is typically young, tech-savvy, and invested in the future of digital finance. Bitcoin Reserve Creation Offering Bitcoin-related services or even accepting Bitcoin as payment could attract a loyal customer base and further cement Amazon’s position as an industry leader.

c) Increased Investor Appeal

Institutional investors are increasingly looking for exposure to Bitcoin. As more firms incorporate Bitcoin into their financial strategies, Amazon could attract new investors who are bullish on cryptocurrencies. The move could also encourage other tech companies to follow suit, creating a ripple effect throughout the industry.

4. The Risks and Challenges of Holding Bitcoin

While the idea of a Bitcoin reserve is appealing, there are risks and challenges that Amazon would need to consider before adopting such a strategy.

a) Price Volatility

Bitcoin’s price is notoriously volatile. While it has grown significantly in value over the past decade, its price fluctuations can be dramatic. For example, Bitcoin has seen several boom-and-bust cycles, with its value swinging widely within short periods. Holding Bitcoin would expose Amazon to this risk, which could affect its financial performance in the short term.

b) Regulatory Uncertainty

The regulatory environment for cryptocurrency is still evolving, and Amazon would need to navigate complex legal and tax frameworks. As governments around the world debate how to regulate digital assets, Amazon could face legal challenges or increased Bitcoin Reserve Creation scrutiny over its Bitcoin holdings. Regulatory uncertainty remains one of the biggest obstacles to large corporations adopting Bitcoin as part of their financial strategy.

c) Security Risks

Storing and securing Bitcoin comes with its own set of challenges. Unlike traditional financial assets, cryptocurrencies require robust cybersecurity measures to prevent theft or hacking. While Amazon is known for its strong technological infrastructure, ensuring the security of its Bitcoin holdings would require ongoing investments in security protocols and monitoring.

5. Could This Be a Sign of a Larger Trend in Corporate Crypto Adoption?

Amazon’s potential move to create a Bitcoin reserve is part of a larger trend where companies are increasingly considering cryptocurrency as an integral part of their financial strategies. Tesla, Square (now Block), and MicroStrategy are among the high-profile companies that have already invested in Bitcoin or integrated it into their business models.

As institutional investors and major corporations start to recognize the benefits of holding digital assets like Bitcoin, it could pave the way for even more widespread crypto adoption. Amazon’s involvement would send a strong signal to the market and could inspire other tech giants to follow suit.

Conclusion

The idea of Amazon creating a Bitcoin reserve is an exciting prospect, signaling the company’s potential embrace of the future of finance. However, the risks involved—such as volatility, regulatory uncertainty, and security concerns Bitcoin Reserve Creation mean that this move would require careful consideration. While the potential rewards, including diversification and increased investor confidence, are appealing, Amazon would need to weigh these against the possible downsides.

[sp_easyaccordion id=”3447″]