The AMP coin price breakout is one of the best performers in the cryptocurrency market since it shows fresh optimistic activity. Investors and market watchers are starting to pay great attention as the digital asset crosses the psychologically critical $0.005 resistance level. AMP is taking the stage as momentum grows and distributed collateral tokens become once more of focus. But is this price increase a fleeting pump or evidence of long-term bullish possibility?

This paper investigates the present AMP price run, its drivers, the market’s technical environment, and wider consequences for distributed financing (DeFi). It will also examine how AMP is positioned in a changing blockchain economy and respond to the most pertinent user questions.

AMP: Fast & Safe Payments

Particularly within the Flexa Network, AMP is a digital collateral token that speeds and ensures safe value transfers. Point-of-sale terminals on this payment system permit quick crypto transactions. As collateral for secure transfers, AMP guarantees merchants are paid even before the blockchain completes transactions. This makes it crucial for stable payment systems and actual crypto acceptance.

Designed by Flexa and ConsenSys, AMP’s creative contract-based approach lowers the volatility sometimes associated with crypto transactions and removes fraud risk. AMP is an ERC-20 token, and most wallets, exchanges, and DeFi interoperability operate on the Ethereum blockchain.

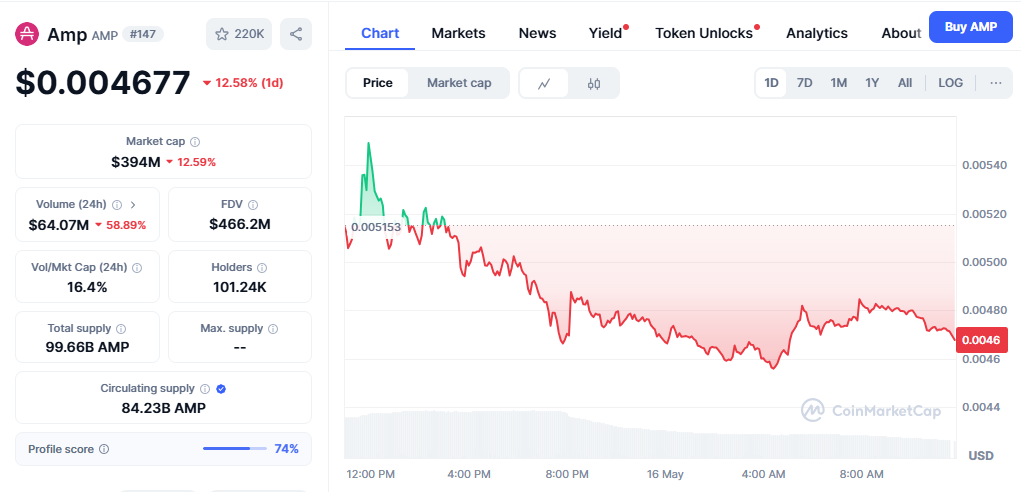

AMP Breaks Through 0.005

Breaking above $0.005 is not only a price movement but also indicates fresh investor optimism. AMP battled below this level for months while resistance zones developed around $0.0048 to $0.0050. A clean breakout with volume confirmation now points to a likely trend change. Technical indicators showing a positive divergence—the Relative Strength Index (RSI)—point to growing purchasing momentum. Additionally, the moving average convergence divergence (MACD) flips positive and indicates an increasing trend.

With more retail traders reviewing the coin, market attitude on platforms like CoinMarketCap and Crypto Twitter shows increasing hope. Over the past seven days, trading volume across centralized exchanges such as Coinbase, Binance, and Gemini has also greatly risen. This volume surge often precedes more robust rallies, especially with low-cap cryptocurrencies like AMP.

Key Factors Behind AMP’s Rally

The present AMP coin price breakout spike is driven by several linked elements that indicate a junction of macro and project-specific momentum. The increasing curiosity in practical crypto payment options is one of the main forces behind it. Flexa’s infrastructure becomes more essential as demand for flawless point-of-sale transactions utilizing digital resources rises. Since AMP is the collateral backbone of the Flexa network, any good news or more general acceptance instantly increases its apparent worth and use.

Furthermore, strategic alliances and merchant integrations enhance AMP’s real-world applicability. Though often indirectly employing Flexa’s payment capabilities via third-party apps, major stores like Whole Foods, GameStop, and Nordstrom help build a growing ecosystem that supports the practical usage of AMP as a payment collateral. These interactions support AMP’s relevance outside of speculative trading and build credibility.

Another significant driver is the fresh attention on Ethereum Layer-2 scalability solutions. Integration with networks like Optimism and Arbitrum would help AMP greatly since Ethereum gas expenses still provide a bottleneck for transaction efficiency. Faster and less expensive transactions provided by these Layer-2 platforms fit Flexa’s aim of providing quick and low-cost payments.

Finally, the positive momentum present in the whole bitcoin market is encouraging. Altcoins like AMP are riding tailwinds from the general bullish attitude as Bitcoin rises beyond $60,000 and Ethereum approaches the $3,000 mark. This mix of market momentum, technological development, and practical application has positioned AMP well for ongoing price appreciation.

On-chain metrics and market sentiment

On-chain analytics provide a deeper understanding of the AMP coin price breakout, increasing popularity. An analytics tool called Santiment reveals unusual wallet addresses that engage with the token and grow. A minor increase in whale activity also points to considerable holdings building in anticipation of a bigger breakout.

Moreover, AMP’s staking measures on Flexa Capacity—a fundamental tool locking AMP to back payment capacity—have also consistently risen. This suggests consumers locking down tokens instead of trading, which is encouraging for long-term stability and price support.

According to social sentiment analysis, trending hashtags such as #AMPtoken, #Flexa, and #CryptoPayments expose a growing enthusiasm for the project. Globally searches for “AMP crypto,” especially from nations with rising crypto use like Turkey, Nigeria, and India, Google Trends also show a spike.

AMP Forecasts and Future Vision

AMP’s breakthrough over $0.005 could indicate the start of a more general trend. With a key level of $0.0080, short-term resistance is predicted to be close to $0.0065. A successful violation of these zones could open the path towards retesting the $0.01 psychological barrier, a main aim for both short—and mid-term bulls.

Price rallies in alternative currencies are sometimes erratic, though. Any notable change in regulatory attitude or Bitcoin decline could affect AMP’s momentum. Still, AMP will remain relevant in the ever-more-competitive DeFi scene if it provides special value in ensuring real-world payments.

Particularly around EIP upgrades and scalability enhancements, long-term positive arguments include increased Flexa acceptance, integration into significant retail systems, and alignment with Ethereum’s roadmap.