The cryptocurrency market has witnessed an intense struggle as Bitcoin approaches and tests the critical $105,000 resistance level, marking what many analysts consider the most significant price battleground of 2025. This pivotal threshold has emerged as a defining moment where bullish momentum meets bearish resistance, creating a perfect storm of market dynamics that could determine Bitcoin’s trajectory for months to come.

The Significance of Bitcoin’s $105K Resistance Zone

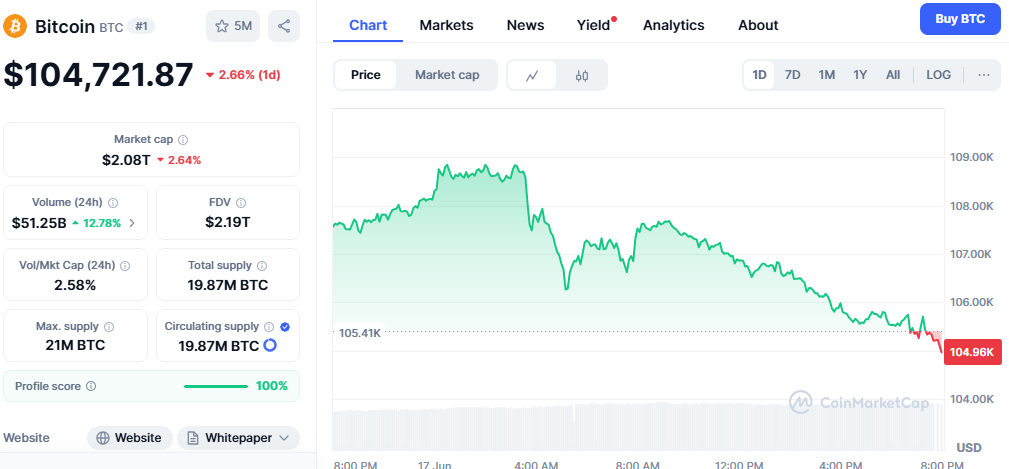

Bitcoin’s approach to the $105,000 level represents more than just another price milestone; it embodies a psychological and technical barrier that has captured the attention of institutional investors, retail traders, and market analysts worldwide. Bitcoin’s price held steady at $105,080 on Monday, with a trading volume of $90.85 billion and a market cap of $2 trillion. This consolidation around the $105K zone demonstrates the market’s uncertainty about the next directional move.

The $105K level has become particularly significant due to its confluence with several technical indicators and market sentiment factors. According to Santiment, Bitcoin has encountered resistance in the $104K to $105K range over the past week, causing a shift toward bearish sentiment among swing traders. This behavioral shift among traders highlights the psychological importance of this price level and its potential impact on future market movements.

Technical Analysis: Mapping the Bull and Bear Territory

From a technical perspective, the $105K zone represents a complex intersection of resistance levels, moving averages, and key Fibonacci retracements that have historically influenced Bitcoin’s price action. Data shows strong support between $92,703 and $105,314, and relatively weak resistance above current prices. This technical setup suggests that while Bitcoin has established a solid foundation below $105K, breaking through this ceiling could open doors to significantly higher price targets.

The Moving Average Convergence Divergence (MACD) indicator and standard deviation bands have been providing crucial insights into Bitcoin’s volatility patterns around this critical level. Market volatility signals have intensified as Bitcoin consolidates near $105K, with technical analysts monitoring for potential breakout scenarios that could trigger substantial price movements in either direction.

Market Sentiment and Trader Positioning

The battle for $105K has significantly influenced trader sentiment and positioning strategies across the cryptocurrency ecosystem. Professional traders and institutional investors are closely monitoring on-chain metrics, order book data, and derivative market signals to gauge the likelihood of a successful breakout or potential rejection at this level.

Swing traders have demonstrated increased caution as Bitcoin tests the $105K resistance, with many adopting wait-and-see approaches rather than committing to directional trades. This shift in trader behavior reflects the market’s recognition of the critical nature of this price level and its potential implications for Bitcoin’s medium-term trajectory.

Institutional Impact and Market Dynamics

The role of institutional investors in Bitcoin’s price action around $105K cannot be understated. Spot Bitcoin Exchange-Traded Funds (ETFs) and corporate treasury adoptions have created new demand dynamics that influence how Bitcoin responds to key resistance levels. Spot Bitcoin ETFs could manage $190 billion in assets by 2025 and $3 trillion by 2033. This institutional framework provides additional context for understanding the significance of the $105K battleground.

Large-scale Bitcoin holders, often referred to as whales, have demonstrated strategic positioning around the $105K level, with some taking profits while others continue accumulating, creating a complex interplay of supply and demand forces that contribute to the ongoing price consolidation.

Price Predictions and Analyst Perspectives

Market analysts and cryptocurrency experts have provided varied perspectives on Bitcoin’s potential to overcome the $105K resistance. Market analysts forecast Bitcoin to reach $150,000 or higher in 2025, although CryptoQuant’s on-chain assessment presents a more restrained perspective. These predictions highlight the divergent views within the analyst community regarding Bitcoin’s near-term price potential.

Some technical analysts suggest that a successful break above $105K could target the next central resistance zone around $120K to $ 125 K. In contrast, others caution that failure to maintain levels above $105K could result in a retest of lower support levels around $95K to $ 100 K. Immediate resistance lies at $106,400, with any upside recovery likely capped until bulls reclaim $108,000+.

Macro-Economic Factors Influencing the $105K Battle

The broader macroeconomic environment plays a crucial role in Bitcoin’s ability to sustain momentum above $105K. Federal Reserve monetary policy decisions, inflation data, and global economic uncertainty continue to influence investor appetite for risk assets, including Bitcoin. The correlation between traditional financial markets and Bitcoin has become more pronounced at higher price levels, adding complexity to the $105K resistance dynamics.

Currency debasement concerns, government debt levels, and geopolitical tensions remain supportive fundamental factors for Bitcoin’s long-term value proposition, potentially providing underlying support for bullish momentum even during periods of technical consolidation around key resistance levels.

On-Chain Metrics and Network Fundamentals

Bitcoin’s on-chain metrics provide valuable insights into the network’s health and user behavior during this critical price juncture. Hash rate stability, network security, and transaction volume patterns offer clues about the sustainability of Bitcoin’s position near $105K and its potential for future growth.

Long-term holders continue to demonstrate conviction by maintaining their positions despite short-term price volatility, while new addresses and active addresses metrics suggest sustained interest in Bitcoin adoption even at elevated price levels. These fundamental network metrics support the case for Bitcoin’s continued relevance and potential for eventual breakout above current resistance levels.

Risk Management and Trading Strategies

For traders and investors navigating the $105K battleground, effective risk management strategies become paramount. The heightened volatility and uncertainty around this critical level require careful position sizing, stop-loss placement, and profit-taking strategies that account for potential whipsaw movements and false breakouts.

Dollar-cost averaging strategies may prove particularly effective during periods of consolidation around primary resistance levels, allowing investors to accumulate positions while managing the risks associated with timing the market. Professional traders often employ options strategies and derivatives to hedge their exposure while maintaining upside participation potential.

Global Regulatory Landscape Impact

The evolving regulatory environment surrounding cryptocurrencies continues to influence Bitcoin’s price dynamics at critical levels like $105K. Positive regulatory developments in major jurisdictions could provide the catalyst needed for Bitcoin to break through resistance. In contrast, regulatory uncertainty or negative policy changes could reinforce bearish sentiment and strengthen resistance levels.

Countries adopting Bitcoin-friendly policies and the potential for additional nation-state Bitcoin adoption represent significant long-term bullish factors that could eventually overwhelm technical resistance levels, including the current $105K battleground.

Future Outlook and Potential Scenarios

Looking ahead, several scenarios could unfold as Bitcoin continues to test the $105K resistance level. A decisive break above this level, supported by substantial volume and sustained momentum, could trigger a rapid acceleration toward $120K and potentially higher levels. Bitcoin is predicted to increase 29.79% in the next 5 days and hit a price target of $139,427 per BTC.

Conversely, rejection at $105K could lead to a period of consolidation or correction, potentially retesting support levels around $95K to $100K before attempting another assault on the resistance zone. The market’s response to this critical level will likely set the tone for Bitcoin’s performance throughout the remainder of 2025.

The $105K level represents more than just a price point; it symbolizes Bitcoin’s maturation as an asset class and its evolution from speculative instrument to legitimate store of value. The outcome of this battle between bulls and bears will have far-reaching implications for cryptocurrency adoption, institutional investment flows, and Bitcoin’s role in the global financial system.