The remarkable journey of the Bitcoin correction 2025 continues to captivate investors and analysts worldwide. Still, recent market signals suggest that the world’s largest cryptocurrency may be approaching a significant correction phase. As BTC trades around $104,000 in June 2025, multiple technical indicators and market dynamics point toward potential downward pressure in the coming months.

Current Bitcoin Market Overview

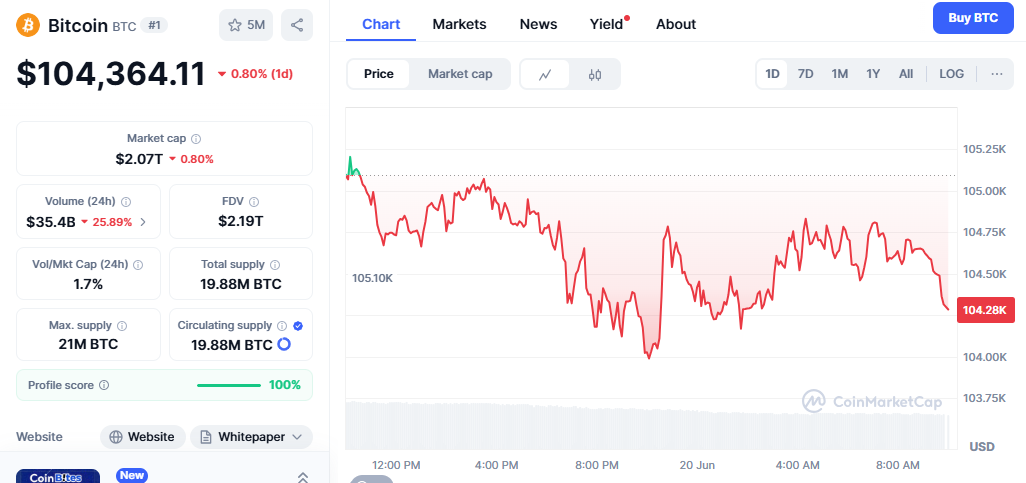

Bitcoin currently trades at over $104,000, representing a substantial gain from previous years. However, the cryptocurrency’s recent price action has shown signs of volatility and uncertainty, with analysts closely monitoring key support and resistance levels.

The current market sentiment remains mixed, with institutional interest continuing to drive long-term bullish expectations while short-term technical indicators flash warning signals about potential corrections.

Key Warning Signs: Technical Indicators Signal Potential Correction

Bearish Divergence Patterns Emerge

Recent analyses highlight multiple bearish divergence signals in Bitcoin, suggesting a possible price reversal as early as June 2025. These patterns are particularly concerning as they mirror similar trends observed during previous market corrections.

Technical analysts are pointing to several key indicators:

- RSI Divergence: The Relative Strength Index is showing bearish divergence, indicating weakening momentum despite higher prices

- MACD Signals: Moving Average Convergence Divergence indicators are flashing potential reversal warnings

- Volume Analysis: Decreasing trading volume during recent price rallies suggests a lack of conviction among buyers

Support Level Concerns

Current forecasts already anticipate a drop to $74,000, which could signal the beginning of a new bear market. This represents a significant correction from current levels and would test Bitcoin’s resilience at a crucial psychological support level.

Market experts emphasize that BTC must respect $74,000 by 2026 to maintain its long-term bullish trajectory. A break below this level could trigger more severe selling pressure and extend the correction period.

Expert Price Predictions: What Analysts Are Saying

Bullish Long-term Outlook Despite Near-term Concerns

Despite correction warnings, many analysts maintain optimistic long-term forecasts for Bitcoin:

- Bernstein’s Forecast: Bernstein forecasts Bitcoin could hit $200,000 by 2025, up from a previous target of $150,000

- Digital Coin Price: Digital Coin Price suggests an average price of $210,644.67 for 2025, with peaks potentially reaching $230,617.59

- Long-term Projections: Analysts suggest Bitcoin could reach between $200,000 and $300,000 by 2027

2026 Market Expectations

In 2026, Bitcoin may experience consolidation after the 2025 highs. The average forecast of $111,187 suggests a potential correction or stabilization phase. This consolidation period could provide a healthy foundation for future growth while allowing the market to absorb previous gains.

Factors Driving Potential Correction

Institutional Dynamics and ETF Impact

The introduction of spot Bitcoin ETFs has created new market dynamics that could contribute to increased volatility. While strong inflows into spot U.S. Bitcoin ETFs drive optimistic outlook, these institutional flows can also amplify both upward and downward price movements.

Macroeconomic Pressures

Several macroeconomic factors are creating headwinds for Bitcoin:

- Interest Rate Environment: Federal Reserve policy decisions continue to impact risk-asset appetite

- Regulatory Uncertainty: Ongoing regulatory developments globally affect market sentiment

- Inflation Concerns: Changes in inflation expectations influence Bitcoin’s appeal as a hedge asset

Market Maturation Effects

As Bitcoin matures as an asset class, its price movements are becoming more correlated with traditional financial markets, making it susceptible to broader economic trends and corrections.

Strategic Considerations for Investors

Risk Management in Volatile Markets

Given the correction signals, investors should consider implementing robust risk management strategies:

- Position Sizing: Avoid overexposure to Bitcoin during uncertain periods

- Dollar-Cost Averaging: Consider systematic investment approaches to reduce timing risks

- Stop-Loss Orders: Implement appropriate risk controls to protect against significant downside moves

Opportunities in Market Corrections

While corrections can be challenging, they often present opportunities for long-term investors:

- Accumulation Zones: Corrections may provide attractive entry points for patient investors

- Market Cycles: Understanding Bitcoin’s historical cycles can help identify optimal investment timing

- Fundamental Strength: Focus on Bitcoin’s underlying adoption and technological developments

Timeline and Key Levels to Watch

Critical Support Levels

Investors should monitor these key price levels closely:

- $104,000: Current trading range and immediate support

- $74,000: Critical long-term support level that must hold for bullish continuation

- $98,000: Previous correction low that could act as interim support

Potential Timeline for Correction

Based on current technical analysis, the correction could unfold over the following timeline:

- Q3 2025: Initial correction phase beginning

- Q4 2025: Potential testing of significant support levels

- Q1 2026: Possible consolidation and base-building phase

Expert Insights: What Industry Leaders Are Saying

Market professionals are maintaining cautious optimism while acknowledging near-term risks. The consensus suggests that while a correction appears likely, Bitcoin’s long-term fundamentals remain intact.

Key themes from expert analysis include:

- Cyclical Nature: Bitcoin corrections are standard parts of its long-term growth trajectory

- Institutional Adoption: Continued institutional interest provides fundamental support

- Technological Development: Ongoing improvements in Bitcoin’s ecosystem support long-term value

Conclusion

Bitcoin’s potential correction represents both a challenge and an opportunity for the cryptocurrency market. While technical indicators suggest near-term downside pressure, the long-term outlook remains constructive based on fundamental adoption trends and institutional interest.

Investors should prepare for increased volatility while maintaining focus on Bitcoin’s revolutionary potential as a decentralized digital asset. The key to navigating this period successfully lies in understanding the cyclical nature of cryptocurrency markets and implementing appropriate risk management strategies.