The cryptocurrency market was volatile when the Bitcoin Israel Iran conflict dropped to about $103,000 after Israel’s military attacks on Iranian sites. This significant price change highlights the sensitivity of digital assets to global events, underscoring the complex relationship between wars and the economy.

Market Reaction to Geopolitical Escalation

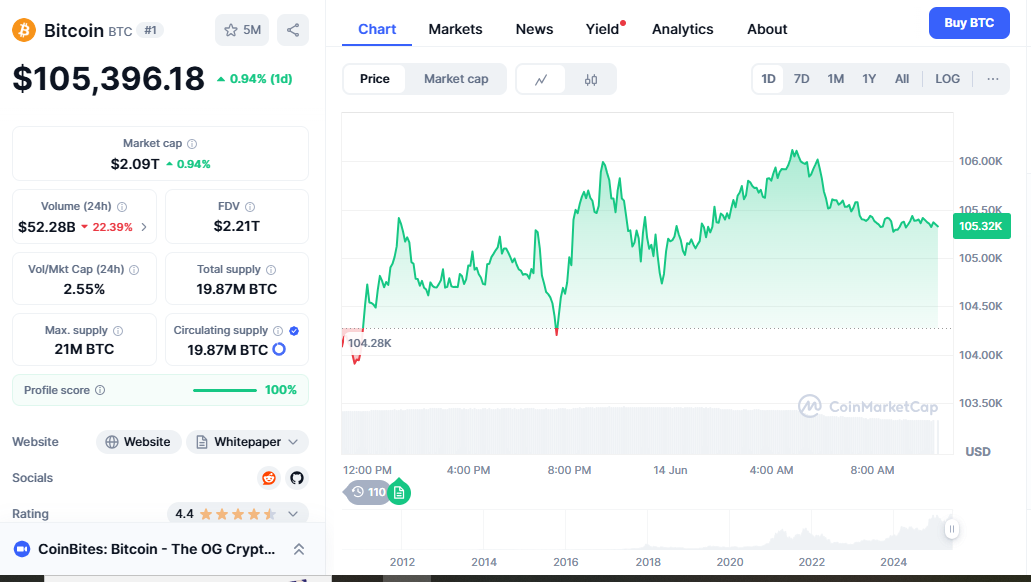

Bitcoin fell more than 4% to $103,556 after Israeli airstrikes near Tehran and Tabriz. This was one of the worst one-day drops in recent weeks. Before the military intervention, the cryptocurrency was trading at about $107,000. After that, investors quickly sold it off to move their money into safer assets.

These political issues have had a significant impact on the broader cryptocurrency ecosystem. Some alternative cryptocurrencies, such as Solana and Cardano, fell further, with some digital assets dropping as much as 8% immediately after the market opened. This significant sell-off demonstrates how the bitcoin market is becoming increasingly tied to global political developments.

Bitcoin’s Response to Geopolitical Events

There remains considerable disagreement regarding the relationship between Bitcoin and geopolitical issues. Many people who are interested in cryptocurrencies have long said that Bitcoin is a digital gold or safe-haven asset. However, recent market behaviour shows that institutional investors still see it as a risky asset when things are uncertain.

When wars escalate, traditional investors typically seek safe-haven assets, such as gold, government bonds, and stable currencies like the US dollar. This “flight to safety” trend generally hurts riskier assets, such as equities, commodities, and cryptocurrencies like Bitcoin.

The current situation between Israel and Iran is a big step up in tensions in the Middle East, which might have effects on global energy markets, international trade routes, and stability in the region. As investors reassess the level of risk they are taking on, financial markets worldwide have become increasingly volatile.

Technical Analysis and Price Levels

Bitcoin’s drop towards the psychologically critical $100,000 mark has caused considerable concern among traders and investors from a technical perspective. Many people in the market believe this price point is a key support level that is necessary to maintain the positive momentum.

The fact that the cryptocurrency couldn’t stay above $105,000 throughout this geopolitical crisis indicates that investors remain cautious, despite Bitcoin’s significant value increase in 2024 and early 2025. During this period, trading volumes have increased significantly, suggesting that more people are becoming involved in the market as buyers and sellers respond to the evolving scenario.

Market watchers are closely monitoring whether Bitcoin Price Analysis 2025 can maintain a price above $100,000. If it breaks below this level, it may cause additional selling pressure and increased volatility on the downside. The subsequent few trading sessions will be crucial, determining whether the drop is merely a short-term reaction to global events or the start of a larger and more significant trend.

Impact on Institutional Investment

The way prices are moving currently suggests that Bitcoin is still struggling to establish itself as a mainstream institutional asset class. In recent years, major companies and banks have invested more heavily in Bitcoin. However, during times of geopolitical tensions, many institutional investors still view cryptocurrencies as risky investments rather than safe havens.

This pattern of behaviour in institutions suggests that Bitcoin’s relationship with traditional risk assets remains strong during times of crisis, despite its purported decentralisation and inflation-resistance as a store of value. During times of geopolitical uncertainty, professional fund managers and institutional treasury departments often employ risk-limiting strategies. These strategies typically involve reducing exposure to volatile assets, such as cryptocurrencies.

Regional Market Implications

The war between Israel and Iran has effects on the economies of the Middle East as a whole and on how people use cryptocurrencies. Several governments in the region have been exploring central bank digital currencies (CBDCs) and regulations for cryptocurrencies. This makes the junction of geopolitical concerns and digital asset markets significant for investors in the region.

Energy markets, which are closely tied to politics in the Middle East, also have a significant impact on cryptocurrency mining operations worldwide. Any problems with the world’s energy supplies might make Bitcoin mining more expensive and less secure, which would make it much harder to determine the value of cryptocurrencies.

Historical Context and Precedents

Cryptocurrency markets have also been affected by past conflicts between Israel and Iran, although the magnitude and duration of these effects have varied significantly. Based on historical data, Bitcoin’s initial response to geopolitical events is typically fleeting. Prices usually return to normal once immediate concerns subside or market participants become accustomed to the new risk settings.

However, the current situation is unfolding at a time when global tensions are escalating, concerns about inflation persist, and monetary policy frameworks are undergoing adjustments worldwide. These big-picture economic issues could impact how quickly cryptocurrency markets recover from geopolitical shocks and whether Bitcoin can continue its upward trend.

Future Market Outlook

The cryptocurrency market’s reaction to the ongoing tensions between Israel and Iran will likely depend on several key factors, including the duration and severity of the conflict, the market’s overall sentiment towards riskier assets, and the behaviour of institutional investors in times of uncertainty. Traders and investors are particularly interested in whether this geopolitical situation worsens or improves over the next several weeks.

People who watch the market are also paying careful attention to how central banks and government officials are handling the current crisis, since decisions about monetary policy and fiscal measures may have a significant impact on the value of cryptocurrencies. Regardless of global events, the Federal Reserve’s interest rate setting remains a crucial factor in determining Bitcoin’s price fluctuations.