Bitcoin ETFs Reach $3.38B: Demand for spot Bitcoin exchange-traded funds (ETFs) surged to its highest level since launch, with an impressive $3.38 billion flowing in this week What is Future Content? Experts predict that this momentum will continue to build once Bitcoin (BTC) surpasses $100,000.

For five consecutive days, positive inflows were recorded, driven by optimism about a more crypto-friendly regulatory environment under President-elect Donald Trump. As a result, the total net asset value of Bitcoin Spot ETFs reached $107.488 billion for the first time.

The largest inflows of the week occurred on November 21, drawing in $1 billion, coinciding with the announcement that SEC Chair Gary Gensler, known for his tough stance on crypto, would step down on January 20. This news coincided with Bitcoin reaching a new all-time high of $99,800, although it fell just short of the $100,000 mark. Bitcoin ETFs Reach $3.38B Despite the dip in inflows into the 12 spot Bitcoin ETF offerings to $490.35 million on Friday, the overall weekly inflows still reached a record $3.38 billion.

BlackRock’s IBIT, with a 12-day inflow streak, led the day’s activity, bringing in $513.2 million. Other funds saw the following inflows:

- Fidelity’s FBTC: $21.71 million

- Valkyrie’s BRRR: $6.19 million

- Grayscale’s Bitcoin Mini Trust: $5.72 million

- VanEck’s HODL: $5.62 million

- Invesco’s BTCO: $4.96 million

Grayscale’s GBTC, which carries the highest fees among these options, was the only fund to see outflows, amounting to $67.05 million. The rest of the funds remained steady. Bitcoin ETFs Reach $3.38B Despite a slight dip in inflows later in the week, market experts maintain that demand for Bitcoin ETFs remains robust.

Kadan Stadelmann

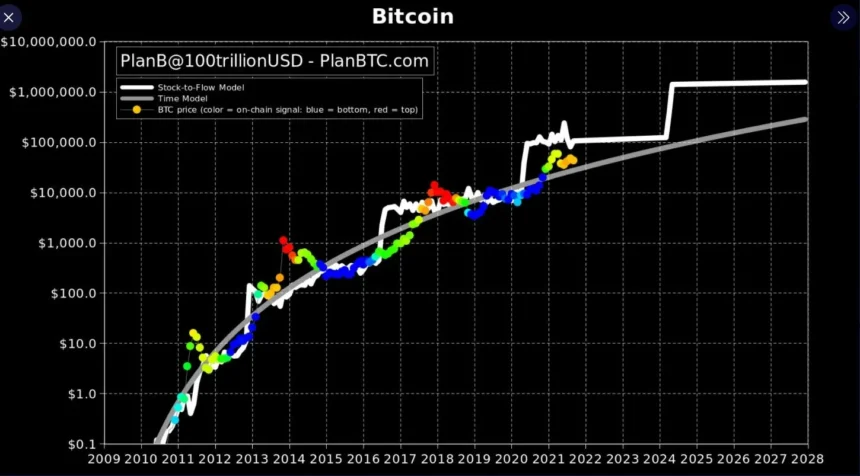

Kadan Stadelmann, an early Bitcoin investor and CTO at Komodo, attributes the surge in demand to the “supply shock” caused by the 2024 Bitcoin halving and increased geopolitical uncertainties, which position Bitcoin as a hedge.

This momentum is expected to grow further once Bitcoin surpasses the $100,000 mark, with TYMIO founder Georgii Verbitskii noting that the milestone will likely attract “renewed attention from mainstream media and traders.”Bitcoin is now just 1.47% shy of hitting the $100,000 mark, with some analysts predicting that it could achieve this milestone before the end of 2024.

You May Also Read: November 2024 is The Best Time To Buy Cryptocurrency

Analysts, including Nathan Frankovitz and Matthew Sigel from VanEck, project that Bitcoin could rise to $180,000 within the next 18 months. Bernstein Research also recently raised its 2025 year-end target for Bitcoin from $150,000 to $200,000.

Bitcoin’s current rally is reminiscent

Frankovitz and Sigel pointed out that Bitcoin’s current rally is reminiscent of its pattern from four years ago, when the price doubled between the 2020 election and the end of the year, followed by an additional 137% gain in 2021. They believe that the next phase of the bull market is just beginning, with no significant technical resistance in sight.

As government support for Bitcoin continues to shift, investor interest is growing rapidly, with many investors finding themselves under-allocated to the asset class. While remaining cautious of market overheating, experts continue to target $180,000 per Bitcoin, as key indicators suggest the rally has much further to go.

Bitcoin ETFs Reach $3.38B Analyst Ali Martinez shared a similar viewpoint on X, comparing the current trend to previous cycles. He predicted that Bitcoin could reach $108,000 in the coming weeks and potentially surge to $135,000 by the end of the year. See below.

Conclusion

The demand for spot Bitcoin ETFs has reached record levels, driven by positive market sentiment and regulatory optimism Coinetech: Latest News on Crypto. With Bitcoin nearing the $100,000 milestone, experts predict continued upward momentum, with some forecasting prices could rise to $135,000 by year-end. The market is poised for significant growth, fueled by factors like the upcoming Bitcoin halving and shifting government support. As investor interest accelerates, the next phase of the bull market appears to be just beginning, with analysts targeting even higher price levels in the months ahead.

[sp_easyaccordion id=”3112″]