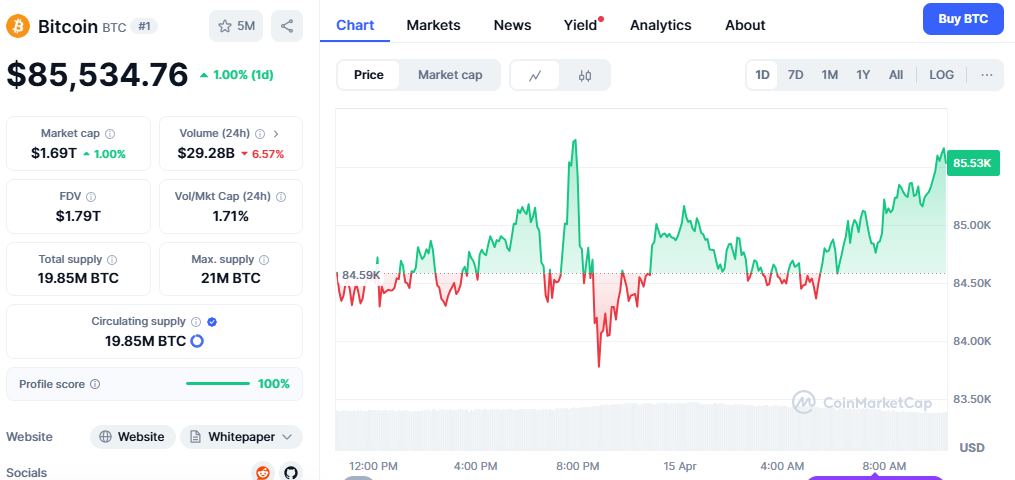

Bitcoin price breakout. As Bitcoin (BTC) keeps skyrocketing, it is displaying fresh vigor. Following over the $83,500 resistance zone, the price settles gains and prepares itself for a possible movement towards the $85,500 and $86,200 resistance levels.

Bitcoin Begins a New Climb

Rising from a firm basis over the $82,500 barrier, Bitcoin started a new upward journey. Taking control, the bulls drove BTC above $83,000 and $83,500 resistance. This increasing momentum continued with a breakout past $84,500 to produce a new swing-high of $85,850.

The price briefly corrected after touching this high. It dropped below $84,000, falling below the 23.6% Fibonacci retracing mark of the upward movement from $78,600 to $85,850. Despite this decline, buyers stayed active close to the $83,000 support zone, enabling Bitcoin to regain ground lost.

I’m writing calls for BTC to trade above $83,500 and stay above the 100-hour Simple Moving Average. On the hourly chart (data source: Kraken), a connecting bullish trend line is developing and provides solid support close to $84,200.

What’s Next for BTC?

On the plus side, the instantaneous resistance is close to $85,000, then the critical breakthrough mark at $85,500. An explicit action at this level can provide the road for more progress. Should Bitcoin be able to clear $86,200, the following upward targets—$87,500 and finally $88,000—mark a solid continuation of the optimistic trend.

If Bitcoin falls short of breaking above $85,500, it might be under more selling pressure. The price might review support at $84,200, which the trend line supports. Should this level fall short, the next notable assist is $83,200. Deeper corrections might lead BTC toward $82,200, matching the current movement’s 50% Fibonacci retracing level. Extra help comes at $81,500 and the critical $80,800 level.

Technical Outlook

Technically, momentum indicators are still positive. The hourly chart’s MACD in the positive zone is picking up speed, implying further purchasing activity. Furthermore, a value above 50 is the Relative Strength Index (RSI) for BTC/USD, supporting the near-term upward inclination.

Is BTC Poised for a Breakout?

The price behavior of Bitcoin points to significant positive momentum above the SMA for one hundred hours and main trend line support. A successful closing over $85,500, particularly $86,200, might set off a fresh buying frenzy that drives BTC toward $87,500 or possibly $88,000.