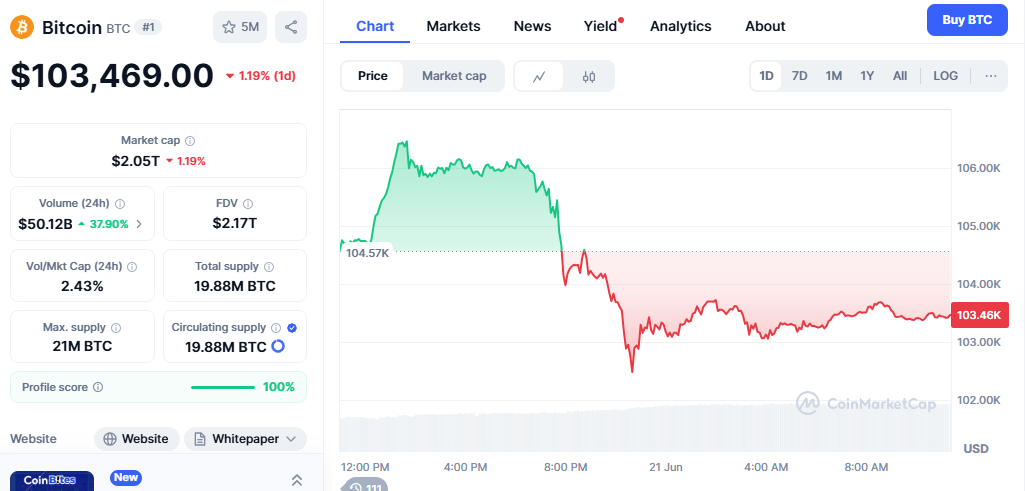

The correlation between Bitcoin and the cryptocurrency market, as well as Bitcoin’s M2 correlation, has been the subject of speculation, as Bitcoin’s price movements appear to be diverging from the traditional correlation with global M2 money supply growth. With Bitcoin currently trading around $104,700, investors are questioning whether this deviation signals the end of the current bull run or merely represents a temporary decoupling in an otherwise robust market cycle.

Historical M2-Bitcoin Correlation

For years, Bitcoin has demonstrated a robust correlation with global M2 money supply expansion, often exceeding 84% correlation during specific periods. This relationship has been a cornerstone of many investment strategies, as Bitcoin has historically acted as a hedge against monetary inflation and currency debasement. When central banks around the world, including the Federal Reserve, the European Central Bank, the People’s Bank of China, and the Bank of Japan, expand their money supplies, Bitcoin has typically responded with upward price movements.

The correlation makes intuitive sense from an economic perspective. As central banks inject more liquidity into the global financial system through monetary expansion, investors often seek alternative stores of value to protect their wealth from potential currency devaluation. Bitcoin, with its fixed supply cap of 21 million coins, has emerged as a digital alternative to traditional hedges like gold, particularly appealing to younger investors and institutions embracing digital assets.

Current Market Dynamics and Deviation Patterns

Recent analysis reveals that while global M2 money supply has increased by 3.25% since the start of 2025, Bitcoin’s performance has not followed the expected trajectory based on historical patterns. The 90-day lagged correlation model, which has traditionally been more predictive of Bitcoin’s price movements, shows a decrease of 0.16% over the same period, yet Bitcoin has gained approximately 8% year-to-date.

This deviation is particularly noteworthy because it suggests that Bitcoin may be operating under different market dynamics than in previous cycles. The cryptocurrency’s evolution from a niche digital asset to a mainstream investment vehicle, complete with institutional adoption and regulatory clarity in many jurisdictions, may be altering its traditional relationships with macroeconomic indicators.

Institutional Adoption and Market Maturation

The current market cycle differs significantly from previous Bitcoin bull runs due to unprecedented institutional participation. Unlike earlier cycles driven primarily by retail speculation, the 2025 market is characterized by substantial institutional capital inflows, regulatory acceptance, and integration into traditional financial systems. This institutional backbone provides Bitcoin with a different support structure that may be less dependent on pure monetary expansion cycles.

Major corporations, pension funds, and investment firms have allocated significant portions of their portfolios to Bitcoin, creating a more stable demand base. This institutional demand may be providing price support even when traditional M2 correlation models suggest otherwise, potentially explaining why Bitcoin has maintained strength despite the apparent deviation from historical patterns.

The Role of Central Bank Policies and Global Liquidity

Despite the apparent deviation, global liquidity conditions continue to be a crucial factor in determining Bitcoin’s price. Central banks worldwide continue to maintain relatively accommodative monetary policies, with many still in rate-cutting cycles. The combination of ongoing quantitative easing measures and low interest rates creates an environment where alternative assets, such as Bitcoin, remain attractive to investors seeking yield and inflation protection.

Market analysts note that while the immediate correlation may appear weakened, the underlying fundamentals supporting Bitcoin’s bull case remain intact. The global22oney supply continues to expand, reaching all-time highs in many regions, which has historically been supportive of Bitcoin’s long-term price trajectory.

Technical Analysis and Market Outlook

From a technical perspective, Bitcoin’s current price action suggests consolidation rather than a definitive end to the bull market. The cryptocurrency is trading within a range between $100,000 and $120,000, holding above its 200-day exponential moving average while maintaining a bullish long-term trend structure. Technical analysts suggest that a confirmed breakout above $112,000 could trigger a rally toward $120,000 or higher by mid-to-late June 2025.

The recent retracement from peaks above $100,000 to lows around $75,000 earlier in the year has been characterized by many analysts as a healthy correction within a broader bull market cycle rather than a trend reversal. Historical patterns from previous cycles suggest that such corrections are normal and often precede the next leg of upward momentum.

Market Sentiment and Future Projections

Current market sentiment remains cautiously optimistic despite the M2 deviation. Several prominent analysts maintain bullish projections for Bitcoin, with some forecasting prices reaching $130,000 to $135,000 by Q3 2025. These projections are based on a combination of technical analysis, cyclical patterns, and fundamental factors, including Bitcoin’s halving cycle dynamics and continued institutional adoption.

The cryptocurrency’s performance relative to traditional assets, such as gold, also suggests continued strength. Bitcoin is currently outperforming gold and other conventional hedges, indicating that investors still view it as a superior store of value in the current macroeconomic environment.

Conclusion

Rather than signaling the end of the bull run, Bitcoin’s apparent deviation from M2 money supply correlation may represent the natural evolution of a maturing asset class. As Bitcoin becomes more integrated into traditional financial systems and gains broader institutional acceptance, its price dynamics are likely to become influenced by a more diverse set of factors beyond pure monetary expansion.

The current market conditions, characterized by institutional support, regulatory clarity, and continued global liquidity expansion, suggest that the bull market remains intact, despite short-term deviations in correlation. While the relationship with M2 money supply remains important, Bitcoin’s price discovery mechanism is becoming more sophisticated and less dependent on any single macroeconomic indicator.