The cryptocurrency market is experiencing unprecedented optimism as Bitcoin Price Predictions $140K soar to extraordinary heights, with traders increasingly confident that the current bull run could propel Bitcoin to $140,000 and beyond. This wave of bullish sentiment reflects a confluence of fundamental factors, institutional adoption, and technical analysis pointing toward a potential paradigm shift in Bitcoin’s valuation trajectory.

The Current Bull Run Momentum and Technical Analysis

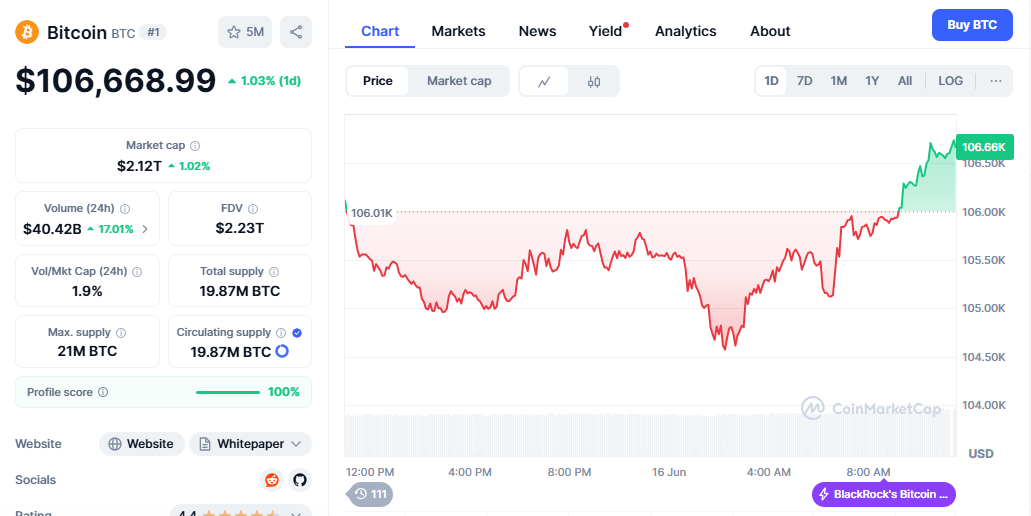

Technical analysts and cryptocurrency traders are setting ambitious price targets that would have seemed fantastical just years ago. Market analysts are identifying neckline resistance at $113,000 as the primary barrier before potential breakout targets of $140,000 and higher. These projections aren’t based solely on speculation, but rather stem from sophisticated chart patterns, historical halving cycles, and unprecedented market dynamics.

The technical foundation supporting these bullish projections includes logarithmic growth curves, Fibonacci retracement levels, and stock-to-flow models that have historically correlated with Bitcoin’s long-term price movements. Traders are observing fractal patterns similar to those of previous bull market cycles, suggesting that Bitcoin’s current trajectory could mirror or exceed the explosive growth seen in 2017 and 2021.

Bitcoin’s recent price action has demonstrated remarkable resilience despite global economic uncertainties. Since the 2024 halving event in April, Bitcoin has climbed more than 33%, defying concerns over global trade tensions and demonstrating institutional disruption of traditional market cycles. This performance highlights the digital asset’s evolving role as a hedge against risks in the conventional financial system.

Bitcoin ETFs Drive Institutional Investment Revolution

The landscape for Bitcoin investment has undergone a fundamental transformation with the introduction of spot Bitcoin Exchange-Traded Funds (ETFs) in January 2024. BlackRock’s iShares Bitcoin ETF has demonstrated remarkable investor appetite, securing $370.2 million in a single day, highlighting the institutional demand that continues to support higher price targets.

Professional investment firms, such as Bernstein, have significantly revised their Bitcoin forecasts upward. Bernstein now forecasts Bitcoin could reach $200,000 by 2025, increasing from their previous target of $150,000, primarily driven by strong inflows into spot U.S. Bitcoin ETFs. This institutional backing provides a solid foundation for the aggressive price predictions currently circulating among cryptocurrency traders.

The ETF phenomenon has created a structural shift in the demand dynamic of Bitcoins. While 80% of spot Bitcoin ETF flows currently originate from retail investors, institutional investments are still emerging, with spot Bitcoin ETFs expected to gain approvals at major wirehouses and private bank platforms. This suggests that the current institutional adoption wave is still in its early stages, potentially supporting even higher price levels as traditional financial institutions increase their exposure to Bitcoin.

Bitcoin Halving: Supply Shock Drives Institutional Adoption

The 2024 Bitcoin halving event has created a fundamental supply shock that underpins the bullish price projections. The halving reduced block rewards from 6.25 Bitcoin to 3.125 BTC, effectively halving new Bitcoin issuance. This programmed scarcity mechanism has historically preceded significant price appreciation cycles, and the current market dynamics suggest this pattern may continue with greater magnitude.

Bitcoin’s designation as digital gold underscores its role as a store of value, particularly amidst the scarcity reinforced by halving events, with institutional investors viewing Bitcoin as a hedge against inflation, finding the halving supportive of its perceived value. This narrative has gained particular traction among traditional finance professionals who previously remained skeptical of cryptocurrency investments.

The combination of reduced supply issuance and increasing institutional demand creates a supply-demand imbalance that supports aggressive price targets. Historical analysis of previous halving cycles shows that Bitcoin’s most significant price appreciation typically occurs 12-18 months following each halving event, suggesting that the current bull run may have substantial room for growth.

Bitcoin Price Predictions: Conservative to Extreme Forecasts

While the $140,000 target represents a commonly cited benchmark, price predictions vary significantly across different analytical frameworks. Some traders are extending Bitcoin price targets to $270,000 by October, maintaining bullish sentiment despite current market volatility. These extreme projections reflect the unprecedented nature of current market conditions and the potential for exponential growth patterns.

Conservative institutional forecasts provide a more measured perspective on Bitcoin’s potential trajectory. For 2025, Bitcoin is expected to move in the $77,000 to $155,000 range, with some analysts maintaining price predictions in the $130,000-$150,000 range, provided global policy tailwinds continue. These projections incorporate macroeconomic factors, regulatory developments, and technical analysis to provide a balanced outlook on Bitcoin’s near-term potential.

Notable cryptocurrency advocates have provided even more aggressive long-term predictions. Robert Kiyosaki, author of “Rich Dad Poor Dad,” has predicted Bitcoin could reach $250,000 by 2025, with longer-term projections extending to $1.5 million by 2035. While these projections may seem extreme, they reflect the growing belief among Bitcoin maximalists that traditional monetary systems face fundamental challenges that could drive unprecedented demand for alternative stores of value.

Bitcoin’s Bull Market Faces Rising Institutional Risks

Despite the overwhelming bullish sentiment, experienced analysts acknowledge increasing market risks. Some institutional analysts believe that while original price targets of $106,000-$190,000 remain attainable, risk has increased significantly, prompting recommendations for risk reduction strategies on rallies to all-time highs. This cautious approach reflects a mature perspective, recognizing that even in bull markets, prudent risk management remains essential.

The introduction of Bitcoin ETFs has created both opportunities and challenges for the maturation of Bitcoin markets. While institutional access has increased demand, it has also introduced traditional market dynamics that may moderate Bitcoin’s historically explosive price movements. Professional traders must now consider correlations with traditional asset classes, regulatory developments, and macroeconomic factors that previously had minimal impact on Bitcoin’s price action.

Technical analysis suggests that Bitcoin’s current position requires careful monitoring of key support and resistance levels. Bitcoin is currently trading below the 20, 50-day, and 100-day exponential moving averages, indicating a clear technical breakdown, with the 200-day exponential moving average (EMA) at $102,300 acting as key support. These technical considerations provide essential context for understanding the timing and probability of reaching aggressive price targets.

Global Adoption and Future Outlook

The broader cryptocurrency ecosystem continues expanding at an unprecedented pace, supporting long-term bullish projections for Bitcoin. Global crypto adoption has surpassed 500 million users, with predictions suggesting it could reach one billion users by the end of 2024, driven primarily by mass adoption rather than institutional investment. This grassroots adoption provides a fundamental foundation for sustained demand growth.

The convergence of retail and institutional adoption creates a unique market dynamic that supports aggressive price targets. Traditional financial institutions are increasingly integrating Bitcoin into their investment offerings, while retail investors gain easier access through ETFs and traditional brokerage platforms. This dual adoption pathway suggests that Bitcoin’s current bull run may have more sustained momentum than previous cycles have had.

Long-term price projections extend far beyond the current $140,000+ targets. Technical analysts project potential Bitcoin price ranges of $200,000 to $450,000 by 2028, following the next halving event, with subsequent years potentially reaching $275,000 to $640,000. These projections assume continued adoption, favorable regulatory environments, and sustained institutional investment flows.