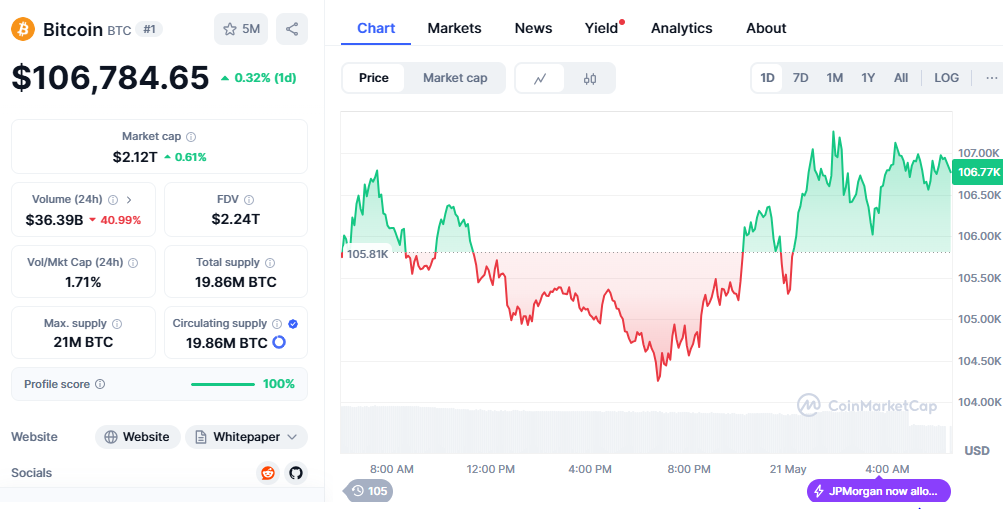

Rising above the $107,000 barrier, Bitcoin’s price surge has sparked more enthusiasm on international financial markets and squarely targets a new all-time high. Apart from breaking psychological limits, the price surge represents a turning point in the larger story of cryptocurrencies, from speculative asset to mature digital commodity. One question drives the market as BTC/USD charts flame up with increasing momentum: Is this the beginning of a new Bitcoin supercycle?

Macroenvironment causing the Increase

Macroeconomic events help to explain the recent price surge in Bitcoin. Investors are turning to Bitcoin as a counterpoint against fiat depreciation as central banks struggle with interest rate policy and inflationary worries loom large worldwide. Unlike the bull run of 2021, which was driven mainly by retail speculation, the present surge is characterized by continuous institutional interest and long-term holder capital inflows.

Glassnode, a blockchain analytics company, reports a notable increase in HODLing behavior, implying that big wallets are not distributing but rather collecting. A surge in Bitcoin wallet addresses containing more than 10 BTC reflects this, highlighting long-term trust in the commodity’s future worth.

ETF Momentum and institutional players

The explosion of Bitcoin spot ETFs, especially in the United States, is among the strongest tailwinds supporting Bitcoin’s current climb. In recent weeks, extraordinary inflows have occurred in BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). These exchange-traded funds have allowed conventional finance to enter the Bitcoin market without dealing with private key management or regulatory uncertainty.

Eric Balchunas, a Bloomberg ETF analyst, claims that since its inception, IBIT alone has attracted over $12 billion in assets under management (AUM), representing a significant portion of fresh demand. For pension funds, sovereign wealth funds, and asset managers, this flood of institutional capital has given Bitcoin markets liquidity and respectability, lowering volatility and making this a more appealing asset class.

Bitcoin Halving Sparks Price Surge

The April 2024 Bitcoin halving event is another critical driver of the price increase. This quadrennial event lowered miner payouts from 6.25 BTC to 3.125 BTC, lowering the new Bitcoin supply onto the market. Because of the typical supply-demand relationship, each halving cycle historically has been accompanied by a notable bull run.

The idea of programmed scarcity, promoted by Bitcoin founder Satoshi Nakamoto, once more shows its power. While demand has not changed, daily fresh Bitcoin issuance has declined. This disparity is driving prices up and supporting the developing story of Bitcoin as “digital gold.”

Global Economic Uncertainty

Beyond market dynamics, geopolitical uncertainty and recession fears in big nations like the United States and the European Union are guiding capital toward uncorrelated assets like Bitcoin. Overall, the continuous turmoil in Eastern Europe, rising Middle Eastern tensions, and U.S. debt ceiling discussions undermine trust in conventional currency systems.

With its distributed architecture and limited supply restriction of 21 million coins, Bitcoin presents a different financial system free from political meddling and devaluation of money. Bitcoin’s increasing acceptance in nations suffering hyperinflation, like Argentina and Venezuela, supports its even more important function as a worldwide monetary hedge.

Technical Indicators and Market Mood

As Bitcoin set its all-time high of $108,500 in late 2021, technical analysts intently examined the charts. Current RSI (Relative Strength Index) values close to 70 indicate overbought conditions but do not yet imply a full-fledged correction. MACD and Bollinger Bands are momentum indicators showing this rally has legs since they stay bullish.

Moreover, trade volumes on big exchanges such as Binance, Coinbase, and Kraken have surged significantly, supporting the validity of this breakout. Rising to above 54%, the Bitcoin price surge dominance index indicates that capital is gathering in BTC instead of shifting into altcoins—another feature of a mature rally.

Experts Endorse Bitcoin Boom

Prominent crypto personalities have commented on Bitcoin’s breakthrough. MicroStrategy executive chairman Michael Saylor tweeted, “$107K is just a stepping stone,” underlining the company’s aggressive Bitcoin accumulation policy. Drawing on exponential network effects and institutional FOMO, Cathie Wood of ARK Invest reaffirmed her long-term price target of $1 million by 2030.

Regulatory authorities are noting this in the meantime. While central banks are fast investigating central bank digital currencies (CBDCs) to remain relevant, the SEC is pressured to allow more crypto-native ETFs. The Bitcoin price surge keeps flying forward while governments try to catch up.

Regulations and Mining Strain Post-Halving

Though there is joy, problems still exist. Regulatory uncertainty could cause volatility, particularly in the United States, regarding tax policy and AML compliance. Furthermore, miner profitability is under pressure post-halving, which might cause hash rate swings should smaller mining activities close down.

Energy issues are also reemerging. Bitcoin’s energy usage and price are rising, sparking once more discussions on the environmental effects of proof-of-work systems. However, especially in Nordic nations and areas of Canada, a growing portion of mining activities are moving to renewable energy.

Bitcoin Enters Financial Mainstream

Bitcoin is no longer an experiment at $107,000; it is a worldwide asset class with actual consequences for politics, finance, and the economy. The present surge enjoys more general basic support than past bull runs. From institutional validation via ETFs to natural user adoption in developing nations to more clarity on regulatory frameworks, Bitcoin is progressively finding its way from the margins to the financial mainstream. This pricing point is more than simply a figure. It’s a remark, a mirror of a ten-year development from obscure digital token to economic powerhouse. And if history provides any guide, the narrative is far from done.