The Bitcoin price recovery in the cryptocurrency market is experiencing a fascinating dichotomy as Bitcoin (BTC) is showing signs of recovery during the European trading session on Monday, climbing above $107,000 after a slight correction last week. This resilient performance comes despite escalating geopolitical tensions in the Middle East that have created significant headwinds for global financial markets.

Current Market Dynamics and Price Recovery

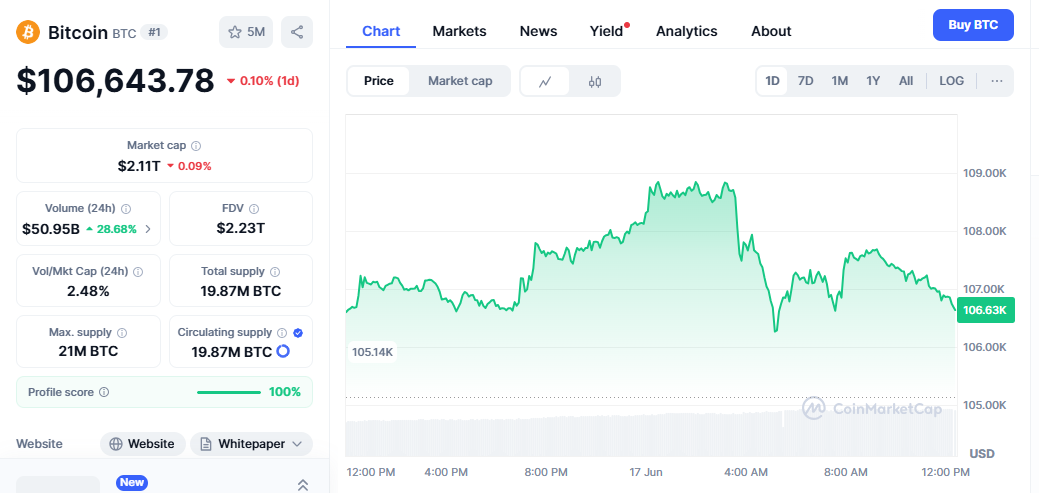

Bitcoin’s recent price action reflects the complex interplay between traditional market forces and cryptocurrency-specific dynamics. After experiencing a substantial correction that saw Bitcoin (BTC) drop 2.8% from $106,042 to $103,053 within 90 minutes following Israeli airstrikes on Iran, the world’s largest cryptocurrency has demonstrated remarkable resilience by recovering above the psychologically important $107,000 level.

The recovery pattern mirrors historical precedents, as many analysts see Bitcoin’s price rallying to record highs in 2025, with year-end predictions ranging from $150,000 to over $200,000. This optimistic outlook is grounded in Bitcoin’s historical performance during periods of geopolitical uncertainty, where it has often rebounded strongly after initial sell-offs.

Geopolitical Impact on Cryptocurrency Markets

The ongoing Israel-Iran conflict has introduced significant volatility into global financial markets, with cryptocurrencies experiencing pronounced effects. Bitcoin price recovery (BTC), Ethereum (ETH), and Ripple (XRP) prices have dipped as escalating geopolitical tension between Israel and Iran has triggered a risk-off sentiment in the cryptocurrency markets. This risk-off sentiment typically drives investors toward traditional safe-haven assets such as gold and the US dollar, temporarily reducing demand for digital assets.

However, the cryptocurrency market’s response to geopolitical events has evolved considerably. The price of Bitcoin slid by only 3% following news of the initial strike and has held firm around the $105,000 level since the conflict started, suggesting that Bitcoin’s correlation with traditional risk assets may be weakening as institutional adoption continues to grow.

Technical Analysis and Key Support Levels

From a technical perspective, the Bitcoin Drops Below $105K structure reveals several critical levels that traders and investors should monitor closely. The currency has support at points 102400 and resistance at points 110000, establishing a clear trading range that has held during the recent geopolitical turbulence.

The technical landscape suggests that short-term support lies near $106.5K, with a potential retest of $103K if tensions escalate. This support zone has proven resilient during the recent correction, providing a foundation for the current recovery attempt.

Market participants should also consider that Bitcoin (BTC) reached its highest price on May 22, 2025 — it amounted to 112,000 USD, establishing a clear resistance level that Bitcoin must overcome to continue its bullish trajectory. The proximity to this all-time high suggests that any sustained move above $110,000 could trigger significant momentum buying.

Institutional Sentiment and Market Flows

Despite the geopolitical uncertainty, institutional interest in Bitcoin remains robust. Bitcoin exchange-traded funds (ETFs) recorded five days of consecutive inflows this week amid the ongoing uncertainty surrounding trade tariffs, indicating that sophisticated investors continue to view Bitcoin as a valuable portfolio diversifier during periods of uncertainty.

This institutional backing provides a fundamental support mechanism that differentiates the current market cycle from previous periods of volatility. The consistent ETF inflows suggest that institutional investors are treating any price weakness as a buying opportunity rather than a reason to reduce exposure.

Historical Context and Pattern Recognition

The current situation bears striking similarities to previous geopolitical events that have impacted Bitcoin’s price trajectory. Back in late 2024, when reports of similar tensions emerged, Bitcoin experienced initial selling pressure before staging a robust recovery. This historical pattern provides context for understanding the current market dynamics and suggests that the recent correction may represent a temporary setback rather than a fundamental shift in trend.

Additionally, in 2024, $BTC exploded after the liquidity grab. In 2025, it’s setting up again, according to technical analysts who see parallels between current price action and previous successful breakout patterns.

Market Outlook and Price Predictions

Looking ahead, the cryptocurrency market faces a complex set of factors that will influence the Bitcoin price recovery trajectory. Bitcoin price has the potential to reach $200,000 before the end of 2025, according to optimistic forecasts that consider the ongoing institutional adoption and potential for regulatory clarity.

However, these bullish projections must be balanced against near-term risks. The technical analysis suggests that Bitcoin may recover from the recent dip if key support near $102,000–$104,000 holds. A breakdown below these levels could signal a more substantial correction, potentially targeting lower support zones.

Risk Factors and Market Considerations

While the recovery above $107,000 is encouraging, several risk factors could impact Bitcoin’s near-term performance. The ongoing geopolitical tensions in the Middle East remain a primary concern, as escalation could trigger broader risk-off sentiment in global markets. Additionally, safe-haven demand has shifted toward the dollar and gold, not Bitcoin, suggesting that Bitcoin has not yet established itself as a consistent safe-haven asset during periods of acute geopolitical stress.

Market participants should also consider the broader macroeconomic environment, including central bank policies, inflation expectations, and global liquidity conditions. These factors often have a more significant long-term impact on Bitcoin’s price than short-term geopolitical events.

Trading Strategy and Investment Implications

Given the current market conditions, investors and traders should adopt a balanced approach that acknowledges both the bullish long-term outlook and near-term volatility risks. The recovery above $107,000 provides a positive technical signal, but the proximity to recent highs suggests that any upward momentum may face resistance near the $110,000-$112,000 zone.

For those considering Bitcoin exposure, the current price levels may present attractive entry opportunities, particularly if the key support levels around $102,000-$104,000 continue to hold. However, position sizing should reflect the elevated volatility environment and the potential for continued geopolitical uncertainty.

Broader Cryptocurrency Market Impact

The Bitcoin price recovery has positive implications for the broader cryptocurrency ecosystem. As the market leader, Bitcoin’s performance often sets the tone for altcoins and the overall digital asset market. The resilience demonstrated during the recent geopolitical turmoil could boost confidence in the cryptocurrency sector’s ability to weather external shocks.

Furthermore, the sustained institutional interest, as evidenced by continued ETF inflows, suggests that the cryptocurrency market is maturing and developing more sophisticated support mechanisms that can help stabilize prices during periods of uncertainty.

Conclusion

Bitcoin’s recovery above $107,000 represents a significant technical achievement that demonstrates the cryptocurrency’s resilience in the face of geopolitical uncertainty. While the Israel-Iran conflict continues to create volatility and risk-off sentiment in global markets, Bitcoin’s ability to maintain key support levels and stage a recovery suggests that the long-term bullish outlook remains intact.

The combination of institutional support, technical resilience, and historical precedent supports the view that the current correction may represent a temporary setback rather than a fundamental shift in Bitcoin’s trajectory. However, investors should remain vigilant regarding geopolitical developments and maintain appropriate risk management strategies given the elevated volatility environment.