As Bitcoin (BTC) dropped below the $104,000 level, the Bitcoin market saw an unexpected shock that resulted in large liquidations on several futures markets. XRP also followed suit, seeing a quick correction, but the larger crypto market is currently dealing with nearly $600 million in long position liquidations. Among traders, institutional investors, and experts, this sudden market movement has drawn questions since it indicates that volatility will always be a feature of digital assets, even in 2025.

Examining the causes of the recent market decline, this in-depth study investigates the effects on BTC and XRP. It assesses what this implies for both long-term and short-term investors of cryptocurrencies. We will also discuss how this event fits into the larger framework of macroeconomic pressures, technological indicators, and continuous global development of crypto rules.

What set off the $600M Crypto liquidations?

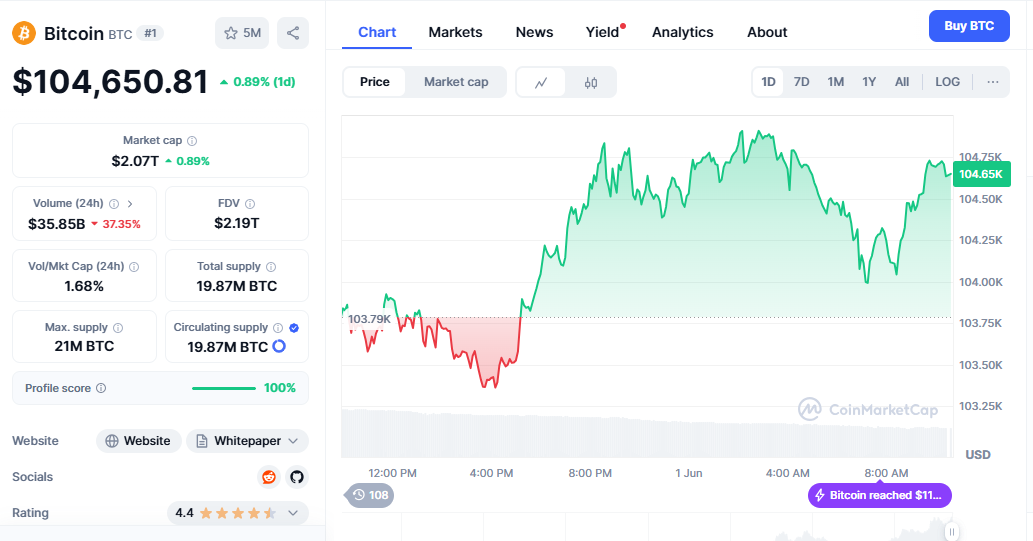

A dramatic decline in the price of Bitcoin, which dropped under $104,000 in early Asian trading hours, caused the recent wave of liquidation. Contextually, driven by hope over U.S. spot Bitcoin ETF inflows and institutional acceptance, Bitcoin had been consolidating in the $110,000–$115,000 region for several weeks. But a sudden rise in sale volume—probably resulting from big wallets or “whales”—spooked the market and set off a chain reaction of liquidations on leveraged long holdings.

Just days earlier, on-chain data from sites like Glassnode and CryptoQuant revealed a substantial outflow of Bitcoin from exchange wallets to cold storage, implying that big players might have expected a correction. Rising above $600 million in just 24 hours, the liquidation amount mostly affected traders on platforms including Binance, Bybit, and OKX, where open interest had peaked.

Dip Below $104K: Technical Analysis of Bitcoin

Technically, the $104,000 support level breach is important. In the most recent bull run for Bitcoin, this level had served as both a psychological and structural support line. Because of margin calls on leveraged positions and stop-loss triggers, the inability to keep above this level allowed quick sell-offs.

Analysts at TradingView and IntoTheBlock claim that important momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) started showing bearish divergence patterns days before the fall. Furthermore, the funding rate of Bitcoin on prominent exchanges turned negative, indicating unequivocally overleveraged and too optimistic speculators.

XRP Reacts as Ripple Deals with Constant Legal Pressure

XRP suffered as well in this liquidation frenzy. Rising beyond $0.90 in expectation of a positive result in the SEC v. Ripple Labs lawsuit, the token fell drastically to about $0.82. On XRP future contracts, this action destroyed a substantial amount of long bets.

Recent events in the legal dispute between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) help to explain the revived pessimistic mood about XRP. Following a procedural action taken by the SEC on XRP’s institutional sales, the case re-entered the scene, and market players were wary.

Legal analysts, like Jeremy Hogan and James K. Filan, pointed out that although Ripple still has a good legal posture, the case’s ultimate decision might reach late 2025. Particularly during more general market falls, XRP’s price and investor mood remain in constant flux from this residual uncertainty.

Macro Influences: Do Fed Policies cause the Dip?

Beyond crypto-native causes, various macroeconomic events added to the volatility of the market. The most important among them is the hawkish attitude the Federal Reserve of the United States adopted during its most recent policy conference. Fed Chair Jerome Powell made hints about the likelihood of yet another rate increase in Q3 2025 should inflationary pressures continue to cause disturbance to risk-on asset classes, including cryptocurrency.

Concurrent with this surge in the U.S. 10-year Treasury yield above 5%, conventional bonds become more appealing than risky digital assets. The DXY Index rising to 106.7 shows the stronger U.S. dollar, which generated even more selling pressure for Bitcoin and alternative cryptocurrencies. Elsewhere, geopolitical concerns concerning Taiwan and the South China Sea have raised risk premiums across worldwide markets, which has driven traders to rotate out of highly beta assets like BTC and XRP.

Leverage and Derivatives’ Part in Increasing Volatility

This latest market pull-down once more highlights the disproportionate influence derivatives and leverage have on short-term price behavior. Even small spot selling can spiral into a huge liquidation loop if positions are too leveraged, as perpetual futures markets control crypto trading volumes.

According to Coinglass data, over eighty percent of the $600 million liquidations were long bets; Bitcoin accounted for more than half. The remaining were Ethereum, Solana, and XRP, which indicated this was a broad-based shakeout rather than a single fix.

Long warnings about the risks of over-leveraged trading in crypto markets have come from professionals, including the co-founder of BitMEX, Arthur Hayes. Along with wiping out billions in paper gains, these liquidations erode investor confidence, especially for retail players.

Forward market sentiment and on-chain signal

On-chain attitude is still wary, even with the carnage. Long-term holder supply and metrics such as the MVRV (Market Value to Realized Value) ratio point to Bitcoin still in a solid bull cycle. Still, the overuse of leverage has produced fragility in short-term pricing dynamics.

While institutional players are anticipated to remain on the sidelines until volatility reduces, social sentiment on sites like X (previously Twitter) and Reddit shows that many retail investors are “buying the dip.” More than 70% of Bitcoin supply hasn’t changed in the past six months, according to Glassnode data, which supports the notion that long-term conviction is still intact even during brief panic.

Looking forward to BTC and XRP?

Analysts are seeing a rebound at the $100,000 psychological support level for Bitcoin shortly. Ignoring this level could cause more losses towards $94,000–$96,000, where strong buy orders had past concentration. Maintaining support at $0.80 is vital for XRP; otherwise, it could return to the $0.72 zone.

This adjustment can offer a strategic accumulation opportunity for long-term horizon investors. Still, given the increased volatility and macro uncertainties, care is advised. Regulatory systems change, especially with planned legislation in the European Union (MiCA) and the United States (Digital Asset Market Structure Proposal), which should increase institutional confidence in the asset class. Moving forward, Bitcoin, XRP, and other big tokens will rely especially on this tailwind.