The way companies and individuals engage with financial services has been greatly transformed by fintech in the past few years. While there have been many advancements in this field, embedded fintech stands out as a game-changer. Embedded fintech allows businesses to provide banking-like functions without becoming banks by integrating financial services into non-financial apps.

This development signifies a sea change in the way financial services are provided. From e-commerce and healthcare to logistics and entertainment, fintech skills are increasingly integrated directly into many industries rather than operating in isolation through distinct applications or platforms. Consumers may anticipate a more streamlined and integrated banking experience thanks to embedded fintech, which is set to revolutionize the financial sector in response to rising consumer expectations and technological capabilities.

The Rise of Embedded Fintech

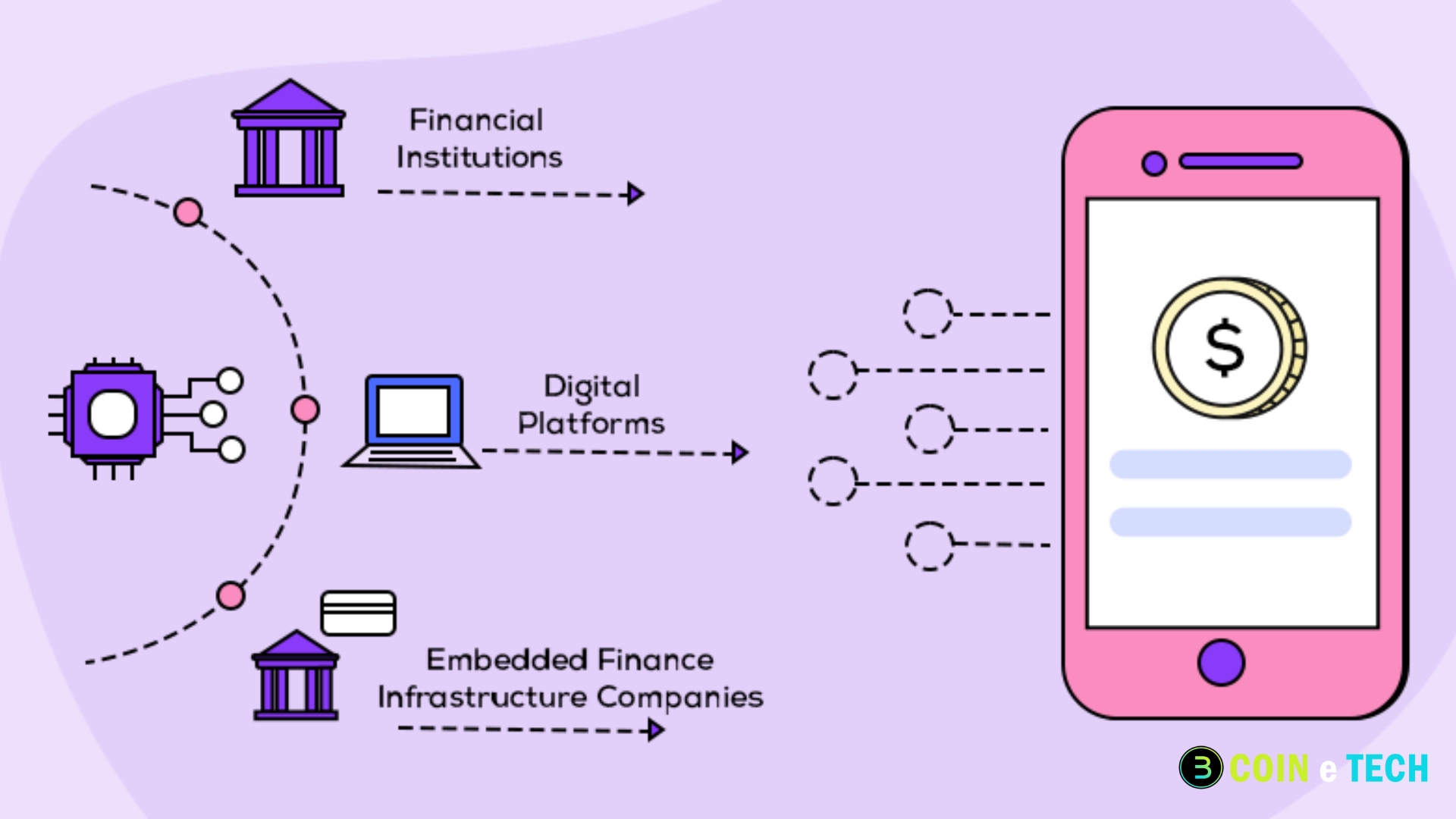

A more general trend toward embedded finance is the idea of embedded fintech, which allows non-financial organizations to offer payment, lending, insurance, and investing services inside their platforms. While embedded finance is not a new concept, businesses have found it simpler to include fintech capabilities into their offers due to the emergence of fintech tools, APIs (Application Programming Interfaces), and cloud-based solutions.

Obtaining the necessary permissions, knowledge, and facilities to provide financial services was a major undertaking in ancient times. Embedded fintech has enabled businesses to work with fintech providers and include financial capabilities through application programming interfaces (APIs) without creating the necessary in-house technology or dealing with the regulatory red tape associated with conventional banking.

Many fintech innovations have resulted from democratizing financial service delivery, allowing startups and smaller businesses to compete in the financial arena without becoming traditional financial institutions. A more interdependent economy is propelled by non-financial businesses, such as software providers, ride-sharing applications, and e-commerce platforms, which can include fintech in their current offerings.

Key Components of Embedded Fintech

Embedded fintech comes in various forms, and its adoption across industries has given rise to different services and solutions that cater to specific needs. Some of the key components of embedded fintech include:

Embedded Payments

This is one of the most common forms of embedded fintech. Companies can integrate payment processing directly into their platforms, allowing users to transact without switching between apps. For example, ride-hailing apps like Uber and Lyft integrate payments so customers can seamlessly pay for rides without leaving the app. Similarly, online retailers provide one-click checkout solutions that embed payment gateways directly within their e-commerce platforms.

Buy Now, Pay Later (BNPL)

BNPL services allow customers to make purchases and pay for them over time. These services are often embedded into e-commerce platforms, providing consumers flexible payment options. Companies like Klarna and Afterpay have seen explosive growth as they partner with retailers to offer BNPL options at checkout. This form of embedded lending has grown particularly popular in online retail, where customers seek convenient financing options.

Embedded Banking

Some companies offer users bank-like services within non-bank platforms, such as savings accounts, checking accounts, or credit cards. For example, fintech startups like Chime and N26 have partnered with traditional banks to offer banking services through their digital interfaces, effectively embedding banking into everyday apps.

Embedded Insurance

This involves offering insurance products directly within the purchase journey. For instance, when buying a smartphone, consumers might be offered device insurance as an embedded option during checkout. Travel companies, car rental agencies, and e-commerce platforms have similarly embedded insurance offerings, making it easier for customers to opt-in without visiting a separate insurance provider.

Embedded Lending

Businesses can offer customers or partners loans and lines of credit directly through their platforms. For instance, platforms like Shopify offer working capital loans to merchants based on their sales history. By embedding lending into their platforms, companies can provide much-needed financing to small businesses without the merchants going through traditional banks.

Embedded Investment

Some platforms now allow users to invest in stocks, bonds, or other financial products without using dedicated investment apps. For example, apps like Acorns and Robinhood provide investment services directly within their platforms, embedding wealth management solutions into broader financial ecosystems.

Benefits of Embedded Fintech

Enhanced Customer Experience

One of the primary drivers of embedded fintech is the desire to improve customer experiences. Companies reduce friction and streamline interactions by embedding financial services directly into platforms people already use. This results in a more cohesive user experience, as customers can complete financial tasks without leaving the environment of their preferred apps.

Increased Revenue Streams

For non-financial companies, embedded fintech presents an opportunity to unlock new revenue streams. Businesses can earn through transaction fees, interest on loans, or premium subscription models by offering financial services within their existing operations.

Greater Accessibility

Embedded fintech democratizes access to financial services. By embedding banking, payments, and lending into everyday applications, users who may not have access to traditional financial services can benefit from these offerings. This particularly impacts developing markets where fintech solutions drive financial inclusion for unbanked or underbanked populations.

Data-Driven Personalization

Embedded fintech allows companies to gather more comprehensive customer data. Companies can deliver more personalized offers by understanding users’ spending habits, credit profiles, or insurance needs, improving customer satisfaction and loyalty. This level of customization leads to higher engagement and conversion rates for businesses.

Efficiency and Cost Reduction

Embedded fintech solutions reduce the need for businesses to build and maintain their financial infrastructure. Instead of navigating complex regulatory requirements and technology investments, companies can partner with fintech providers, allowing them to focus on their core business while still delivering financial services.

Industry Applications of Embedded Fintech

The versatility of embedded fintech means it can be applied across a wide range of industries. Here are some prominent examples:

- E-commerce: Online retailers are at the forefront of embedded fintech adoption. With embedded payments, BNPL options, and integrated insurance services, e-commerce platforms can streamline purchasing and offer customers more convenient payment options.

- Healthcare: Embedded fintech is also making inroads into healthcare. For example, healthcare platforms can integrate payment processing for medical bills or offer financing solutions for expensive procedures. Additionally, embedded insurance can provide patients with coverage options at the point of care.

- Transportation and Mobility: Ride-sharing companies like Uber and Lyft have pioneered embedded fintech by integrating payments directly into their apps. Beyond that, embedded insurance and financing options for car purchases or rentals are emerging trends within the mobility sector.

- SaaS Platforms: Software-as-a-service (SaaS) companies are directly embedding fintech solutions like payments, billing, and subscription management into their platforms. This helps streamline the user experience and ensures customers can manage their finances without leaving the software environment.

Challenges and Considerations

There are benefits to embedded fintech, but there are also some challenges. One of the most important is regulation. Financial services are subject to varying degrees of regulation across regions; as a result, businesses that use fintech solutions must follow all applicable regulations. Companies in multiple nations with different regulatory frameworks may find this especially challenging.

Furthermore, there are major worries about data privacy and security. Companies using integrated fintech have a specific responsibility to protect their customers’ personal information and the security of their financial transactions due to the delicate nature of this data. Businesses must protect their users by investing in strong security solutions, as cybersecurity threats are always changing.

The Future of Embedded Fintech

It is anticipated that integrated fintech will become increasingly more important to daily life as it evolves. Open banking, decentralized finance (DeFi), and AI are still in their early stages of development, so we may expect them to hasten the trend even further. Businesses are going to try to include financial services in ways that are easier to use, more tailored to their customers, and safer overall.

Fintech startups and traditional financial institutions will work together more closely in the future to offer streamlined financial services to different industries. The rise of embedded fintech has the potential to revolutionize the way we use financial services and alter the international financial system.

Embedded fintech represents a sea change in the provision and utilization of financial services; it is more than a fad. A more accessible, efficient, and customized financial ecosystem will be created for businesses and individuals alike as technology continues to grow through the integration of finance into non-financial platforms.