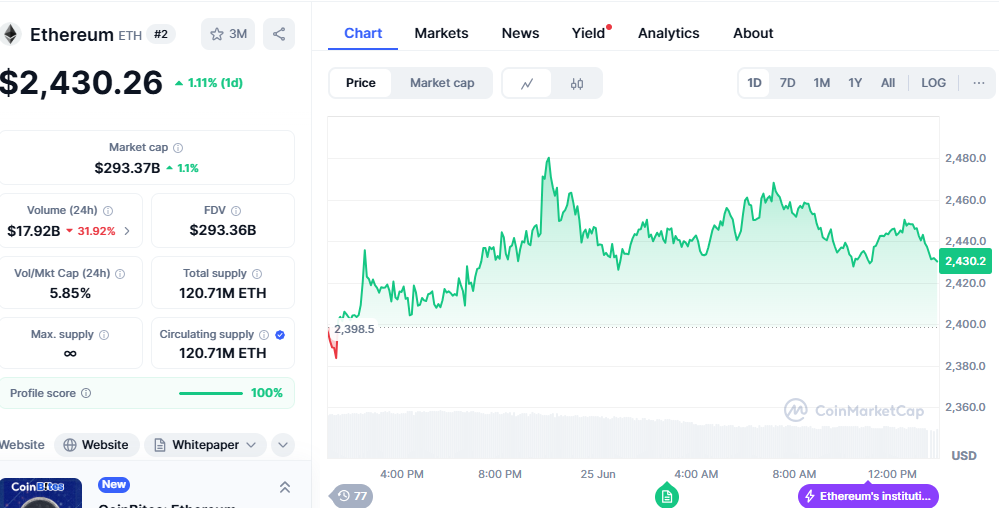

Ethereum price analysis market is abuzz with anticipation as Ethereum (ETH) hovers around the critical $2,500 resistance level, presenting a pivotal moment for both bulls and bears. With substantial liquidity pools concentrated above this psychological barrier, the question remains: can ETH bulls muster enough strength to break through and capitalize on the available liquidity?

Current ETH Price Action: A Critical Juncture

The live Ethereum price today is USD 2,437.24, with a 24-hour trading volume of $ 26,459,261,682.14.. This positions ETH tantalizingly close to the $2,500 threshold that has become a focal point for traders and institutional investors.

Recent market analysis reveals that Ethereum price analysis traded within a $72 range over 24 hours, from a low of $2,460.35 to a high of $2,532.41. This narrow trading range suggests consolidation before a potential breakout, with traders closely monitoring the $2,520-$2,530 resistance zone.

Key Support and Resistance Levels

The technical landscape for Ethereum shows several critical price zones:

- Support Zone: $2,460-$2,470 has emerged as a key support level where ETH has consistently bounced

- Immediate Resistance: $2,520-$2,530 range presents the first major hurdle

- Target Zone: Breaking above $2,500 could open doors to the $2,600-$2,700 region

Liquidity Pool Dynamics Driving ETH Price Action

The concept of liquidity in cryptocurrency markets extends beyond simple trading volume. Liquidity pools, particularly in decentralized finance (DeFi), play a crucial role in price discovery and market stability.

Understanding Ethereum’s Liquidity Ecosystem

Uniswap is one of the leading entries in the list of liquidity pools, especially considering its substantial trading volume. As the leading decentralized exchange on Ethereum, Uniswap’s liquidity pools serve as barometers for ETH’s market sentiment and price direction.

The mechanics of liquidity pools work through automated market makers (AMMs), where if a trader buys ETH from an ETH/USDT pool, the ETH supply decreases, and its price rises relative to USDT. This dynamic pricing mechanism creates natural pressure points that can trigger significant price movements.

Institutional Interest and ETF Impact

A significant catalyst for ETH’s recent price action comes from institutional adoption. Institutional inflows into Ethereum ETFs, as noted earlier, further underscore a shift in capital from traditional markets to crypto, with potential impacts on crypto-related stocks like Coinbase (COIN), which saw a 3% price increase to $225 as of June 21, 2025.

This institutional interest creates a feedback loop where traditional finance validates cryptocurrency investments, attracting more capital and increasing liquidity at higher price levels.

Technical Analysis: Bulls vs. Bears

Bullish Scenarios

Several factors align in favor of Ethereum price analysis bulls breaking the $2,500 resistance:

- Options Expiry Pressure: If bulls can hold ETH above $2,500 ahead of expiry, it may prompt short-covering or delta hedging activity, which could lift the price through key resistance.

- Volume Support: Strong trading volumes during recent bounces from support levels indicate healthy buying interest

- Market Sentiment: The Fear & Greed Index is displaying a score of 65 (Greed), suggesting optimistic market sentiment

Bearish Considerations

Despite bullish signals, several factors could prevent a sustained breakout:

- Historical resistance at the $2,500 level has proven formidable

- Broader market uncertainty could dampen risk appetite

- Profit-taking from long-term holders near psychological levels

Expert Predictions and Price Targets

Market analysts remain divided but generally optimistic about Ethereum’s medium-term prospects. Johnny Gabriele, head analyst of blockchain economics and AI integration at the Lifted Initiative, is pretty bullish, predicting that ETH will close 2025 worth $10,000 based on its potential for institutional adoption.

More conservative estimates suggest its value will increase by 2.4% and reach 2475.51 by June 26, 2025. This near-term prediction indicates steady but modest growth expectations.

Long-term Outlook

Looking beyond immediate price action, Ethereum is forecasted to average $3,304, with high-end estimates reaching over $6,300 by 2030, reflecting the network’s fundamental value proposition in decentralized applications and smart contracts.

DeFi Liquidity Trends Shaping ETH’s Future

The decentralized finance ecosystem continues to evolve, with new developments potentially impacting ETH liquidity:

Emerging Protocols and Upgrades

The planned Fluid v2 upgrade, targeted for June or July, will introduce dynamic fees, permissionless pools, and custom LP ranges. Such improvements in DeFi infrastructure could enhance capital efficiency and attract more liquidity to Ethereum-based protocols.

Top Liquidity Pool Opportunities

For investors looking to participate in ETH’s liquidity ecosystem, several options present themselves:

- Uniswap V3: Concentrated liquidity positions for ETH/USDC and ETH/USDT pairs

- Curve Finance: Stablecoinools with ETH exposure

- Aave: Lending and borrowing protocols utilizing ETH as collateral

Risk Management and Trading Strategy

Given the current market dynamics, traders should consider several factors:

Entry and Exit Points

- Bullish Entry: A decisive break above $2,530 with volume confirmation

- Conservative Approach: Dollar-cost averaging around current support levels

- Risk Management: Stop-losses below $2,400 to protect against major corrections

Market Catalysts to Watch

Several upcoming events could significantly impact ETH’s price action:

- Ethereum Protocol Updates: Any network improvements or scalability solutions

- Regulatory Developments: Clarity on ETF regulations and institutional adoption

- Macro Environment: Federal Reserve policy decisions and broader market sentiment

Conclusion

Ethereum’s position above $2,400 with substantial liquidity sitting above $2,500 creates a compelling setup for potential upside. The combination of institutional interest, technical support levels, and positive sentiment provides a foundation for bullish momentum.

However, breaking through the $2,500 resistance requires sustained buying pressure and favorable market conditions. The Ethereum price action on the 4-hour chart displays a clear compression pattern forming between rising support near $2,457 and descending resistance, indicating a potential breakout is imminent.