Ethereum price analysis, the world’s second-largest cryptocurrency by market capitalization, has been experiencing notable price fluctuations in recent trading sessions, leaving many investors wondering about the underlying causes. For June, Ethereum price could reclaim the $2,800–$2,900 zone, if bullish momentum revives mid-month. Downside risk persists to $2,280, especially if macro sentiment weakens. Understanding the factors behind Ethereum’s current price movements is crucial for both existing holders and potential investors looking to make informed decisions in this volatile market environment.

Market Volatility and Trading Patterns

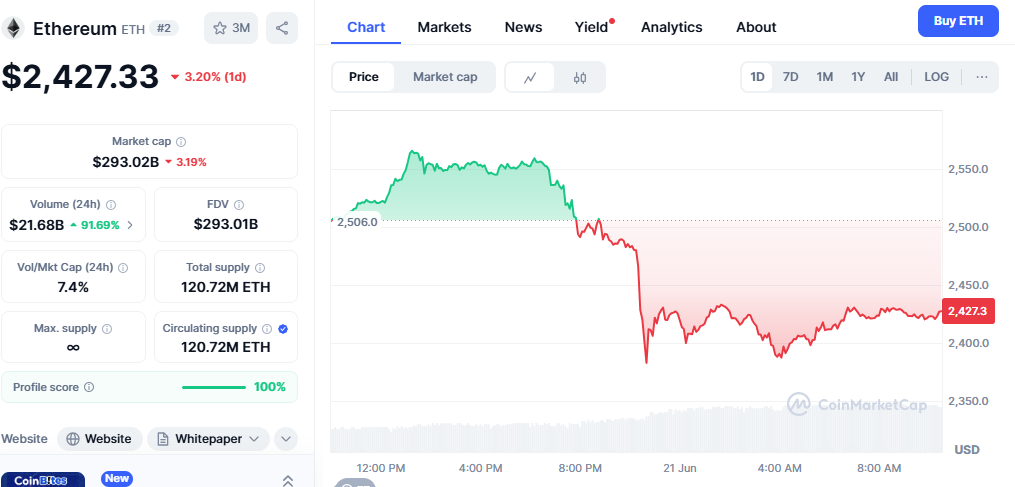

The cryptocurrency market’s inherent volatility continues to impact Ethereum’s price dynamics significantly. Recent trading data suggests that institutional and retail investors are responding to various market signals, creating increased pressure on ETH’s price stability. The focus of the chart is that there have been trades around near-month expiration, specifically during this month, suggesting potential future volatility or market manipulations that may significantly affect the forecast of Ethereum’s price.

Options trading activity has intensified around monthly expirations, indicating that derivatives markets are contributing to heightened volatility. This pattern often leads to increased price swings as prominent positions are unwound or rolled over, creating temporary selling pressure that can drive prices lower in the short term.

Competition from Alternative Blockchain Networks

One of the most pressing challenges facing Ethereum today comes from the growing competition posed by alternative blockchain networks. Influencing factors for these bearish forecasts include competition from faster and cheaper blockchains such as Solana and Sui, which are gaining market share and could thus put pressure on Ethereum’s price.

These competing platforms offer faster transaction speeds and significantly lower fees compared to Ethereum’s current infrastructure, making them increasingly attractive to both developers and users. Solana, in particular, has gained substantial traction in the decentralized finance (DeFi) space and NFT markets, which Ethereum has traditionally dominated. The migration of projects and users to these alternative networks represents a direct challenge to Ethereum’s market position and may be contributing to a decline in demand for ETH tokens.

The competitive landscape has intensified as these newer blockchains continue to mature and expand their ecosystems. Many projects that might have previously chosen Ethereum as their default platform are now considering alternatives, leading to concerns about Ethereum’s long-term market share retention.

Macroeconomic Factors and Regulatory Uncertainties

The broader macroeconomic environment continues to exert significant influence on cryptocurrency markets, with Ethereum being particularly sensitive to these external factors. Federal Reserve policy decisions, inflation data, and overall market sentiment all play crucial roles in determining investors’ appetite for risk assets, such as cryptocurrencies.

Recent economic indicators have created uncertainty about future monetary policy directions, leading many investors to adopt a more cautious approach to digital assets. When traditional markets face headwinds, cryptocurrencies often experience amplified volatility as investors seek to reduce their exposure to riskier assets.

Regulatory uncertainties also contribute to the current market conditions affecting the Ethereum market. While the approval of Ethereum ETFs has provided some institutional legitimacy, ongoing regulatory discussions in major markets continue to create uncertainty. Investors remain watchful of potential policy changes that could impact cryptocurrency trading and adoption.

Technical Analysis and Price Predictions

From a technical perspective, Ethereum’s price action reflects the broader market sentiment and underlying fundamentals. As of January 5, 2025, Ethereum was worth $ 3,634.10 – significantly less than the $ 4,400 it reached by the end of 2021. The cryptocurrency has been consolidating after reaching higher levels earlier in the year, with traders closely watching key support and resistance levels.

Market analysts suggest that Ethereum’s price movements are following established technical patterns, with potential for both upside and downside scenarios depending on how various factors unfold. The current trading range reflects a period of price discovery as the market weighs the competing forces that affect the cryptocurrency’s valuation.

Long-term Outlook Despite Short-term Pressures

While current market conditions may appear challenging for Ethereum, many analysts maintain optimistic long-term projections for the cryptocurrency. With factors such as the growing Ethereum network, rising inflows, broader market recovery, and increased adoption, the ETH price is likely to yield multi-fold returns in 2025. The underlying fundamentals of the Ethereum network, including its role in decentralized finance and innovative contract applications, continue to support its long-term value proposition.

The ongoing development of Ethereum’s infrastructure, including scaling solutions and network upgrades, positions the platform for future growth despite current market pressures. Many institutional investors view temporary price declines as potential entry opportunities, recognizing Ethereum’s established position in the cryptocurrency ecosystem.

Network Development and Future Catalysts

Ethereum’s development roadmap includes several upcoming upgrades and improvements that could serve as positive catalysts for price recovery. The network’s transition to proof-of-stake consensus has already improved its energy efficiency, and ongoing scaling solutions continue to address concerns regarding transaction speed and cost.

The growth of decentralized applications built on Ethereum, along with the increasing institutional adoption through ETF products, provides a foundation for potential future price appreciation. While short-term volatility may continue, these fundamental developments suggest that Ethereum’s long-term trajectory remains positive.

Conclusion

Ethereum’s current price movements reflect a complex interplay of factors, including market volatility, competitive pressures from alternative blockchains, and broader macroeconomic uncertainties. While these challenges are creating short-term headwinds for ETH prices, the cryptocurrency’s fundamental strengths and ongoing development initiatives suggest that current market conditions may represent a temporary adjustment rather than a long-term decline.

Investors should carefully consider their risk tolerance and investment timeline when evaluating Ethereum’s current market position. The cryptocurrency market’s volatile nature means that prices can change rapidly. While current conditions may appear challenging, they also present opportunities for those with a longer-term investment perspective. As always, thorough research and careful risk management remain essential when navigating the dynamic cryptocurrency market environment.