Ethereum price prediction 2025: The Cryptocurrency landscape is witnessing a pivotal moment as Ethereum (ETH) experiences significant network expansion alongside groundbreaking legislative developments. With the GENIUS Act advancing through Congress, Ethereum’s ecosystem is positioning itself for unprecedented growth, despite current price volatility around the $2,500 mark.

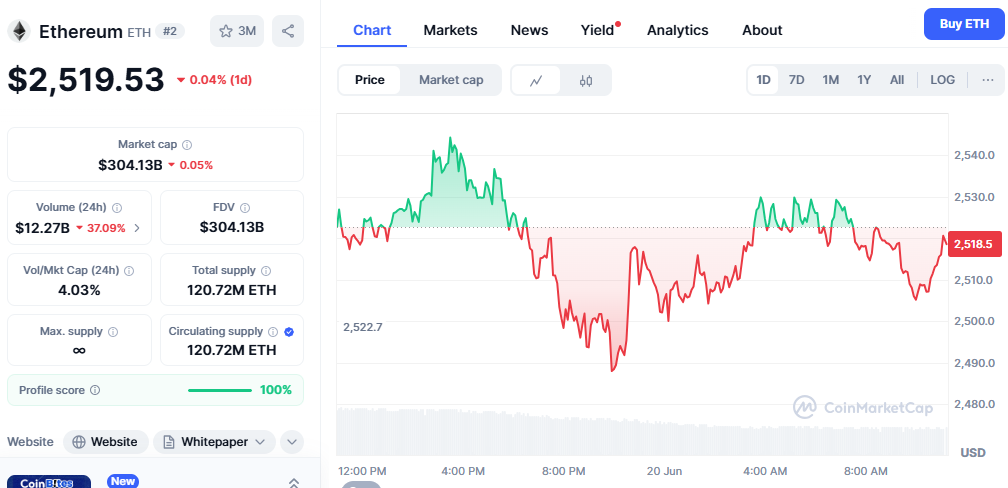

Current Ethereum Market Overview: Where ETH Stands Today

Ethereum (ETH) is trading around $2,500 in the early Asian session on Friday despite a surge in new address growth over the past month. This price stability comes amid broader market uncertainty, with recent geopolitical tensions affecting sentiment for cryptocurrencies globally.

Key Price Metrics and Market Performance

- Current Trading Range: ETH is consolidating around $2,500-$2,521

- Recent Performance: Ethereum’s current price is at $2,504.99 with an intraday price drop of 1.73%

- Support Levels: Traders are watching the $2350 to $2425 zone for support

- Resistance Target: Multiple analysts are eyeing the $3,000 psychological level

The cryptocurrency has demonstrated remarkable resilience, maintaining its position as the second-largest digital asset by market capitalisation while showing signs of institutional adoption and network expansion.

GENIUS Bill: A Game-Changer for Cryptocurrency Regulation

The GENIUS Act represents the most significant cryptocurrency legislation to gain bipartisan support in recent years, with far-reaching implications for the entire digital asset ecosystem.

What is the GENIUS Act?

The GENIUS Act is a proposed bill that regulates stablecoins, a $200 billion part of the multi-trillion-dollar cryptocurrency system. This landmark legislation has successfully navigated through the Senate and is now awaiting House approval.

Legislative Milestones and Bipartisan Support

The bill has achieved remarkable political momentum:

- Senate Passage: Senate passes the GENIUS stablecoin bill with bipartisan support, marking the first primary crypto legislation to clear the chamber.

- Voting Results: It passed the Senate in a 68 to 30 vote

- Bipartisan Coalition: Sixteen Democrats voted with the majority of Senate Republicans to advance the bill

Key Provisions and Market Impact

The GENIUS Act introduces several critical regulatory frameworks:

Stablecoin Regulation: The bill, known as the GENIUS Act, would establish a regulatory framework for the $250 billion market for stablecoins

Tech Company Restrictions: The GENIUS Act restricts non-financial large tech companies from directly issuing stablecoins unless they establish or partner with regulated financial entities

Government Official Prohibitions: The bill features a stipulation that would “prohibit any member of Congress or senior executive branch official from issuing a payment stablecoin product during their time in public service.”

Ethereum Network Growth: The Numbers Tell the Story

Despite price volatility, Ethereum’s underlying network metrics reveal a different narrative of robust growth and increasing adoption.

Network Activity and Address Growth

The Ethereum network is experiencing unprecedented expansion in user adoption. Recent data shows a significant surge in new address creation, indicating growing interest from both retail and institutional investors. This network growth is essential as it represents real utility and adoption rather than speculative trading activity.

Developer Activity and Ecosystem Expansion

Ethereum continues to dominate the decentralised application (dApp) ecosystem, with developers building innovative solutions across decentralised finance (DeFi), non-fungible tokens (NFTs), and Web3 infrastructure. The network’s transition to Proof-of-Stake has improved energy efficiency and scalability, making it more attractive for enterprise adoption.

Expert Price Predictions: What Analysts Are Saying

Market analysts remain bullish on Ethereum’s long-term prospects, with several key factors supporting higher price targets.

Short-Term Outlook (2025)

- Conservative Estimates: As per CoinPedia’s Ethereum price prediction 2025, the Bulls can hit $5,925 in 2025

- Optimistic Projections: They project Ethereum might hit $5.4K by the end of 2025

- Immediate Targets: analysts eyeing a bullish reversal to $3,000

Long-Term Projections (2026-2030)

Looking beyond 2025, analysts project even more substantial growth:

- 2029 Targets: approach $6.1K by the end of 2029

- Ultra-Bullish Scenarios: DigitalCoinPrice projects an optimistic trajectory for Ethereum, expecting it to break past $6.9K within a year

- Decade Outlook: Their forecasts suggest a rapid climb, with Ethereum possibly reaching around $11K

The Intersection of Regulation and Innovation

The GENIUS Act’s progress represents more than just regulatory clarity—it signals institutional acceptance of cryptocurrency as a legitimate financial instrument.

Institutional Adoption Catalyst

The bill’s passage could catalyse institutional adoption by:

- Providing regulatory certainty for financial institutions

- Creating standardised compliance frameworks

- Reducing regulatory risk for corporate treasury adoption

- Enabling traditional banks to offer cryptocurrency services

Market Confidence and Liquidity Impact

Regulatory clarity typically leads to increased market confidence and liquidity. As the GENIUS Act moves closer to becoming law, we can expect:

- Reduced regulatory uncertainty premiums in cryptocurrency pricing

- Increased institutional investment flows

- Enhanced market stability and reduced volatility

- Greater integration with traditional financial systems

Technical Analysis: Key Levels to Watch

From a technical perspective, Ethereum is at a critical juncture with several essential price levels to monitor.

Support and Resistance Levels

Critical Support: The $2,350-$2,425 range represents crucial support that could determine ETH’s near-term direction.

Immediate Resistance: The $2,600-$2,650 zone poses the first significant resistance level for bullish momentum.

Psychological Target: The $3,000 level remains a key psychological target that could trigger significant momentum if breached.

Volume and Market Structure

Recent trading volume patterns indicate institutional accumulation, with large transactions increasing during periods of price consolidation. This activity pattern typically precedes significant price movements.

Risks and Considerations

While the outlook appears positive, several factors could impact Ethereum’s price trajectory.

Regulatory Challenges

Despite the GENIUS Act’s progress, regulatory uncertainty remains in other jurisdictions. International regulatory developments could significantly impact global cryptocurrency adoption.

Market Volatility

Cryptocurrency markets remain inherently volatile, with price movements frequently driven by sentiment rather than fundamental factors. Investors should be prepared for significant price swings.

Competition and Technology Risks

Ethereum faces increasing competition from other blockchain platforms that offer similar functionality, with potentially superior scalability or lower costs.

Investment Implications and Strategic Outlook

The convergence of regulatory progress and network growth creates a compelling investment thesis for Ethereum.

For Retail Investors

The current price consolidation around $2,500 may present an attractive entry point for long-term investors, particularly given the positive regulatory developments and network growth metrics.

For Institutional Investors

The GENIUS Act’s progress reduces regulatory risk, making Ethereum more suitable for institutional portfolios. The established regulatory framework could enable pension funds, insurance companies, and other institutions to allocate to cryptocurrency.

For Developers and Entrepreneurs

The regulatory clarity provided by the GENIUS Act could accelerate innovation in the Ethereum ecosystem, creating new opportunities for developers and entrepreneurs building decentralised applications.

Conclusion

Ethereum stands at a critical inflexion point where regulatory clarity meets network growth, creating conditions for substantial price appreciation. The GENIUS Act’s progress through Congress represents a watershed moment for cryptocurrency regulation, while Ethereum’s expanding network metrics demonstrate real-world adoption and utility.

It’s been an intense few weeks for ETH, with a 50% rally behind it, and the combination of regulatory tailwinds and network growth suggests this momentum could continue. However, investors should remain mindful of the inherent volatility in cryptocurrency markets and consider their risk tolerance when making investment decisions.