The cryptocurrency landscape has undergone a dramatic transformation since Ethereum transitioned to proof-of-stake, fundamentally reshaping how investors approach yield generation and long-term value creation. As we navigate through 2025, Ethereum finds itself at the center of an intensifying battle for yield, with traditional staking rewards competing against innovative DeFi protocols and institutional investment products. This evolution has created unprecedented opportunities for ETH holders while simultaneously raising critical questions about the network’s future trajectory and sustainability.

The Staking Revolution: Ethereum’s New Foundation

Ethereum’s proof-of-stake mechanism has matured significantly since its inception, with staking rates predicted to exceed 50% of the total supply by year’s end. This remarkable growth reflects increasing confidence in the network’s security model and the attractive yield opportunities it presents. Currently, Ethereum staking provides returns ranging from 2.5% to 7% annually, offering a relatively stable income stream compared to the volatile nature of traditional cryptocurrency trading.

The staking ecosystem has evolved beyond simple solo staking to encompass a diverse range of participation methods. Staking pools have democratized access to ETH rewards, allowing smaller holders to participate without meeting the 32 ETH minimum requirement for running a validator node. This accessibility has contributed to broader adoption and has strengthened the network’s decentralization by distributing validation power across a larger number of participants.

Institutional interest in Ethereum staking has surged dramatically in 2025, driven by clearer regulatory frameworks and the potential approval of staking-enabled exchange-traded funds (ETFs). Industry experts predict that staking Ethereum ETFs could potentially surpass Bitcoin ETFs in terms of asset attraction, underscoring the growing institutional interest in yield-generating crypto assets. This institutional influx brings both opportunities and challenges, as it provides legitimacy and capital inflows while potentially concentrating stakeholder power among fewer, larger entities.

DeFi’s Persistent Appeal: Beyond Traditional Staking

While staking provides a foundation of steady returns, the decentralized finance sector continues to offer more aggressive yield opportunities that attract risk-tolerant investors. Platforms like Uniswap, Aave, and Curve Finance continue leading the charge in providing innovative yield farming opportunities that often exceed traditional staking returns.

The DeFi yield farming landscape has matured considerably, with established protocols offering more sophisticated risk management tools and automated strategies. Aave continues to dominate the lending space, providing users with flexible borrowing and lending options while enabling yield generation through liquidity provision. The platform’s introduction of features like flash loans and variable interest rates has created new opportunities for advanced traders and yield farmers to maximize their returns.

Uniswap and other decentralized exchanges have refined their liquidity provision models, offering improved capital efficiency and reduced impermanent loss risks. These improvements have made yield farming more accessible to mainstream investors who previously avoided these strategies due to complexity and risk concerns. The integration of automated market makers with yield optimization protocols has streamlined the user experience while maintaining the potential for higher returns than traditional staking.

Yield farming remains profitable in 2025, especially for those who understand the risks and choose the right platforms. This profitability stems from continuous innovation in protocol design, improved user interfaces, and better risk management tools that help investors navigate the complex DeFi landscape more effectively.

Price Predictions and Market Dynamics

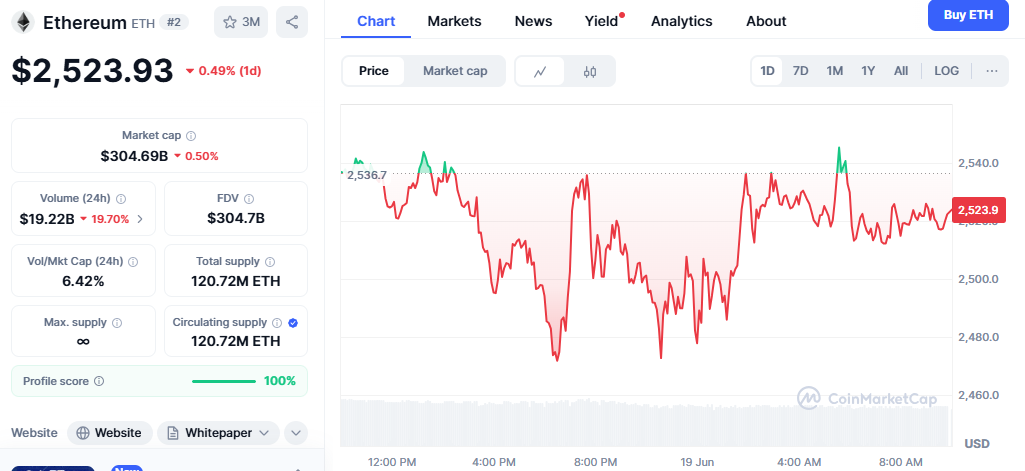

The battle for yield occurs against a backdrop of evolving price expectations and market dynamics that significantly influence investor behavior and platform adoption. Expert opinions for Ethereum tend to cluster between $4,000 and $8,000 for 2025, with factors such as ETH 2.0 adoption and staking rewards playing crucial roles in determining the price.

More optimistic projections suggest even higher potential, with some experts predicting that Ethereum could surpass $6,100 by 2025 and potentially reach up to $12,000 by 2030. These bullish forecasts reflect confidence in Ethereum’s technological roadmap, including continued improvements to scalability, security, and sustainability through various upgrade proposals.

The relationship between yield opportunities and price appreciation creates a complex feedback loop that influences investor behavior. Higher ETH prices make staking more attractive in absolute dollar terms, while increased staking participation can reduce selling pressure and support price stability. Similarly, successful DeFi protocols built on Ethereum can drive demand for ETH as gas fees and collateral requirements increase network utility.

Market volatility remains a significant factor in yield strategy selection, with Ethereum remaining volatile and potentially rising above USD 5,000 or falling below USD 2,000 depending on various market conditions and regulatory developments. This volatility creates both opportunities and risks for yield farmers and stakers, as the underlying asset price movements can significantly impact overall returns.

Technological Innovation and Future Opportunities

The ongoing development of Ethereum’s technological infrastructure continues to create new yield opportunities and improve existing ones. Layer 2 solutions have dramatically reduced transaction costs and increased throughput, making smaller-scale yield farming strategies economically viable. These improvements have opened DeFi participation to a broader user base and enabled more sophisticated trading strategies that were previously cost-prohibitive.

Smart contract security has improved substantially, with better auditing practices and formal verification methods reducing the risk of protocol exploits. This enhanced security has increased institutional confidence in DeFi protocols, leading to larger capital deployments in yield-generating strategies. The combination of improved security and regulatory clarity has created a more stable environment for generating long-term yields.

The integration of artificial intelligence and automated portfolio management tools has revolutionized how investors approach yield optimization. These tools can automatically rebalance portfolios, harvest rewards, and compound returns while managing risk exposure across multiple protocols. This automation has made sophisticated yield strategies accessible to retail investors who lack the time or expertise to manually manage complex DeFi positions.

Cross-chain bridges and multi-chain protocols have expanded the yield opportunity landscape beyond Ethereum’s native ecosystem. While maintaining significant exposure to ETH, investors can now diversify their yield strategies across multiple blockchains, potentially reducing risk while maintaining or increasing overall returns.

Challenges and Risk Considerations

The pursuit of yield in the Ethereum ecosystem presents significant challenges and risks that investors must carefully consider. Smart contract risks remain a primary concern, despite improvements in security practices. Even well-audited protocols can contain vulnerabilities that may not be discovered until after significant capital has been deployed. The permanent and irreversible nature of blockchain transactions means that losses from exploits are typically unrecoverable.

Regulatory uncertainty continues to cast a shadow over both staking and DeFi yield strategies. While 2025 has brought greater clarity in many jurisdictions, the regulatory landscape remains fragmented and continues to evolve. Changes in regulatory attitudes toward staking rewards, DeFi protocols, or cryptocurrency taxation could significantly impact the attractiveness and accessibility of various yield strategies.

Impermanent loss remains a significant concern for liquidity providers in automated market makers. While newer protocols have introduced mechanisms to mitigate this risk, the fundamental mathematical relationship between asset price movements and liquidity provision losses persists. Investors must carefully consider their risk tolerance and market outlook when choosing between staking and liquidity provision strategies.

Market concentration risks have emerged as institutional adoption increases. The potential for large holders to dominate staking or influence protocol governance could undermine the ecosystem’s decentralized nature. This concentration could lead to regulatory scrutiny and potentially reduce the long-term sustainability of high-yield opportunities.

The Road Ahead: Strategic Considerations for Investors

As Ethereum continues to evolve and the battle for yield intensifies, investors must develop sophisticated strategies that balance risk and reward while adapting to changing market conditions. Diversification across different yield strategies can help mitigate specific risks while maintaining exposure to the ecosystem’s growth potential. This might involve combining stable staking rewards with more aggressive DeFi strategies, adjusting allocations based on market conditions, and personal risk tolerance.

The importance of staying informed about technological developments, regulatory changes, and market trends cannot be overstated. The rapid pace of innovation in the Ethereum ecosystem means that new opportunities and risks emerge regularly. Successful yield generation requires continuous learning and adaptation to changing conditions.

Due diligence and risk management should be the cornerstone of any yield strategy. This includes understanding the technical aspects of protocols being used, assessing the track record and reputation of development teams, and maintaining appropriate diversification to avoid catastrophic losses from any single protocol failure.

The future of Ethereum and its yield opportunities appears bright, with continued technological innovation, growing institutional adoption, and expanding use cases driving demand for the network and its native token. However, success in this evolving landscape requires careful planning, risk management, and the flexibility to adapt strategies as conditions change. As the battle for yield continues, those who approach it with knowledge, caution, and strategic thinking are best positioned to benefit from Ethereum’s ongoing evolution and the expanding opportunities it creates.