$100,000 Bitcoin Impact Financial: Bitcoin, the world’s first and most prominent cryptocurrency, has long been a symbol of financial innovation and decentralization. As its value continues to climb, with predictions and speculation about reaching $100,000 per Bitcoin, questions arise about its broader implications. One critical issue that demands attention is its impact on financial inequality, Crypto Flash Loans: A Complete Guide By Coinetech particularly in the digital age. Could Bitcoin be a tool to bridge wealth gaps, or does it risk exacerbating existing disparities?

Bitcoin as a Tool for Financial Inclusion

Bitcoin was designed to be a decentralized digital currency, accessible to anyone with an internet connection. This premise positions it as a potential game-changer for financial inclusion.

- Banking the Unbanked

An estimated 1.4 billion adults globally remain unbanked, primarily in developing countries. Bitcoin offers a solution, providing access to a global financial system without the need for traditional banking infrastructure. A mobile phone and internet connection enable individuals to store, send, and receive money securely. - Protection Against Inflation

In countries facing hyperinflation and unstable national currencies, Bitcoin acts as a store of value. For example, in nations like Venezuela or Zimbabwe, citizens have turned to Bitcoin to preserve their wealth when local currencies lose value rapidly. - Reduced Barriers to Entry

Traditional financial systems often exclude individuals through stringent requirements, such as credit history or minimum deposits. Bitcoin’s permissionless nature eliminates these barriers, offering opportunities for economic participation.

Challenges and Risks

While Bitcoin presents opportunities, it also carries challenges that could perpetuate or even worsen financial inequality.

While Bitcoin presents opportunities, it also carries challenges that could perpetuate or even worsen financial inequality.

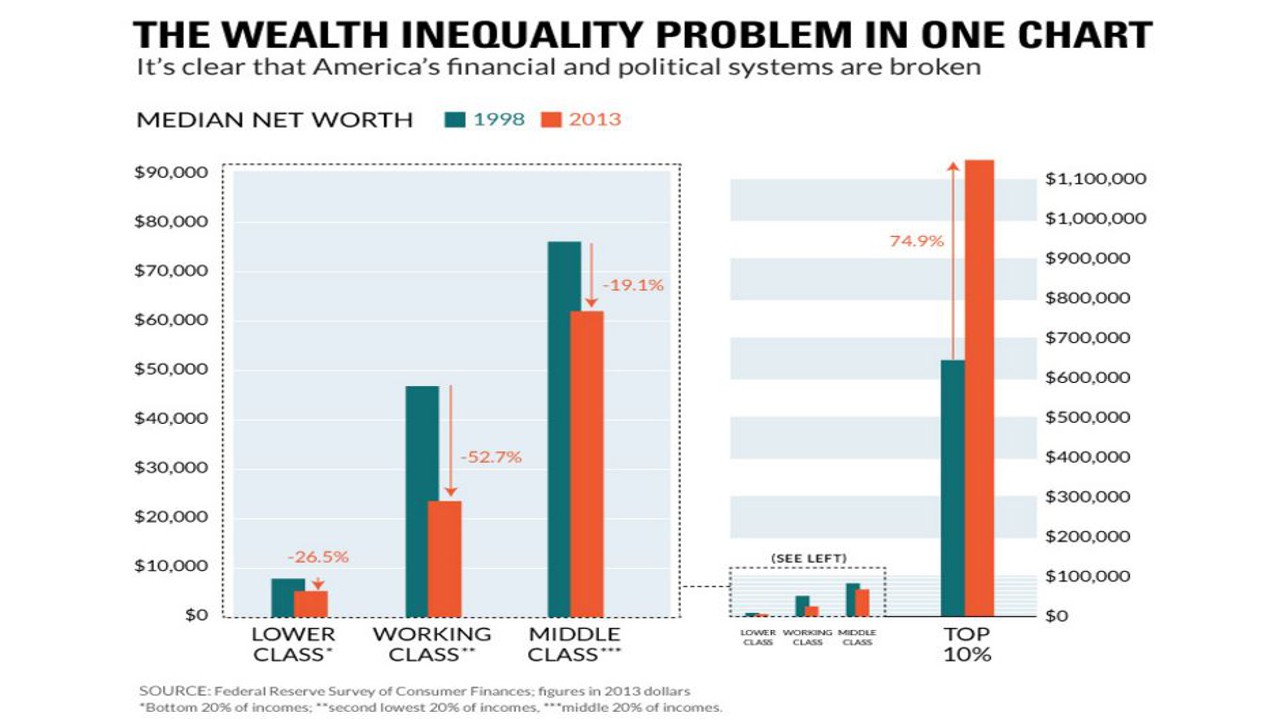

- Wealth Concentration

Bitcoin ownership is highly concentrated. Studies show that a small percentage of wallets hold the majority of Bitcoin. As its value rises, early adopters and large-scale investors (whales) accrue massive wealth, leaving latecomers at a disadvantage. - Access Inequality

While Bitcoin is theoretically accessible to everyone, practical barriers persist. Reliable internet access, technological literacy, and the ability to manage digital wallets securely are prerequisites that many in impoverished or rural areas lack. - Speculative Nature

Bitcoin’s volatility makes it a risky investment, particularly for low-income individuals who may invest more than they can afford to lose. This speculative environment can lead to wealth losses for those hoping to achieve quick financial gains.

Potential Scenarios in a $100,000 Bitcoin Era

1. Further Polarization of Wealth

As Bitcoin’s value skyrockets, the gap between early adopters and new investors could widen. Wealthier individuals who can afford substantial investments may reap significant returns, while smaller investors might struggle to accumulate meaningful holdings.

2. Increased Adoption in Emerging Markets

If Bitcoin reaches $100,000, it could gain more trust and recognition, particularly in economies with unstable currencies. This may spur adoption among individuals and businesses in emerging markets, potentially leveling some aspects of the financial playing field.

3. Institutional Dominance

Large financial institutions and corporations are increasingly entering the cryptocurrency space. While this could legitimize Bitcoin, it also raises concerns about centralization and dominance by powerful entities, potentially sidelining individual users.

How to Mitigate Financial Inequality in the Bitcoin Economy

- Education and Accessibility

Expanding educational resources on Bitcoin and blockchain technology can empower more people to participate. Governments, NGOs, and private organizations can play a role in fostering digital literacy. - Decentralized Finance (DeFi) Solutions

DeFi platforms built on blockchain technology can enhance accessibility, allowing users to engage in financial activities like lending, borrowing, and saving without intermediaries. - Policy and Regulation

Thoughtful regulation can help ensure fair access and reduce the concentration of power among institutional players. Policies that promote transparency and equitable access to Bitcoin infrastructure can mitigate inequality.

Conclusion

A $100,000 Bitcoin represents both immense potential and significant challenges in addressing financial inequality in the digital age. While it can serve as a powerful tool for inclusion, its impact will depend on how its adoption is managed and whether barriers to entry are addressed. Bridging the gap between promise and reality requires collective effort from governments, technology innovators, and global communities. Bitcoin alone won’t solve financial inequality, but it can be a catalyst for change in the broader financial system. The key lies in ensuring that its benefits are distributed equitably, rather than concentrated in the hands of the few.

[sp_easyaccordion id=”3415″]