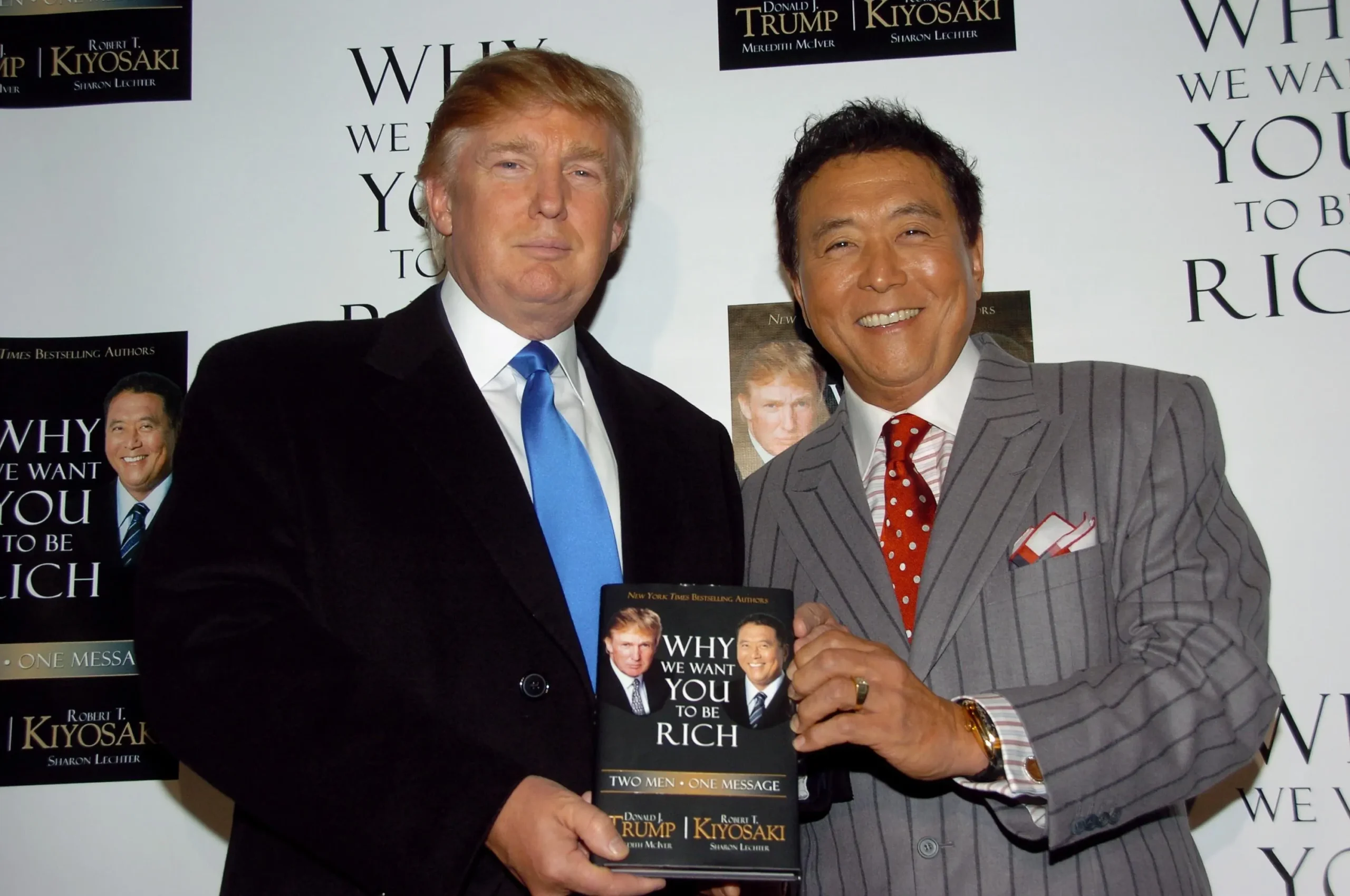

The world’s financial landscape is approaching a critical juncture, and Robert Kiyosaki, bestselling author of “Rich Dad Poor Dad,” is sounding the alarm. With global debt reaching unprecedented levels and traditional financial systems showing signs of strain, Kiyosaki is urging investors to consider Bitcoin as a hedge against what he calls the impending “global debt bubble burst.”

The Debt Crisis: A $37 Trillion Time Bomb

The U.S. national debt is approaching a staggering $37 trillion, representing one of the most significant financial challenges of our time. This astronomical figure doesn’t include the trillions in unfunded liabilities and the mounting debt burdens of other major economies worldwide.

Key Debt Statistics That Should Concern Every Investor:

- U.S. National Debt: Nearly $37 trillion and climbing

- Global Debt-to-GDP Ratios: Many developed nations exceed 100%

- Interest Payments: Consuming increasing portions of government budgets

- Unfunded Liabilities: Trillions more in future obligations

The mathematics are simple yet terrifying: “The game of printing money can’t last forever,” as Kiyosaki recently warned. The current trajectory is unsustainable, and the consequences of this debt accumulation could reshape the global financial system.

Kiyosaki’s Bold Bitcoin Prediction: A $1 Million Target

Robert Kiyosaki isn’t just warning about economic collapse—he’s offering a solution. He has predicted that Bitcoin will reach $1 million by 2030, with shorter-term targets suggesting significant upside potential in the coming years.

Why Kiyosaki Believes Bitcoin Will Surge:

- Inflation Hedge: As central banks continue printing money, Bitcoin’s fixed supply becomes increasingly attractive

- Store of Value: Unlike fiat currencies, Bitcoin cannot be devalued by government policies

- Institutional Adoption: Growing acceptance by corporations and institutional investors

- Global Uncertainty: Geopolitical tensions and economic instability drive demand for alternative assets

Kiyosaki predicts a significant financial crisis in 2025, potentially the “Greatest Depression,” due to the bursting of the “Everything Bubble”. His strategy? Use market crashes as opportunities to accumulate more Bitcoin, gold, and silver.

The “Everything Bubble” Phenomenon

The term “Everything Bubble” refers to the simultaneous overvaluation of multiple asset classes, including stocks, bonds, real estate, and commodities. This unprecedented situation has been fueled by:

- Ultra-low interest rates for over a decade

- Quantitative easing programs are pumping liquidity into markets

- Government stimulus measures during the pandemic

- Speculative investment behavior across asset classes

According to Kiyosaki, 2025 represents “the biggest change in world financial history” as millions of jobs are lost to artificial intelligence, while inflation erodes the retirement savings of baby boomers.

Bitcoin’s Current Market Position and Expert Predictions

As of late June 2025, Bitcoin is trading above $107,000, having reached new all-time highs earlier in the year. Bitcoin experienced a strong rally in Q2 2025, driven by easing trade war tensions, which pushed the price to a new all-time high of $ 112,000.

Expert Price Predictions for Bitcoin:

- 2025 Targets: Analysts from Bitwise, Standard Chartered, and VanEck predict Bitcoin could hit $180,000 to $200,000 in 2025

- Conservative Estimates: Bitcoin price prediction for 2025 ranges between $100,000 and $150,000

- Bullish Scenarios: Some experts see potential for even higher peaks if institutional adoption accelerates

The Winners and Losers in Kiyosaki’s Vision

Kiyosaki’s investment philosophy divides the world into two camps when the debt bubble bursts:

The Winners:

- Bitcoin holders: Benefiting from digital scarcity and global adoption

- Precious metals investors: Gold and silver as traditional stores of value

- Real asset owners: Those with tangible, productive assets

The Losers:

Those who “save in fiat or buy bonds despite the anticipated economic meltdown will be the biggest losers,” according to Kiyosaki. This includes:

- Cash savers: Losing purchasing power to inflation

- Bond investors: Facing potential defaults and currency devaluation

- Traditional pension holders: Vulnerable to systemic financial collapse

Strategic Investment Considerations

While Kiyosaki remains bullish on Bitcoin’s long-term prospects, he’s also showing tactical awareness. He recently cautioned that the current prices of Bitcoin and gold are too high to be considered good buys, revealing he is waiting for both assets to crash before adding to his positions.

Kiyosaki’s Current Investment Hierarchy:

- Silver: Currently his top pick due to relative affordability

- Bitcoin: Long-term favorite, waiting for better entry points

- Gold: Traditional haven, but seeking lower prices

- Real Estate: Productive assets in strategic locations

The Institutional Bitcoin Revolution

The approval of Bitcoin ETFs in 2024 has fundamentally changed the investment landscape. The approval of Bitcoin ETFs in 2024 has set a strong foundation for institutional inflows, propelling BTC’s growth trajectory.

Key Institutional Adoption Drivers:

- Corporate Treasuries: Companies adding Bitcoin to balance sheets

- Pension Funds: Seeking inflation protection and portfolio diversification

- Sovereign Wealth Funds: Nations considering Bitcoin reserves

- Retail Access: ETFs making Bitcoin accessible to traditional investors

Navigating the Transition: Practical Steps

For investors considering Kiyosaki’s advice, here are practical steps to consider:

1. Education First

- Understand Bitcoin’s technology and use cases

- Learn about wallet security and self-custody

- Study market cycles and volatility patterns

2. Dollar-Cost Averaging

- Implement gradual accumulation strategies

- Avoid timing the market perfectly

- Take advantage of price volatility

3. Diversification

- Don’t put all eggs in one basket

- Consider precious metals alongside Bitcoin

- Maintain some traditional assets for stability

4. Risk Management

- Only invest what you can afford to lose

- Understand the regulatory landscape

- Plan for extreme volatility

The Broader Economic Context

Bitcoin’s price action historically correlates with major economic events and policy decisions. Several factors are converging to create what Kiyosaki sees as a perfect storm:

- Central Bank Policies: Continued monetary expansion globally

- Geopolitical Tensions: Driving demand for neutral assets

- Technological Disruption: AI and automation changing employment

- Demographic Shifts: Aging populations straining social systems

Conclusion

Robert Kiyosaki’s call to invest in Bitcoin before the global debt bubble bursts represents more than investment advice—it’s a warning about systemic financial risks and a roadmap for wealth preservation. While his predictions may seem extreme, the underlying concerns about unsustainable debt levels and currency debasement are shared by many economists and investors.

The question isn’t whether change is coming—it’s whether investors will be prepared for it. As Kiyosaki urges, the goal is to “be winners” rather than victims of the coming financial transformation.