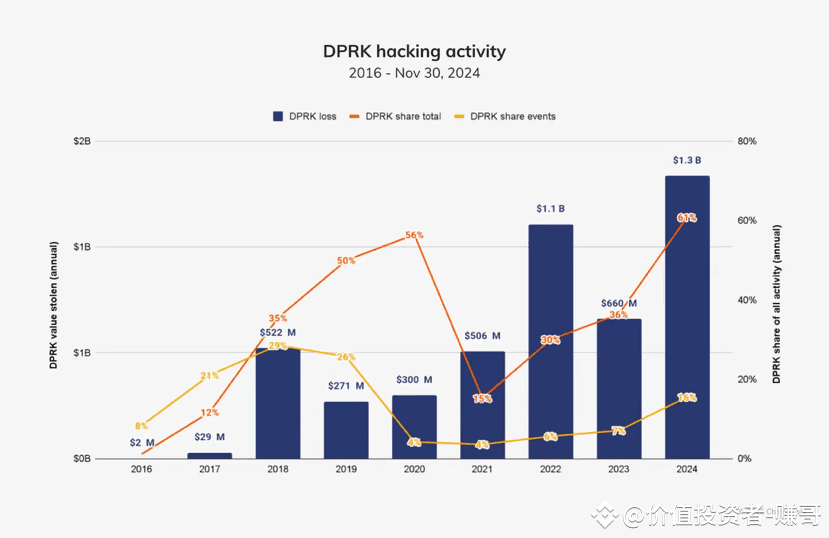

Lazarus Group’s $1 Billion: As cybercriminals have become more sophisticated, likewise their adversaries, a new development has reportedly emerged from Bybit, a cryptocurrency exchange, in which more than $1 billion in digital assets are being traced to North Korea’s very own Lazarus Group. By doing so, the news not only emphasizes the immense scale of cybercrime being funded via crypto but also sheds light on the blossoming blockchain forensic landscape and security measures.

Who is the Lazarus Group?

Lazarus Group is probably one of the most notorious state-sponsored hacking guilds in the world and operating under the aegis of North Korea’s Reconnaissance General Bureau. In the last 10 years or so, high-profile attacks using the internet have included the Sony Pictures hack in 2014, the WannaCry ransomware outbreak in 2017. And more than a dozen cryptocurrency exchange breaches.

The main aim appears to be financial in nature. With capital either being funneled directly or indirectly back to the North Korean regime to mitigate the effects of international sanctions. Cryptocurrency, then, with its vague anonymity and borderless mobility, seems to be the best instrument for the group’s operations.

Bybit Steps Into the Spotlight

Bybit has traditionally been one of the world’s rapidly growing crypto exchanges. As it stands, the exchange has taken an aggressive approach towards the fight against cybercrime. In a recent investigation, Bybit claims to have traced the intricate trail of transaction data by which stolen crypto assets-over 1 billion dollars, are linked to wallets associated with Lazarus.

Bybit has traditionally been one of the world’s rapidly growing crypto exchanges. As it stands, the exchange has taken an aggressive approach towards the fight against cybercrime. In a recent investigation, Bybit claims to have traced the intricate trail of transaction data by which stolen crypto assets-over 1 billion dollars, are linked to wallets associated with Lazarus.

It was reportedly carried out using internal analytical functions, cooperation with third-party blockchain forensic firms, and collaboration with law enforcement. Though, as far as security considerations are concerned, the specific methodology has not been disclosed. However, the latest findings bring to bear the potential chain between centralized platforms and what would be considered decentralized worlds to curb the use of their membership for illegal activities.

How Lazarus Launders Crypto

Tools that have a reputation for advanced laundering techniques are employed by the Lazarus Group. They start by routing stolen funds through several wallets and then typically use mixers or tumblers to obscure the coins’ origins. In some instances, they have been known for converting digital assets to privacy-focused coins like Monero, which are quite hard to track.

They might also use decentralized exchanges (DEX) with less strict know-your-customer (KYC) protocols, and then gradually cash out through smaller transactions across several platforms. The $1 billion traceable through that network speaks volumes about the increasingly advanced abilities of blockchain surveillance technologies.

The Role of Centralized Exchanges in Fighting Crypto Crime

In this instance, it shows aptly how centralized exchanges like Bybit can act as powerful gatekeepers. Unlike decentralized platforms, these centralized ones can impose compliance standards, freeze assets, and make reports of suspicious activities. Bybit’s involvement is also an indication of a broader turn in the crypto industry: self-regulation and proactive policing must be considered as accountability from exchanges is increasingly being demanded by regulators around the world.

In this instance, it shows aptly how centralized exchanges like Bybit can act as powerful gatekeepers. Unlike decentralized platforms, these centralized ones can impose compliance standards, freeze assets, and make reports of suspicious activities. Bybit’s involvement is also an indication of a broader turn in the crypto industry: self-regulation and proactive policing must be considered as accountability from exchanges is increasingly being demanded by regulators around the world.

Coin E Tech – Latest News on Crypto In recent years, we have seen a platforms like Binance, Kraken, and Coinbase advancing in this area by making heavy investments in compliance infrastructure and working closely with authorities. These very actions protect the users but, more importantly, also legitimize the industry as a whole.

Implications for the Crypto Ecosystem

The news ofthe Lazarus Group moving more than $1 billion of digital assets has a chilling effect. The effect on perceiving the magnitude of cybercrime and how deeply the criminal syndicates have already penetrated the crypto world. It, nevertheless, shows how far the industry has come in detecting and disrupting such threats. Naturally, Blockchain enjoys transparency, and with the right tools and skills, every transaction, even anonymized and underground, can be assessed and traced.

This development could trigger several shifts:

- Tighter KYC/AML protocols across exchanges

- Increased scrutiny of privacy coins

- More collaboration between exchanges and regulators

- Greater investment in blockchain forensics tools

Ultimately, this could help weed out bad actors and build trust with the broader public.

The Geopolitical Angle

The Lazarus Group is not simply a criminal syndicate. They form a cog in the machinery of a nation-state under heavy sanctions. Their cryptocurrency heists serve a political and economic purpose. Tracking and disrupting their financial flows are thus a matter of international security.

Bybit’s findings reinforce existing attempts by the United States. South Korea and other nations to economically choke North Korea. Once law enforcement can use this data to freeze assets or to identify collaborators, it would be a serious blow to Pyongyang’s cyber warfare capabilities.

What Happens Next?

Tracing funds is the vital first step in the process, but recovering them is a much bigger challenge. This is dictated by the complexity of legal jurisdiction and, coordination of law enforcement agencies across the world. And the technological limitations with regard to the freezing of decentralized assets. However, Bybit’s influence may pave the way toward more collective initiatives. There are talks of joint blacklists of wallet address, a protocol for real-time reporting. And even resource-sharing task forces to combat cybercrime arising from the crypto ecosystem.

Final Thoughts

The crypto world is no longer the wild west it once was. In addition, as exchanges mature and compliance technology improves,. Malicious actors like the Lazarus Group will face resistance. Bybit tracing $1 billion in crypto is a warning to all hackers that resistance comes with hope in the fact that the tools are finally catching up. This moment represents a turning point where the crypto industry steps out. From behind the shadows to help lead the charge in securing the digital future.