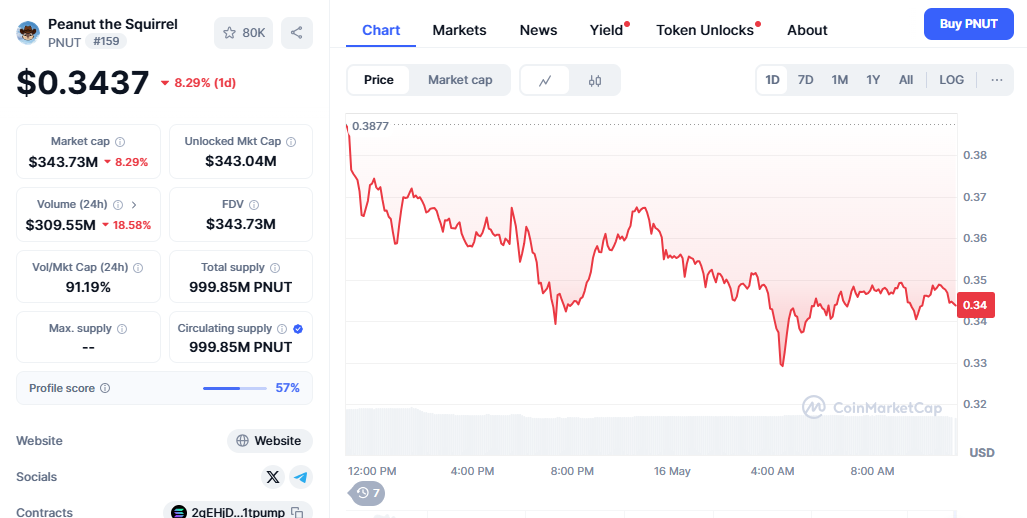

$PNUT/USDT technical analysis: Technical analysts and crypto community traders are especially paying close attention to the $ PNUT/USDT 4-hour (4h) chart. Following a strong bullish breakout earlier in the week, the chart shows a bearish pullback that has dangerously placed the pair near a crucial support level. This moment is vital for comprehending the micro-trend of $PNUT and how it fits into the macro landscape of cryptocurrencies in 2025, since investor attitude changes daily, and the market’s volatility is more general.

Both day and swing traders hoping to profit from short-term price swings while matching with long-term fundamentals must understand how $PNUT (Peanut Token) behaves against Tether (USDT) during the four hours. This article thoroughly breaks down the $PNUT/USDT pair, its technical indications, possible situations, and implications for investors moving ahead.

PNUT/USDT Retreats from Resistance

After a strong bullish impulse starting near $0.035, the $PNUT/USDT pair has broken down from a local resistance zone around $0.048. Starting as bearish divergence on the Relative Strength Index (RSI), the retreat is now consolidating close to the 0.618 Fibonacci retracement level, a traditional zone for either more profound reversal or possible trend continuation.

Along with a dropping MACD histogram, this 4-hour period reveals a bearish crossover approach of the signal line. This suggests declining momentum in the bulls’ favour, in line with the general crypto market risk-off attitude under recent regulatory uncertainties and limited liquidity conditions. Depending on the following few candles, the convergent moving averages (EMA 50 and EMA 200) suggest a possible golden or death cross.

Consistent drop since the last peak indicates from volume analysis that this is a corrective action rather than a complete trend reversal. This reduced period structure, however, should be examined in the context of macro support levels and historical price zones rather than in isolation.

$PNUT Key Support Zone

For $PNUT/USDT, one of the most observed values falls close to the $0.040–$0.042 band. From many bounce points over the four-hour and daily charts, this area has historically been a powerful accumulation zone. Should price keep declining and test this support, it will probably serve as a pivot, perhaps laying the groundwork for a bullish recovery or a bearish collapse aiming at lower levels around $0.036 and even the psychological $0.030 mark.

From a structural standpoint, this support zone is vital at the junction of the 200 EMA, past consolidation zones, and Fibonacci retracing levels. Should buyers enter here with more volume, there is a reasonable likelihood of a positive reversal or a consolidation phase that would re-attract momentum traders and speculative money.

$PNUT’s Growth Potential Amid Liquidity

Examining $PNUT’s path in the framework of the larger altcoin market and macroeconomic environment can help one know where it is headed. Many altcoins have entered a retracement phase as Bitcoin hangs close to resistance levels and Ethereum shows mixed on-chain signs. Declining dominance of altcoins points to a risk-off attitude that permeates lower-cap assets like $PNUT.

Moreover, uncertainty about forthcoming central bank policies and growing interest rates have resulted in temporary liquidity outflows from risk assets, including cryptocurrencies. However, as earlier cycles have repeatedly shown, these times may be rich ground for long-term accumulation, especially for tokens with strong foundations and community support.

Projects like PeanutSwap, the distributed exchange platform under $PNUT, keep adding new capabilities, including NFT staking and cross-chain integration. This basic increase might lay a strong basis for a future rally if matched with appropriate technical indications.

$0.040 Support: Reversal or Breakdown?

During several subsequent trading sessions, traders should closely check price movement at the critical $0.040 support zone. Early warning of a possible reversal would be rejection of lower prices, coupled with positive divergence on oscillators like RSI or stochastic. Note wallet activity and transaction flows on-chain, especially unusual surges in $PNUT outflows from central exchanges, which may imply accumulation.

However, a breach below $0.040 with significant selling volume would refute the positive thesis and provide the route to even more negative objectives. Under these circumstances, risk management takes front stage and stop-losses are positioned sensibly depending on ATR (average true range) levels or past swing lows.

Analysing the Structure of $PNUT Against Other Altcoins

A comparative study of various micro-cap DeFi tokens, such as $BANANA (from ApeSwap) and $CAKE (PancakeSwap), uncovers some fascinating structural parallels. These tokens, like $PNUT, also experienced recent negative retreats following fleeting favourable recoveries. Still, currencies with active development teams, significant community involvement, and cross-chain utility usually bounce back faster.

PeanutSwap is among the top developing DEXS on smaller chains on platforms like DeFiLlama and CoinGecko, which might work as a long-term stimulus should user acceptance increase. From a tokenomics standpoint, $PNUT’s fixed supply and deflationary burn mechanism also create a degree of scarcity that might be useful in a bull market situation.

Key Levels Ahead for $PNUT

Should $PNUT respect the present support zone and exhibit indications of bottoming, we might observe a retest of the $0.48–$0.050 resistance level followed by a return to $0.045. A good break of this zone with heavy volume would indicate a continuation pattern and draw breakout traders, possibly pushing the token toward $0.060 in the medium term.

On the other hand, neglect of critical support can result in cascading liquidations, particularly in cases where leveraged longs are in effect. In this case, traders may seek to re-enter around deeper support at $0.035, matching past consolidation and the next main Fibonacci level.

Long-Term Project for $PNUT

From a long-term investing standpoint, $PNUT remains a speculative yet interesting asset in the distributed financial network. The PeanutSwap team continues to extend capabilities and interact with the DeFi community. Should the initiative interact with key ecosystems like Ethereum L2S or Solana, $PNUT’s value proposition may increase.

Especially when combined with fundamental analysis and technical confirmation, accumulating during bearish pullbacks close to historically strong support levels remains a sensible approach for investors looking beyond the transient volatility.