$PORTAL resistance breakout: The cryptocurrency market never sleeps, thus $PORTAL has evolved. The newest altcoin to grab traders’ interest is when it questions a vital resistance level of $0.0708. This exam has spurred rumors of a possible optimistic turnaround. Now, closely observing technical patterns, historical behavior, and macro factors, traders and experts are deciding what $PORTAL is about. Whether to break out or if it is preparing for yet another rejection. This paper delves deeply into $PORTAL’s recent price behavior, its applicability in the larger market context, and what a successful breach of this resistance would entail for short- and long-term investors.

$PORTAL: Web3 Decentralization Token

Designed with peer-to-peer (P2P) technology to decentralize infrastructure for Web3 apps, $PORTAL is the native token of Portal. The portal offers Bitcoin’s trust-minimizing security concept, as well as the performance of layer-2 solutions. The token is staked, governed, and transaction-facilitated inside the Portal ecosystem.

Among well-known players such as Polkadot, Cosmos, and Chainlink, the cryptocurrency distinguishes itself in the DeFi interoperability space. Growing interest in distributed infrastructure initiatives, $PORTAL has positioned itself as a rising cryptocurrency competitor.

Recent Price Action: $0.0708 Resistance

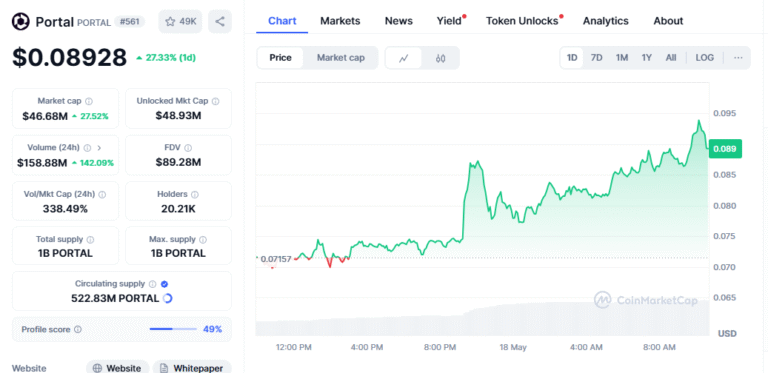

As investor sentiment rises, $PORTAL has displayed indications of accumulation, swinging within a limited range in recent weeks. At $0.0708, the resistance reaches a historically noteworthy degree. Over the past 90 days, the token has attempted to access it several times. The only way to counter denials is to indicate that bots and short-term traders are driving that profit-taking.

Technical indicators, including the Relative Strength Index (RSI), MACD, and Fibonacci retracing levels, converge, implying increased volatility. The RSI on the 4-hour and daily charts, hovering close to the overbought area, indicates strong momentum, but not yet exhaustion.

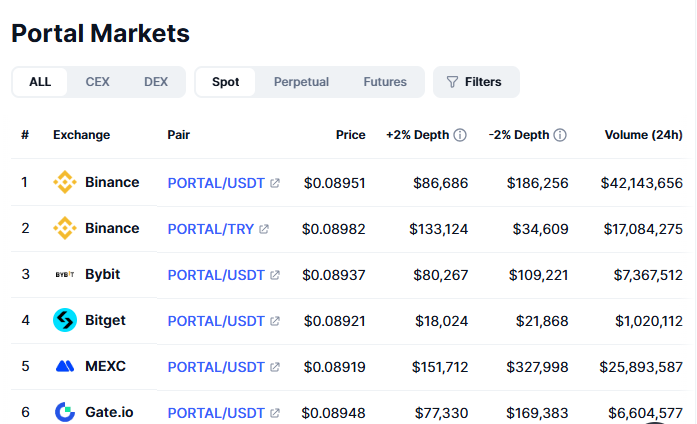

Particularly on distributed exchanges like Uniswap and controlled platforms like KuCoin and Binance, an increase in trade volume points to institutional interest or larger retail positioning. Tools for blockchain analytics such as Santiment and Glassnode show a rise in active wallet addresses and a drop in exchange flows, therefore reflecting hodler confidence.

$PORTAL: Market and Macro Factors

Beyond technical study, several fundamental drivers influence $PORTAL’s latest movements. Led by Bitcoin and Ethereum, the broader cryptocurrency market has shown signs of revival, with Bitcoin stabilizing above $60,000. Major crypto movements define altcoins. Hence, this relationship helps to explain why $PORTAL might profit from increased investor hope.

Furthermore, the Portal’s expected release of its mainnet upgrade and interoperability with significant DeFi protocols are attracting speculative interest. A positive attitude is resulting from the Portal’s next tokenomics update and collaboration rumors with infrastructure providers like Chainlink and Arbitrum.

Macroeconomic elements, including the posture of the U.S. Federal Reserve on inflation trends and interest rates, still influence risk asset performance. As the risk-on attitude returns to conventional and digital asset markets, altcoins like $PORTAL become main targets for speculative momentum activities.

$PORTAL Price at Turning Point

A good break of the $0.0708 resistance would indicate a trend reversal and create a new support zone. Chart analysts and Fibonacci forecasts suggest that this would probably cause a retest of more resistance around $0.085 and $0.095. Reversing at this level would confirm the overhead selling pressure and maybe drive $PORTAL back into the support region of $0.062 to $0.065.

The outcome hinges on several variables:

-

Confirmation of bullish patterns like a cup-and-handle or ascending triangle

-

Volume confirmation on the breakout

-

External macroeconomic conditions and BTC performance

Perhaps whales and smart money are already positioned ahead of the breakthrough. On-chain data reveal rising staking behavior and a decline in tokens held on exchanges, which traditionally marks a prelude to increased activity in cheaper altcoins.

Portal Eyes Cross-Chain Future

Recent updates on portal development have further stoked the speculative fire. The platform aims to integrate cross-chain atomic swaps and roll out zk-SNARK-based privacy layers, distinguishing Portal from existing interoperability-oriented systems.

At the recent AMA, CEO Eric Martindale emphasized Portal’s commitment to Bitcoin-centric decentralization and hinted at the development of institutional onboarding tools. These upgrades reinforce the fundamental case for long-term investors considering the $PORTAL resistance breakout. The portal’s lean approach could appeal to DeFi developers and security-conscious consumers as rivals like Cosmos and Polkadot battle scale difficulties and governance inefficiencies.

Key Levels and Indicators to Watch for $PORTAL Breakout or Breakdown

The next few 4-hour candlesticks on the $PORTAL/USDT and $PORTAL/ETH pairs are vital for traders seeking clarity. The technical confirmation that bulls seek would be a clear breakout accompanied by a 20–30% rise in volume, then a retest and bounce.

On the other hand, failing to hold above $0.0708 can cause a liquidity grab and lock late buyers, therefore driving prices down to previous consolidation zones. Forecasting potential price objectives and stop-loss placements can benefit from trading sites like TradingView, which offer indicators such as Bollinger Bands, Ichimoku Clouds, and volume profiles.

$PORTAL Breakout Watch

This resistance test’s result is vital for those observing altcoins’ activity in the current market cycle and for $ PORTAL holders. Breakdowns in specific tokens often foreshadow more general cryptocurrency rallies. Should $PORTAL resistance breakout confirm a positive reversal, traders might rotate cash into related low-cap, high-potential businesses. This conduct reflects past trends from 2021 and 2017, whereby small-cap breakouts followed significant cryptocurrency spikes.