In the’ fast-changing landscape of technology, Quai Network is a revolutionary blockchain solution that addresses scalability issues without sacrificing decentralisation. Growing interest in layer-1 blockchain substitutes also reflects growing focus on QUAI—the native cryptocurrency running the Quai Network. The present Quai Network price, its live price chart, market capitalisation, and larger ecosystem affecting the market performance of the asset are investigated in this paper.

This tutorial covers all you need to know about the Quai crypto token and the network underlying it, regardless of your level of interest in long-term blockchain technologies, investor tracking of QUAI pricing trends, or a beginner seeking to grasp its possibilities.

Quai Network: Scalable Multi-Threaded Blockchain

Quai Network is a distributed, multi-threaded blockchain system for grand-scale and fast performance. Unlike conventional blockchain systems, proof-of-Entropy-Minima (PoEM) is a fresh consensus mechanism used in Quai. One of the few projects able to handle millions of transactions per second (TPS) without compromising decentralisation is this, which allows the network to perform simultaneous transaction processing across several chains, or threads.

Designed by Dominant Strategies, a blockchain R&D organisation, Quai was introduced to solve fundamental constraints, including gas prices, sluggish confirmations, and network congestion observed in past chains, including Ethereum and Bitcoin. Combining ideas in sharding and consensus, Quai Network presents a next-generation substitute for layer-1 systems, such as Solana, Avalanche, and Polkadot.

QUAI Token: Markets and Utility Dynamics

The Quai ecosystem cannot be functional without the QUAI token. It pays transaction fees and stakes for security and helps with on-chain governance. Demand for Quai keeps rising as the ecosystem develops using DeFi protocols, NFTs, and dApps.

From a tokenomics standpoint, QUAI features a well-crafted emission scheme and a limited supply to help prevent inflationary pressure. Investors evaluate the token’s state by paying great attention to critical on-chain metrics such as staking ratio, circulating supply, and wallet activity.

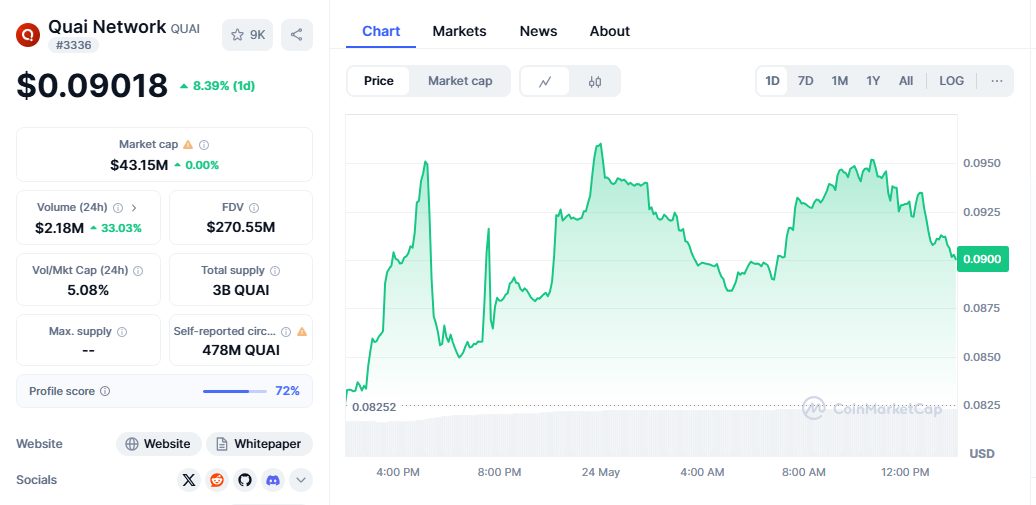

Market Capitalisation and Liquidity

For crypto analysts, QUAI’s current market capitalisation piques great attention. Although the currency is still a relatively young entrant compared to behemoths like Ethereum and BNB, listings on distributed exchanges like Uniswap and centralised platforms aiming for future support strengthen its liquidity. Using crypto data aggregators such as CoinGecko, CoinMarketCap, and DexTool—all of which show live price charts, trading volume, and historical data—real-time QUAI price data may be followed.

QUAI Live Price Chart: Real-Time Data and Technical Indicators

Following QUAI’s live price chart provides insightful analysis for investors and traders. It usually shows real-time market movement, including candlestick patterns, moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These charts are based on basket sentiment, volume indicators, and techno. Technical tools like TradingView allow users to project possible bullish or bearish movements.

Recent activity in QUAI, for example, has correlated with changes. The Quai mainnet rollout, social sentiment on platforms like X (previously Twitter), and ecosystem collaborations. Chart analysts sometimes compare QUAI with low-cap altcoins to project future development.

Future Outlook for Quai Network and QUAI Token

The Quai Network will likely be critical in the upcoming generation of scalable, permissionless blockchains. With continuous improvements to its protocol and robust developer environment, QUAI might become a fundamental tool in the future of modular blockchain.

Experts and influencers, including Chris Dixon of a16z and blockchain researchers from Messari, often stress scalable infrastructure as the secret to widespread blockchain acceptance. Should Quai live up to its promise of decentralisation and be free from congestion? The price of QUAI could ultimately reflect this fundamental strength.

Community expansion, developer tools, and DeFi app compatibility are essential benchmarks. Native smart contracts and token bridges with chains like Ethereum are also important. Arbitrum will probably be catalytic in helping Quai’s ecosystem and demand for its native token grow.

Where to Buy and Store QUAI

Purchase and Storage Location: QUAI is available on a few distributed exchanges and is accessible with liquidity pools on sites like SushiSwap and Uniswap. We should see Binance, Coinbase, and Kraken listings as adoption rises. Users of hardware wallets like Ledger and Trezor or software wallets supporting EVM-compatible assets can find safe storage on centralised exchanges. Following Quai Network’s official blog, Discord server, and X account helps one remain current. The real-time listings, wallet support, and fiat on-ramp availability are all useful.

Finally

The Quai Network is an ambitious blockchain project addressing many first-generation platform shortcomings. Emphasising scalability, decentralisation, and interoperability, it has established a distinct place in the crowded crypto scene. The QUAI token captures this value proposition by representing the economic engine of this creative ecosystem.

Anyone looking at Quai Network’s Web3 future must monitor live price, market cap, and network developments. In the long term, Quai’s architecture will seem bright as more developers and investors find its advantages. Never stop learning about the technology revolutionising distributed finance; keep educated and current.