Singapore Exchange Ltd. (SGX) is preparing to offer Bitcoin perpetual futures in the second half of 2025. This move shows traditional financial markets stepping further into cryptocurrency derivatives. These contracts will be just for big institutional clients and professional investors; regular people won’t be able to join in. The Monetary Authority of Singapore (MAS) still has to say yes.

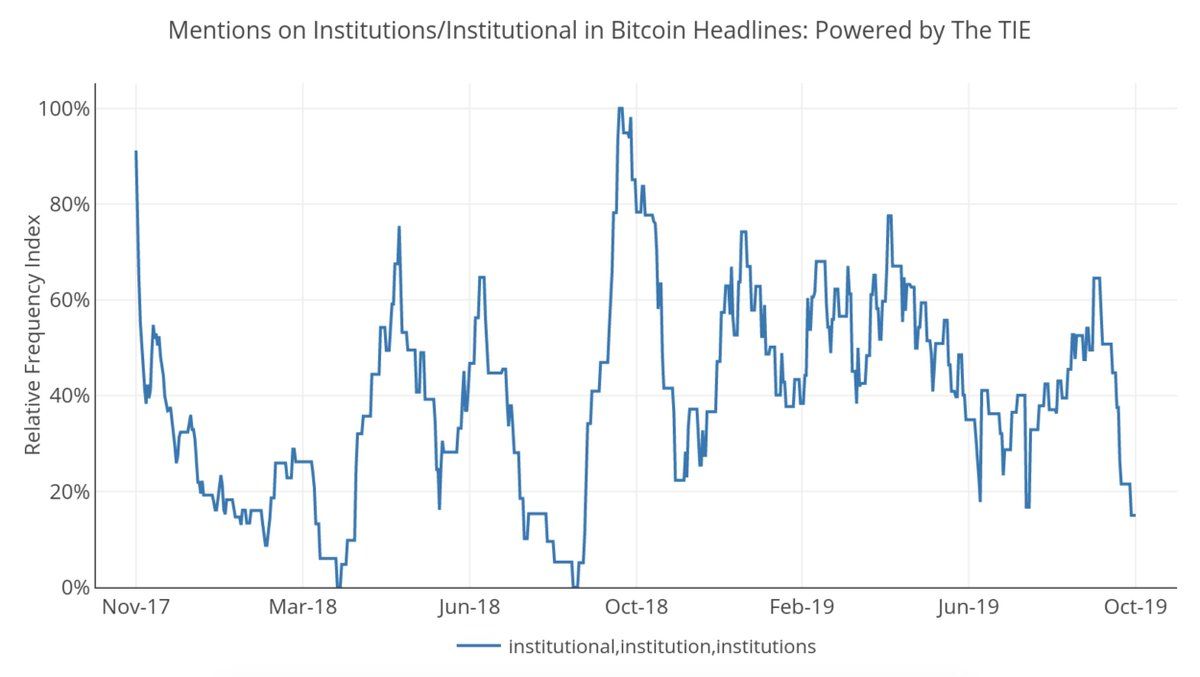

Institutional Interest in Bitcoin

This step matches the growing interest from institutions in Bitcoin derivatives, especially as more people worldwide feel good about crypto. U.S. President Donald Trump’s pro-crypto words have helped push demand for digital asset investments. In Japan, Osaka Dojima Exchange Inc. also asks permission to offer Bitcoin futures, showing how established exchanges are jumping into crypto.

Singapore Exchange Ltd. (SGX) is preparing to offer Bitcoin perpetual futures in the second half 2025. This move shows traditional financial markets stepping further into cryptocurrency derivatives. These contracts will be just for big institutional clients and professional investors; regular people won’t be able to join in. The Monetary Authority of Singapore (MAS) still has to say yes.

This step matches the growing interest from institutions in Bitcoin derivatives, especially as more people worldwide feel good about crypto. U.S. President Donald Trump’s pro-crypto words have helped push demand for digital asset investments. In Japan, Osaka Dojima Exchange Inc. also asks permission to offer Bitcoin futures, showing how established exchanges are jumping into crypto.

SGX: Bridging Finance and Crypto

SGX views itself as a reliable intermediary between the rigorous realm of finance and the volatile realm of cryptocurrency trading. Someone from the company said this new product would “significantly expand institutional market access,” giving a safer option than risky offshore crypto platforms. SGX’s strong Aa2 rating from Moody’s makes it look solid in an industry where exchanges sometimes fail.

Perpetual futures started with BitMEX in 2016. They let traders guess the price changes of Bitcoin without owning it. Unlike conventional ones, these futures lack an expiration date, making them significant in cryptocurrency trading. Something similar happens in commodity markets, like Japan Exchange Group’s rolling-spot gold futures, which track gold prices without needing the actual metal.

SGX Joins Bitcoin Derivatives

SGX isn’t the only one doing this. In early 2024, EDX Markets LLC, a digital asset company backed by Citadel Securities, said it would bring similar products to Singapore. Meanwhile, U.S.-based Bitnomial Inc. is working on launching perpetual futures for Bitcoin and Ether with its new Botanical trading platform. Targeting institutional clients and professional investors, the Singapore Exchange (SGX) has declared intentions to include Bitcoin perpetual futures contracts in the later part of 2025. These non-expirational contracts seek to offer a controlled and safe substitute for trading futures of cryptocurrencies. The project is awaiting approval from Singapore’s Monetary Authority (MAS).

SGX’s action fits a larger pattern among conventional exchanges adopting bitcoin derivatives. Reflecting increased institutional interest in digital assets, especially in light of U.S. government regulations supporting cryptocurrencies, Japan’s Osaka Dojima Exchange Inc. is also seeking a license to market Bitcoin futures. With big exchanges moving into crypto, institutional investors now have safer ways to invest in Bitcoin derivatives, proving that cryptocurrency is becoming a fundamental part of regular finance.

Final thoughts

This paper draws attention to a notable move in the financial sector: Singapore Exchange LTD. (SGX) preparing to present Bitcoin perpetual futures in the second half of 2025. Especially given institutional interest in Bitcoin derivatives, this action marks a significant change in how the conventional financial market views cryptocurrencies.

Among the most noteworthy features is that these Bitcoin perpetual futures would be aimed at institutional clients and expert investors rather than regular investors. This conforms with a more significant trend of institutional players entering the bitcoin market, sometimes seen as erratic and dangerous. SGX hopes to create a safer, more controlled environment for these investors by presenting these contracts rather than via riskier offshore facilities. Based on Moody’s excellent Aa2 rating for SGX, the