Ethereum hasn’t suffered as Solana’s amazing ascent has occurred. Rather, it has extended the whole crypto user base. Far from driving consumers away from Ethereum, Solana has been a conduit introducing fresh users into the realm of Web3. Fast transactions, minimal fees, and a dynamic app layer have made it the ideal platform for onboarding the newest meme coin traders.

Memecoins: A Gateway to Crypto and Web3

Memecoins like Fartcoin and Harry Potter, and Obama’s Sonic Inu were not merely noise. Millions of people were first exposed to cryptocurrencies thanks in great part to them; many of them were fresh to the field. Solana was their first interaction with web3, not just where they conducted their first deal. Although many of these traders lost money, some persisted, and their ongoing involvement offers a special opportunity.

As Vitalik Buterin advised last year regarding meme coins, there is a chance to turn this flood of consumers into something “positive-sum and long-lasting.”

Keeping Web3 Users Post-Solana Surge

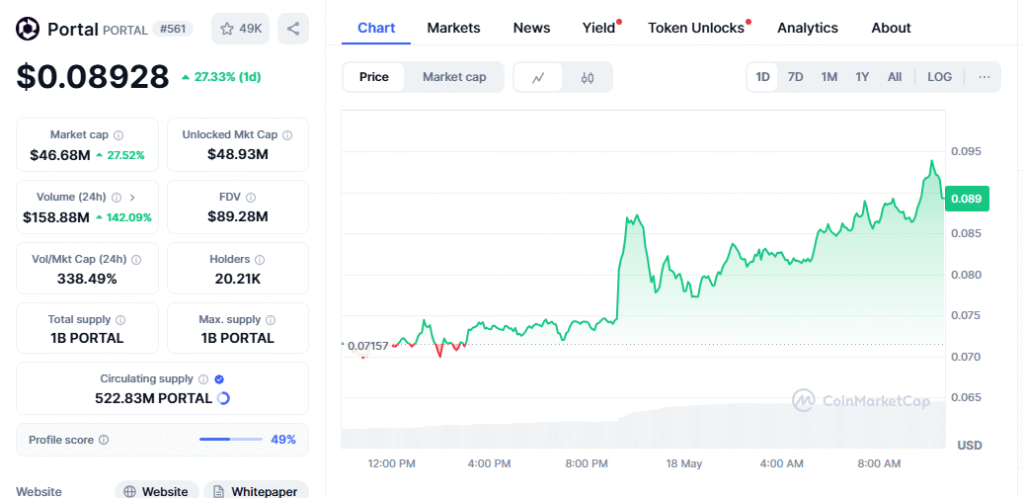

This flood of fresh users gives the crypto market a rare opportunity to reach broad acceptance. The blockchain was capitalized at $47.9 billion during Solana’s meme coin surge. Although meme coins dropped 76% from their all-time peak in December 2024, Solana’s influence in generating actual user involvement and capital cannot be understated.

The meme coin frenzy fades, but the users it drew from still have to. How do we ensure they remain and enjoy more of what Web3 has to offer outside of speculation?

Solana’s Web3 Retention Challenge

Getting users is no longer the primary obstacle. Retention is the real test. Like ICOs, DeFi, and NFTs before them, Memecoins on Solana opened the door for a fresh generation of crypto consumers. The emphasis now has to be on creating a more general, seamless, and understandable Web3 ecosystem. Solana still feels very different from Ethereum’s ecology. We risk losing consumers as soon as they arrive if we fail to make it simple for them to explore various ecosystems once the meme coin fever passes.

Removing Friction in Blockchain Travel

Traveling from one blockchain to another felt costly and confusing. It’s like landing in an interesting new city only to discover that inadequate transit makes the best sites difficult to reach. Sadly, many crypto users now find this to be their experience. Though there is great potential, friction limits the path.

The good news is that we have the means to remove this friction today.

Crosschain Infrastructure in Web3

Crosschain infrastructure can fix this. ERC-7683 and other industry standards let web3 apps manage intricate, multi-step cross-chain transactions as a single user request. Designed by Across and Uniswap, this standard streamlines cross-chain interactions so users may enjoy the advantages of several chains with one’s simplicity of use. Using this technology, developers can provide a consistent experience across blockchains, facilitating user interaction with the larger Web3 ecosystem.

Solana’s Path to a Unified Web3 Ecosystem

Solana’s latest expansion emphasizes the importance of maximizing user experience (UX) in driving onboarding. But onboarding is only a starting point. The actual difficulty is retention. Web3 has to feel like a unified ecosystem instead of a disjointed network of chains if we are to enable real expansion.

As ERC-7683 has unified Ethereum’s Layer 2 solutions, we must deliver Solana the same flawless experience. The objective is to establish a common, understandable Web3 experience, not for one blockchain to prevail. Web3 can grow well when we create infrastructure linking consumers across chains, streamline complexity, and feel coherent.

Web3: Seamless Like the Internet

Eventually, Web3 will only become widely adopted when users stop considering the chains they are dealing with, just as no one finds TCP/IP when surfing the Internet today. The future we are creating is one in which Web3 is as smooth and simple as navigating the Internet itself.