SXT Token Space and Time is rapidly advancing in the blockchain data infrastructure ecosystem. It provides a fresh solution as distributed apps (dApps) and Web3 platforms become more sophisticated and demand a distributed data warehouse that seamlessly integrates on-chain and off-chain data, enabling smart contracts to run with strong, tamper-proof insights. For investors, developers, and companies trying to create scalable, safe blockchain ecosystems, SXT’s capacity has become a top priority.

Underlying the network’s usefulness, SXT—the native token of the Space and Time protocol—ensures data integrity across its distributed nodes and motivates node operators. Demand for verifiable computing and zero-knowledge proofs rises in fields such as DeFi, gaming, and artificial intelligence-enhanced data science, driving market interest around SXT.

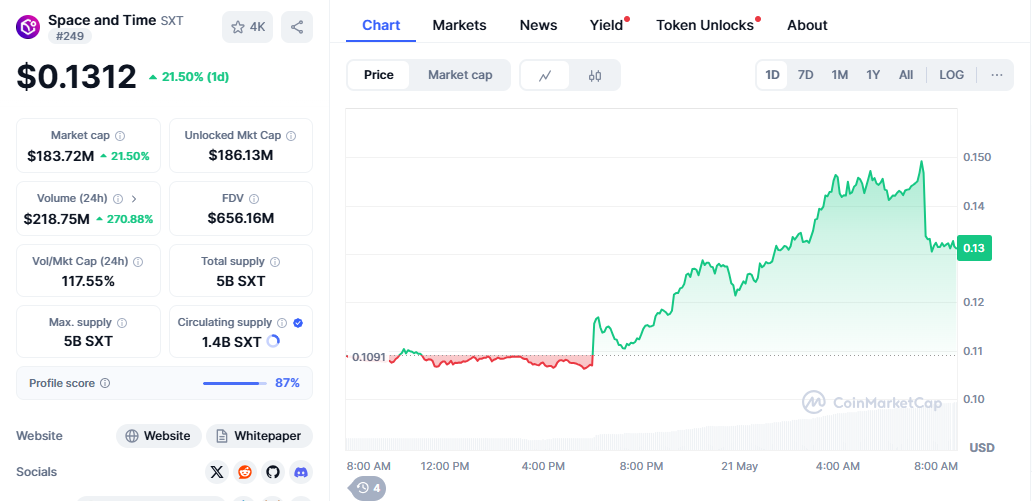

SXT Live Price Today and Market Development

The live pricing of SXT is actively changing to keep up with more general market dynamics and project-specific advancements. Over the past 24 hours, SXT has seen considerable price volatility that draws both long-term investors and short-term traders. Updates in SXT’s development roadmap, strategic alliances, and technical advances affect SXT’s general crypto market mood and pricing movements.

Users of live cryptocurrency data aggregators such as CoinMarketCap or CoinGecko may obtain real-time SXT token price updates. These systems give SXT an interactive price chart displaying historical data, current trends, and market analytics, including trade volume, price movements across many timeframes, and exchange liquidity measures.

SXT’s current market cap, reflecting a reasonable but rising adoption rate, puts it among mid-size digital assets. Key indicators include circulating supply, total supply, and token distribution schedules, which greatly influence market attitude and valuation forecasts.

Knowing the Technology Supporting Space and Time

Built for Web3, Space and Time functions as a distributed data warehouse. Its hybrid design, combining on-chain data immutability with off-chain processing capability, sets it apart from centralized alternatives like Amazon Redshift or Google BigQuery. Proof of SQLTM, a novel zero-knowledge protocol with a cryptographic guarantee of query integrity, forms the foundation of its product.

Developers working on dApps sometimes need access to data on-chain and off-chain to support analytics, artificial intelligence integration, and data visualization, among other uses. Perfect for applications in areas including distributed finance (DeFi), NFT platforms, and decentralized gaming ecosystems, Space and Time addresses this by offering safe query computing with end-to-end cryptographic verification.

The lifeblood of this system, SXT enables everything from staking to governance and access to premium analytics tools. Companies like Microsoft’s Azure and Chainlink have noticed that Space and Time are now included in the Chainlink BUILD program, confirming its purpose.

Elements Affecting SXT Price Trends

Several fundamental and technical aspects influence the price of the SXT token. Macroeconomically, the momentum of the crypto market, driven by Bitcoin and Ethereum trends, affects most altcoins, including SXT. However, SXT’s unusual status as a distributed data layer adds other factors.

Technological events, including mainnet releases, SDK updates, or connections with Layer-1 and Layer-2 blockchain networks like Polygon, Avalanche, or Arbitrum, are positively inspiring catalysts. Furthermore, announcements involving well-known tech partners like Nvidia or Oracle, or the onboarding of corporate clients, could cause price spikes resulting from increased demand and network activity.

The investor mood also plays a big part. As artificial intelligence and machine learning applications demand more verified, tamper-resistant data layers—where Space and Time shine—retail and institutional interest in decentralized infrastructure tokens has surged.

SXT Tokenomics and Utility Tokenism

SXT’s tokenomics support fair pay for contributors and long-term network security. While users may stake SXT to engage in governance or access particular datasets, node operators receive SXT in exchange for validating data and guaranteeing uptime.

Token emissions maintain incentive structures while following a well-controlled schedule to prevent inflationary pressures. Utility-driven demand for SXT is predicted to rise as adoption scales and network utilization intensifies, perhaps acting as a deflationary asset.

Moreover, Space and Time’s governance structure lets SXT holders vote on essential proposals such as modifications to data format, reward distribution, and ecosystem grants, giving the currency yet another layer of community-driven utility.

Recent News on Time and Space (SXT)

Recent developments concerning Space and Time have been mostly favorable, highlighting both strategic and developmental advancements. In Q2 2025, the team revealed a significant integration with the Ethereum scaling technology zkSync so developers could run verifiable SQL queries for zk-rollup-based apps. This puts space and time first and foremost in scalable, distributed computing.

Furthermore, the release of its Developer Portal and API suite has reduced the obstacles to creating distributed analytics solutions. Recent on-chain data shows that these changes have helped explain the daily increase in active users.

Leading thinkers in the Web3 infrastructure arena, and Time’s leadership—including CEO Nate Holiday and CTO Jay White—have been visible in industry events, including Consensus by CoinDesk and ETH Denver, therefore confirming its position as a thought leader in the field of distributed data warehousing.

Future View of SXT and the Space and Time Protocol

Future directions for Space and Time seem bright. Support for AI-enhanced searches, data tokenizing for dataset monetizing, and cross-chain compatibility for more general interoperability are among forthcoming improvements. As the demand for distributed data infrastructure picks up, SXT stands to gain as the worldwide market for blockchain-based analytics is estimated to reach $10 billion by 2027, Statista notes.

Analyses from companies like Messari and Delphi Digital have pointed out SXT as an under-the-radar jewel in the infrastructure space from an investment perspective. Given ongoing network adoption and utility-driven demand, its somewhat low market cap compared to competitors like The Graph (GRT) or Ocean Protocol (OCEAN) points to space for upward mobility.

Purchase and Organize: How to SXT

Growing bitcoin exchanges now list SXT, including centralized platforms like KuCoin and distributed exchanges like Uniswap. Users of a crypto wallet supporting ERC-20 tokens—such as MetaMask, Trust Wallet, or Ledger—must purchase SXT. Token purchases should be followed by safe storage in a cold wallet to reduce the possibility of custodial mismanagement or exchange fraud. As always, extensive study and evaluation of personal risk tolerance are vital before investing in volatile digital assets.