Former President Donald Trump will throw a special dinner for the top holders of his Trump meme coin dinner at Trump National Golf Club in Washington, D.C., on May 22, 2025. Exclusive to the top 220 wallets and providing a secret White House visit to the top 25 investors, this event has changed the market mood by rekindling enthusiasm for the meme coin and the larger bitcoin industry. The junction of political theatre with digital resources highlights the rising entwining of public figures with crypto markets, providing a focal point for traders and regular viewers.

Experts in ethics caution that the event is a pay-to-play scam, allowing wealthy investors, including perhaps foreign players, to court favour with a former occupant of the Oval Office. Blockchain analytics company Chainalysis notes that barely $1.35 million is streaming in following the dinner announcement, while the companies behind the $Trump coin have accumulated around $320 million in fees. Such numbers validate that the Trump meme coin dinner is a deliberate tool to generate token demand and, thus, market price, not just a publicity gimmick.

Bitcoin Eyes New ATH, Trump Dinner, & Institutional Surge

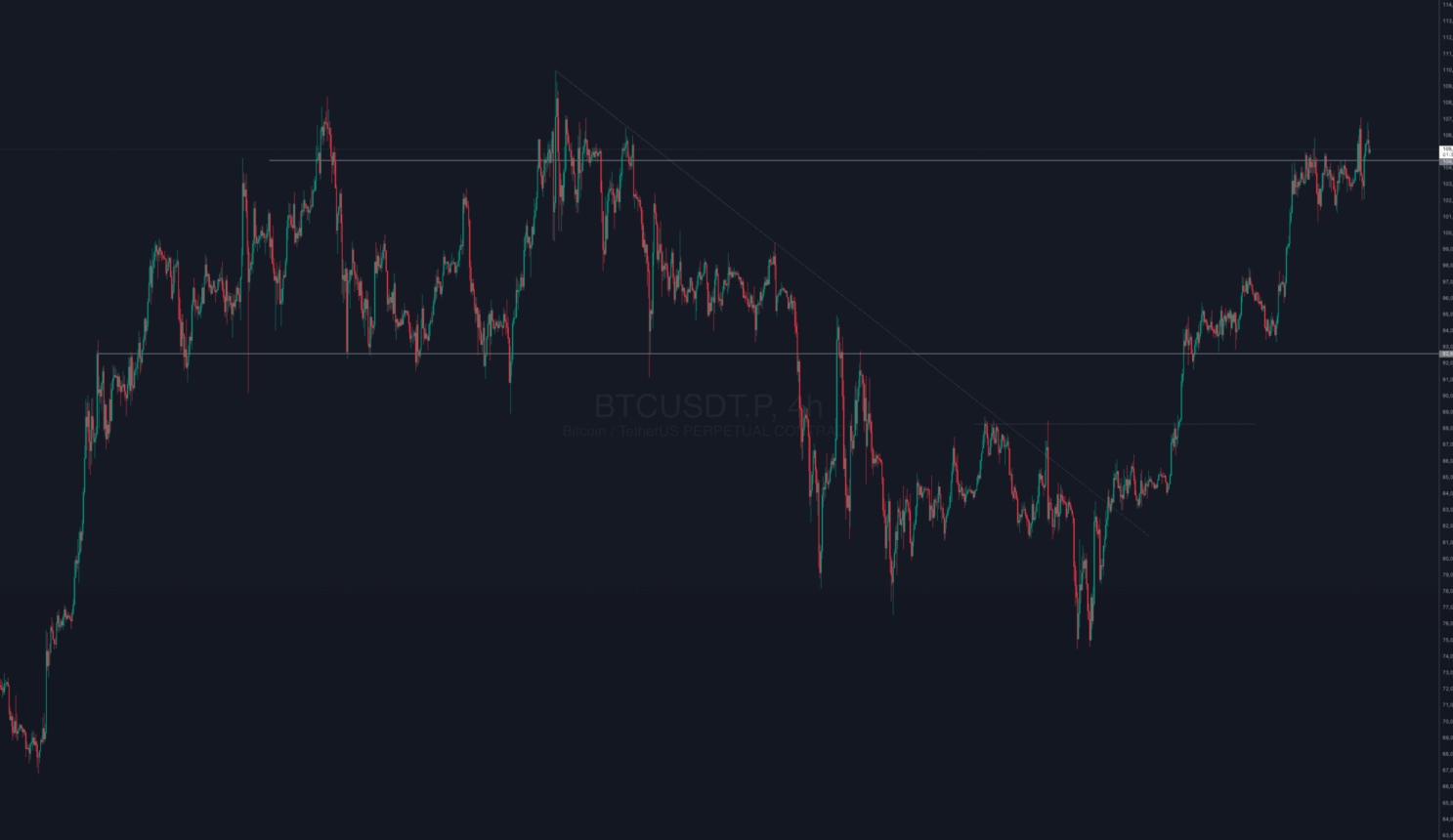

Macro events and celebrity sponsorships have historically responded to Bitcoin. The news of the Trump dinner marks the beginning of a hopeful path whereby BTC challenges its record of almost $68,789. Late-May trade points to a range-bound surge with technical indications hinting toward a possible breakout over $70,000. As smart money strategists reposition ahead of the highly publicised conference, analysts at Coin Gape predict Bitcoin might hit $108,000.

Institutional involvement has changed. While prominent hedge funds have started devoting up to 5% of their portfolios to digital assets, Fidelity’s recent deployment of custody services for BTC saw inflows of over $150 million in the first quarter of 2025. This institutional momentum produces a positive feedback loop that high-profile events like Trump’s dinner might magnify and drive BTC toward a new all-time high (ATH).

$Trump Token Volatility Rises

Launched on the Solana blockchain on January 17, 2025, the Trump Meme Coin showed a significant initial increase. It was valued at least $29 billion in 48 hours and netted at least $350,000 in fees for Trump‑affiliated companies by March 2025. Following the announcement of the dinner, $Trump’s price increased by over 50% to show the token’s sensitivity to exclusive incentives.

According to Chainalysis statistics, the top 25 holders eligible for the VIP Trump meme coin dinner comprise concentrated wallets managing over 10% of the circulating supply. When big holders choose to buy in or dump their positions, this concentration may cause notable price volatility, as shown by 16 VIP accounts emptying their wallets right after securing their slots.

FOMO and Federal BTC Backing

Smaller investors are chasing the same returns, fueling retail sentiment fueled by FOMO. Institutional players, meanwhile, are boosting their Bitcoin investments with the expectation of a mainstream breakout. Established by presidential order on March 6, 2025, the U.S. Strategic Bitcoin Reserve now has an estimated 200,000 BTC, indicating government-level BTC interest as a valid reserve asset. Such formal support would give BTC’s attempt for a new ATH more weight.

Chasing Growth Beyond Bitcoin

Beyond Bitcoin, diversity across reputable ventures might maximise risk-adjusted returns. The following sections need particular attention from those trying to take the next step.

Ethereum Tops TVL

Based on total value locked (TVL), Ethereum is still the top innovative contract platform. After the Shanghai upgrade, Layer 2 networks like Arbitrum and Optimism will execute over a million daily transactions. Staked ETH liquidity has grown. ETH and Layer 2 tokens provide lower costs and faster settlement, making them appealing to bull market participants.

Solana Rides $Trump Buzz.

Solana’s high throughput and sub-second finality have positioned it as a competitor for distributed apps needing fast execution. Significant money is being drawn to Solana-based initiatives such as Star Atlas for on-chain gaming and Serum for distributed exchange. SOL’s native token may benefit from Solana’s link with the $Trump meme coin on its chain, boosting event enthusiasm.

One significant development in 2025 is real-world asset tokenising. Centrifuge and Maple Finance let investors tokenise real estate, invoicing, and other assets for digital bonds and loans. As institutional demand for stable income increases, RWA sectors may enjoy inflows that match DeFi liquidity pools, creating a defensive yet growth-oriented allocation.

DePIN Drives On-Chain Income

Using blockchain incentives, decentralised physical infrastructure networks (DePIN), such as Helium and Filecoin, create vast sensor networks and distributed storage. These projects ‘ on-chain mining and use fees may outperform speculative coins amid market drops.

Smart Crypto Positioning Tips

Investors should scale into holdings over time, use stop-loss orders, and match position sizes to risk tolerance. Dollar-cost averaging into Bitcoin and several altcoins can reduce volatility and emotional trading prejudices. Balanced portfolios with tokenised treasuries and high-beta meme coins can optimise long-term gains and reduce hype-driven drawdowns.

In summary,

The junction of political spectacle and bitcoin markets, embodied by Trump’s forthcoming dinner, has sparked the renewal of investor interest. Even if Bitcoin rises, discriminating investors will assess Ethereum, Solana, RWA projections, and DePIN networks to form a strong portfolio. Aligning strategic allocations with developing on-chain trends helps players maximise the expected wave of widespread acceptance and technological innovation.