Bitcoin whale accumulation Data from Caueconomy shows that big Bitcoin (BTC) holders, sometimes known as smart money, have amassed over 100,000 BTC since March. This trajectory differs somewhat from the larger market, where on-chain activity stays stationary and retail demand is still weak.

Institutional wallets have sped up purchases even if smaller investors are hesitant; these big holders separate market emotion and conduct using current price declines to lower their average entry point.

Whales Quietly Accumulate Bitcoin

Whale wallets were dormant from December through February. That changed in March, when accumulation surged dramatically. Data from the Caueconomy reveals that over 100,000 BTC were added during this period, even as retail interest kept declining.

“Despite low activity on the Bitcoin and Cryptocurrencies network and weak retail demand,” Caueconomy said on X, “whale reserves have continued to grow.” This supports the idea that big players are establishing long-term positions and may be ready to grab gains on the next surge.

Bitcoin Eyes Bullish Breakout

Although traders’ opinions are still divided, various technical clues suggest that Bitcoin may be preparing for a bounce. Posting on X, trader Merlijn found a verified double bottom around the $78,700 zone. He pointed out that Bitcoin is currently valued at $86K and that a breakout beyond this point would cause an explosive increase.

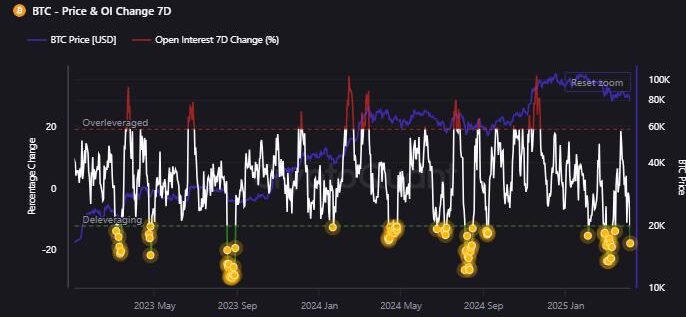

Short interest is also primarily focused around the $90,000 mark. Should Bitcoin breach this significant resistance, one trader cautioned that over $7 billion in BTC shorts might be sold off. With forced buy-backs, a brief squeeze might set off fast upward momentum.

Mikybull Crypto also shows another encouraging trend: a declining wedge formation on Bitcoin’s weekly chart, a pattern usually linked with positive reversals. His expected breakthrough aim is close to $99,000. Still, many traders wait for more general market signals before committing to a direction since these configurations call for confirmation.

Bollinger Bands “W” Bottom in Bitcoin

Author of the Bollinger Bands indicator, John Bollinger, commented on Bitcoin’s Journey’s current structure. Based on his patented %b signal, he noted in an April 10 post a likely “W” bottom developing on the weekly chart. Although he pointed out it’s a classic reversal pattern, he underlined that proof is still required.

Often used to identify turning points, the %b statistic follows closing prices about Bollinger Band positions. Should validation prove this pattern, it indicates that the recent lows in Bitcoin could point to a long-term bottom. However, BTC/USD still hangs close to the bottom band, while the intermediate band provides short-term opposition.

Bitcoin’s Link to Markets Weakens

The narrowing link between Bitcoin and conventional markets complicates its short-term prognosis. Jurrien Timmer, director of Global Macro at Fidelity Investments, noted that stocks and Bitcoin had entered an extremely oversold area. He observed that the S&P 500 has moved from two standard deviations above trend to almost two below, a phenomenon equally applicable to Bitcoin whale accumulation.

Similarly, network economist Timothy Peterson said that although Bitcoin led the Nasdaq during the previous collapse, it might now trail behind in recovery. He also cautioned that a further 10% decline in stocks could still be ahead, probably postponing Bitcoin’s next significant action.

Summary

Whales have actively entered the market and have amassed over 100,000 BTC since March. Their activities imply increasing long-term confidence, even if retail involvement is still limited. Early indicators of a possible rebound are technical ones like a double bottom, declining wedge, and Bollinger Band signals. Still, primary short interest close to $9primaryd general macroeconomic pressures carry hazards.