XRP ETF Approved: Crypto buzzing news includes the recent announcement of an XRP-based Exchange-Traded Fund (ETF) that received regulatory approval. This is a long-awaited sign that institutional acceptance is growing amongst non-XRP holders and blockchain enthusiasts. Before popping the champagne, it’s important to understand this one key detail: it is not a spot ETF. So what does that mean? Why does it matter? And what could it mean for XRP and the wider crypto landscape?

What Is an XRP ETF?

ETFs natively relate to a pool of investments that follow the value of the particular asset or group of assets and trade on stock exchanges like any common stock. In the case of cryptocurrencies, an ETF follows the cryptocurrency business. An instance is the newly approved XRP ETF, which provides exposure to XRP-the cryptocurrency of the Ripple network-through derivatives-like futures contracts-instead of directly holding XRP.

Spot ETF vs. Futures ETF

For a deeper understanding of the implications, it is vital to differentiate between spot ETFs and futures ETFs:

For a deeper understanding of the implications, it is vital to differentiate between spot ETFs and futures ETFs:

- Spot ETFs hold the underlying asset directly. A spot XRP ETF would hold XRP tokens physically, or in a digital sense, on behalf of the investors, having as price the market price of XRP at that moment.

- On the contrary, a futures ETF buys futures contracts for the assets. Those are contracts for purchasing or selling the asset at a given price on a subsequent date. While they are intended to keep pace with the value of the assets, futures may further complicate matters by creating such circumstances as contango (in which futures prices exceed spot prices)

- And rollover costs, which can create divergence in performance of the ETF and value of the cryptocurrency itself.

So, while an XRP ETF has indeed been approved, it’s structured around futures, not spot holdings.

Why the Distinction Matters

The difference between spot and futures ETFs may seem subtle, but it has real consequences:

- Price Tracking Accuracy: Spot ETFs tend to track the price of the underlying asset more closely. Futures ETFs are susceptible to price distortions due to market conditions, contract rollovers, and expiration cycles.

- Market Impact: Spot ETFs require actual purchases of the underlying asset. If XRP were being directly bought for ETF purposes, it could significantly impact demand and price. A futures ETF doesn’t have this effect since it doesn’t involve buying XRP itself.

- Investor Appeal: Many institutional and retail investors prefer spot ETFs because of their simplicity and better price correlation. Futures-based products can be harder to understand and carry more risk, especially in volatile markets like crypto.

Why Was an XRP Futures ETF Approved First?

This mirrors what happened with Bitcoin in the U.S. Regulators, particularly the Securities and Exchange Commission (SEC), have shown more willingness to approve futures-based crypto ETFs before considering spot versions. The reasoning often cited includes:

This mirrors what happened with Bitcoin in the U.S. Regulators, particularly the Securities and Exchange Commission (SEC), have shown more willingness to approve futures-based crypto ETFs before considering spot versions. The reasoning often cited includes:

- Futures contracts trade on regulated platforms like the Chicago Mercantile Exchange (CME), offering more oversight and market surveillance.

- Concerns about fraud and market manipulation in spot crypto markets remain a key barrier for regulatory approval of spot ETFs.

- By approving a futures-based XRP ETF first, regulators are dipping their toes in the water, offering a relatively safer, more controlled exposure to XRP for traditional investors.

Implications for Ripple and XRP

The Ripple firm has long been contesting in courts the merits of XRP being categorized as a security. This case still rages and will have a significant bearing on the future of XRP, considering any regulatory crumbs offered or swallowed. The approval of an XRP ETF, albeit a futures-based one, shows increasing comfort for institutional involvement with XRP as an asset class. Coin E Tech – Latest News on Crypto.

It also shows the possibility that regulators are becoming lenient, at least to the extent of permitting XRP-related financial products into the mainstream channels of investment. This could increase the confidence of retail investors and trigger further adoption. Unless a spot ETF is permitted, however, the price ramifications and the legitimacy of XRPs in the market may remain limited.

What’s Next for XRP ETFs?

And now that a futures ETF has been approved, attention is naturally turning toward the prospect of a spot XRP ETF. It could be a game-changer, coming about in the future with precise timing. Just look at what happened with Bitcoin: after years of futures ETFs, the U.S. finally approved in early 2024 multiple spot Bitcoin ETFs, leading to a massive inflow of institutional purchases and increased interest in the asset.

For XRP, a spot ETF would mean:

- Institutional investors would likely gain more confidence to enter the XRP market.

- Demand could increase substantially, possibly influencing the price in a significant way.

- Ripple’s broader vision for cross-border payments and utility-based crypto usage would gain further legitimacy.

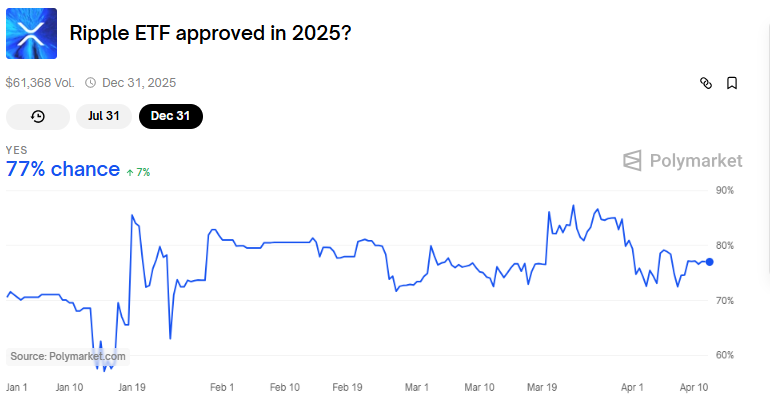

But that path is still uncertain. Regulatory clarity remains a hurdle, and the SEC has not yet indicated it’s ready to approve a spot XRP product.

Final Thoughts

The announcement of an XRP ETF concluded a stellar run in the world of finance: that’s right, neighbors, it’s just a futures ETF after all. This has been great for saying that the world isn’t going old-fashioned, concentrating everything on Bitcoin and Ethereum. It is, though, a step closer to what’s essentially a spot ETF that many previously believed would come.

Here, in derogatory optimism, investors should approach this. It marks an entry into the quotation of XRP, but does not yet mean complete institutional acceptance, which could change once in months, if not years, with shifting regulatory tides and Ripple’s legal challenge going in favor of them. Until then, the message is clear: progress has been made but not much as yet for XRP to really join the big players in ETF territory.