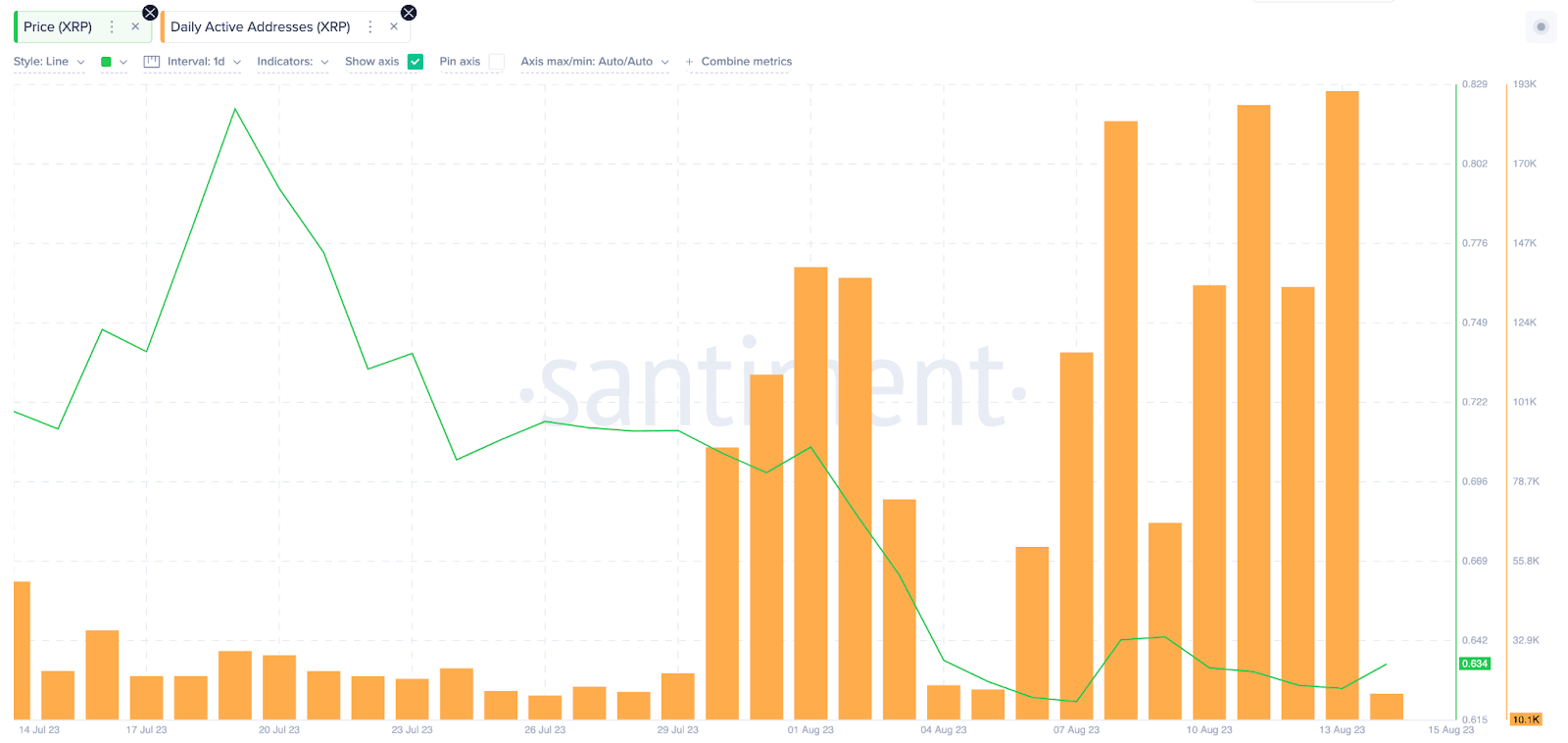

Investor engagement with XRP significantly diminished over the past few days. Together with the terrifying uncertainty in the crypto space, this reflects a growing uncertainty in the perception of XRP in the market context. The active addresses on the XRP network have plummeted dramatically to a low of merely 123,000 from a recent high of 530,000.

The massive drop hints at investors’ diminished confidence and heightened apprehension about getting involved with the altcoin. Declining participation reflects an overall market bearish sentiment, implying that most traders are backing away from XRP.

XRP Market Trends Stability

The sharp reduction in active addresses indicates that investors are increasingly cautious about XRP. As participation levels decrease, liquidity within the XRP market also shrinks. Lower liquidity makes it harder for the altcoin to recover quickly from price drops and reduces the chances of a strong upward movement.

However, long-term holders (LTHs) have emerged as a key stabilising force for XRP. Despite the recent downturn, many LTHs have held onto their positions rather than sell at lower prices. This behaviour has helped prevent XRP from sliding below critical support levels. The MVRV (Market Value to Realised Value) Long/Short Difference indicates that LTHs are currently sitting on significant profits, which gives them less incentive to sell during market dips. Their decision to hold onto their investments has been crucial in maintaining XRP’s price stability.

XRP Price Analysis Overview

XRP’s price is currently at $2.2, above the critical support of $2.14. The altcoin, though experiencing a 22% correction in recent weeks, has avoided dipping below the crucial level of $2.00. This indicates that long-term holders are taking centre stage in supplying a safety net to the asset. If LTHs maintain their stance, XRP can consolidate above the $2.14 level.

As of March 12, 2025, XRP trades around USD 2.20. The key support levels for XRP are between $2.20 and USD 2.30. If the price drops below this zone, it could trigger further bearish momentum. On the upside, XRP must break through resistance levels to confirm any bullish trend.

The broader cryptocurrency market has been quite volatile recently, influenced by economic conditions and regulatory news. XRP’s price movements are often linked to these more significant market dynamics. Analysts are paying close attention to how XRP reacts to upcoming events and market sentiment. Yet, crossing above the $2.33 resistance point can be tricky in the current market climate.

XRP Price Forecast Overview

Based on prevailing market trends, XRP will likely stay range-bound between $2.14 and $2.33 soon. The breakout in both directions will depend highly on overall market trends and investors’ sentiment. If Bitcoin Price and other prominent cryptocurrencies show a strong upward trend, XRP might keep pace and test the $2.33 resistance level. Conversely, if the bearish sentiment continues or economic uncertainty grows, XRP may come under renewed pressure and threaten to go below the $2.14 support level.

XRP’s long-term prospects are also connected with the actions of LTHs and the overall market sentiment. The more long-term holders hold on and market conditions stabilise, the more XRP might witness a steady price recovery. However, a long-term rally will need increased investor confidence and enhanced market liquidity. Until then, XRP’s price movement can be expected to stay in a tight trading range, with risk-averse optimism from investors.

Final thoughts

The paper offers a complex picture of XRP’s present market situation, stressing its possibilities and problems. With active users dropping from 530,000 to just 123,000, the notable loss in active addresses on the XRP network points to a fall in investor involvement and confidence. Together with the general bearish market attitude, this drop in participation shows traders’ cautious approach, which makes it more difficult for XRP to bounce back rapidly from price falls. The less liquidity in the market further complicates any possible upward rise.

Conversely, for XRP, long-term holders (LTHs) have been vital in helping to stabilise the currency. Sitting on significant gains, these investors have been less likely to sell during market declines, keeping XRP from sliding below critical support levels. Their eagerness to hold has allowed XRP’s price to remain above the crucial $2.14 support level, based on stabilisation.