XRP Bitcoin pattern analysis is witnessing an intriguing development, as XRP displays technical patterns remarkably similar to those of Bitcoin’s behaviour before its explosive surge from $70,000 to $100,000 in late 2021. This pattern recognition has caught the attention of technical analysts and investors alike, suggesting that XRP might be positioned for a significant bullish breakout.

Bitcoin-XRP Pattern Connection

The MACD Signal That Started It All

The Moving Average Convergence Divergence (MACD) indicator has become the focal point of this analysis. XRP’s price shows resilience against bearish MACD signals, indicating potential for a bullish trend. The current XRP market situation mirrors BTC’s conditions before its late 2024 surge from $70,000 to $100,000.

The MACD indicator measures the relationship between two moving averages of an asset’s price. When MACD bars cross from negative to positive territory, it typically signals a bullish shift in momentum, often indicating the beginning of an uptrend. This exact pattern preceded Bitcoin’s remarkable rally to six-figure territory.

Technical Analysis Breakdown

Key Technical Indicators Supporting the Bullish Thesis:

- MACD Convergence: The indicator is showing similar convergence patterns that preceded Bitcoin’s major breakout

- Ascending Channel Formation: XRP rebounded sharply after a 6% drop, stabilising above $2.04 and forming a bullish ascending channel

- RSI Momentum Shift: RSI momentum shifted strongly bullish, exiting oversold territory and indicating strengthening momentum

Current Market Performance and Price Levels

Recent Price Action

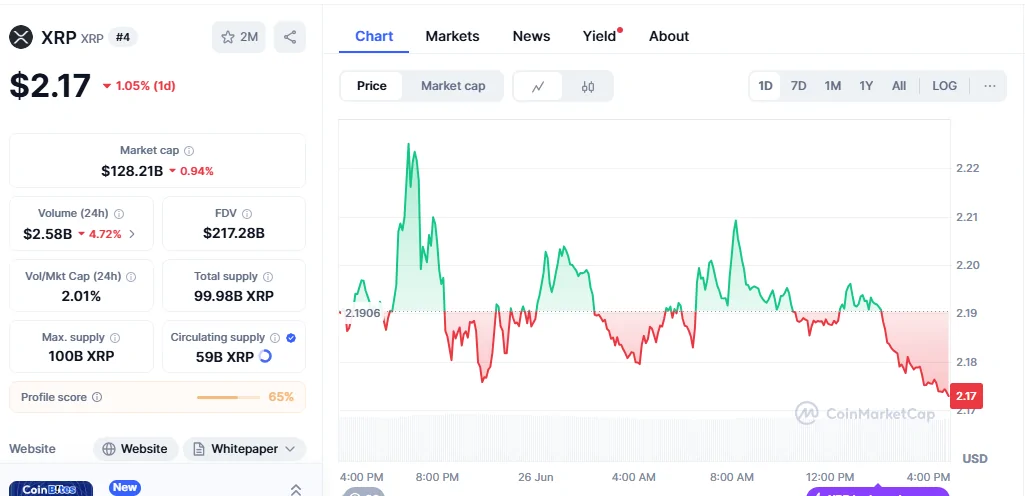

XRP has demonstrated remarkable resilience in recent trading sessions. XRP reached its highest price on January 16, 2025 — it amounted to $ 3.40000, establishing a significant high for the year. Currently, the token is trading in a consolidation phase with key support and resistance levels clearly defined.

Critical Price Levels to Watch

Support Levels:

- Primary support: $2.04-$2.05 range

- Secondary support: $1.92-$2.00 zone

Resistance Levels:

- Immediate resistance: $2.09-$2.22

- A breakout above the $2.22 level will cause XRP to run to the $2.30 level or above

Expert Price Predictions and Market Outlook

Short-Term Projections (6-12 Months)

Market analysts are presenting optimistic forecasts for XRP’s near-term performance. XRP is expected to gain 42.94% in the next six months and reach $3.16 on December 22, 2025, according to technical analysis models.

Long-Term Bullish Scenarios

The long-term outlook for XRP appears even more promising:

- 2026 Projections: XRP roughly 3× to 4× up from 2025 levels by 2026, driven by Ripple expanding ODL to more corridors, a significant increase in transaction volumes, or a crypto market upswing

- 2028 Forecasts: Price range in 2028: $5.82–$21.82, with CryptoNews anticipating that Ripple will gain substantial backing from institutional investors

Fundamental Drivers Supporting the Bullish Case

Regulatory Clarity and Legal Developments

The rising confidence of the XRP Army awaits a positive outcome of the Ripple vs. SEC lawsuit, accompanied by growing optimism surrounding potential ETFs and progress related to RLUSD. This regulatory clarity could serve as a significant catalyst for institutional adoption.

Institutional Adoption and Use Cases

Ripple’s expanding network of financial institutions continues to drive real-world utility for XRP. The token’s role in cross-border payments and remittances provides fundamental value beyond speculative trading.

Market Maturation Factors

Technical patterns such as ascending channels could highlight steady upward growth, while the MACD may continue to show positive divergence. As the crypto market matures, XRP Bitcoin pattern analysis adoption as a mainstream financial tool could push its value to unprecedented levels.

Risk Factors and Potential Downside Scenarios

Technical Risks

While the bullish pattern is compelling, traders should be aware of potential risks:

- A decisively low close under $1.92–$2.05 on volume signals downside is still dominant

- Market volatility could disrupt the pattern formation

- Global economic uncertainty is affecting cryptocurrency markets

Regulatory Considerations

Despite positive developments, U.S. regulatory risks remain a factor that could impact XRP’s price trajectory.

Trading Strategies and Market Timing

For Bullish Scenarios

Traders looking to capitalise on the potential breakout should monitor:

- Volume Confirmation: High volume breakouts above $2.22 resistance

- MACD Signal Confirmation: Sustained positive MACD histogram readings

- Support Holding: Maintaining levels above $2.04-$2.05

Risk Management

- Set stop-losses below key support levels

- Consider position sizing based on volatility

- Monitor Bitcoin’s performance as a market leader

Conclusion

The technical similarities between XRP’s current pattern and Bitcoin’s pre-$100K formation are striking and warrant serious attention from both technical analysts and fundamental investors. The long-term targets range from $3 to $8 if the breakout holds. Some analysts are bullish, but the returns of fundamental investors don’t guarantee future results. The combination of improving technical indicators, regulatory clarity, and growing institutional adoption creates a compelling case for XRP’s potential significant upward movement. Investors should remain vigilant for confirmation signals while managing risk appropriately.