XRP Price Outlook Ripple’s XRP has sometimes stood out for its stability and excellent community support in a market known for its volatility and speculation. But new events are throwing shadows on its near-term pricing path. Following an ongoing influx pattern marked by institutional investments and retail confidence pushing XRP’s price higher, the trend seems to be reversing.

Market analysts and blockchain data point to XRP approaching a significant support level as investor inflows dry off, possibly as low as $2. This change has spurred discussions about Ripple’s future, the effects of SEC litigation, and the changing relations in the larger bitcoin ecosystem.

Institutional Confidence in XRP Faces Sharp Decline

Long-term institutional inflows are a gauge of market confidence in digital assets. Driven mainly through fresh confidence following a partial judicial victory in Ripple Labs’ continuous fight against the U.S. Securities and Exchange Commission (SEC), CoinShares’ Digital Asset Fund Flows report shows XRP enjoyed a good run of inflows during Q1 and early Q2 2025. Inspired by liquidity from crypto hedge funds and more listings on major exchanges like Coinbase and Kraken, XRP shot from under $0.60 to highs over $3.50 during this period.

Still, the last two weeks have seen a significant change. The same Coin Shares data shows that XRP showed net outflows of $5 million for the first time in 2025, indicating declining institutional interest. This slump corresponded with the Fed’s surprising hawkish remarks on interest rates and increased conjecture on more stringent crypto control in the United States.

Blockchain information from Santiment supports this change of attitude even further. Declining tendencies abound in on-chain indicators like active addresses, transaction volume, and social sentiment indices. A declining XRP trade volume across distributed exchanges such as PancakeSwap and Uniswap indicates a more general pullback from risk assets.

Regulatory Uncertainty Continues to Stall XRP Growth

XRP’s price fluctuations are heavily influenced by the continuous SEC v. Ripple Labs case. The matter is far from settled, even if Judge Analisa Torres’s 2023 summary judgment, which said XRP is not a security in secondary sales, momentarily drove the coin to new heights. The appeal and continuous debates of the SEC have long shadowed XRP’s long-term regulatory clarity.

The uncertainty affects ordinary investors and institutional players who need legal certainty before deploying funds. In their most recent 13F filings with the SEC, BlackRock, Fidelity Digital Assets, and Grayscale have stopped further investment or exposure to XRP, citing “regulatory uncertainty.” The asset stays in limbo without a definitive answer, limiting its upward movement.

XRP Faces Bearish Signals Amid Market Pressure

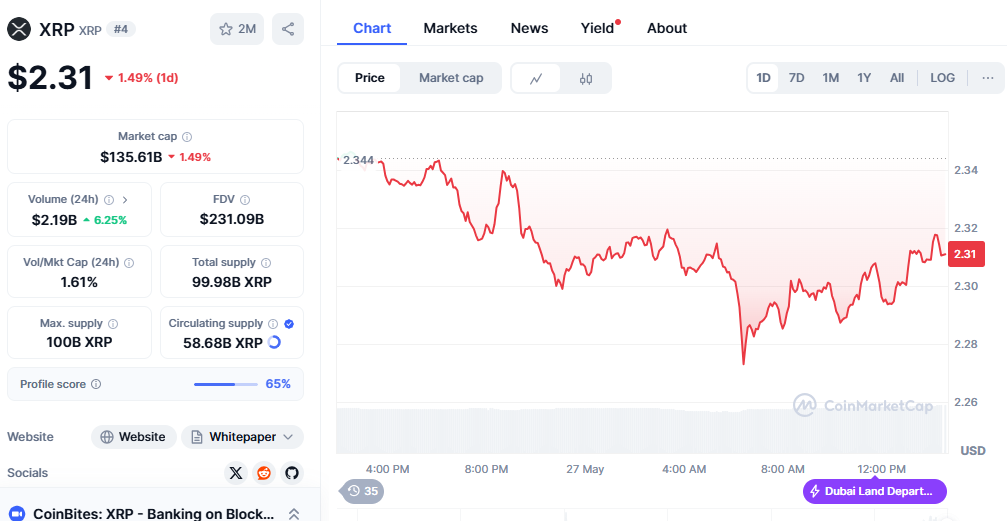

Technically, XRP’s price behavior points to a traditional distribution phase preceded by a developing downward trend. The Relative Strength Index (RSI) on the daily chart has slipped below 50, signifying weakening hopeful momentum. Whereas the 50-day moving average approaches a death cross with the 200-day MA – a typically bearish indication in technical trading, the Moving Average Convergence Divergence (MACD) has switched bearish.

According to crypto market researcher Michaël van de Poppe, the next major demand zone falls around the psychological $2.00 barrier, should XRP lose its present support at $2.40. From its current high, this would show a roughly 40% drop and cause more liquidation among leveraged traders. Traders should also be alert for volume confirmation; a lack of buying demand at these levels would confirm the bearish breakdown.

Whale Moves and Falling Interest Signal Caution

From private wallets to centralized exchanges like Binance, Huobi, and Bitstamp, on-chain analytics company Whale Alert has seen a notable rise in large-scale XRP transactions. Usually, these swings come before sell-offs when whales set themselves to rebalance or leave holdings.

Furthermore, Google Trends data on “XRP price prediction” and “Is XRP a good investment ” have dropped by 30% in the past thirty days, demonstrating declining retail interest. Often focused on long-term holding and regulatory prediction, social media sites like Reddit and X (previously Twitter) reflect a turn in community debates from optimistic to protective ones.

XRP Volatility Amid Broader Crypto Market Pressures

Recent problems with XRP do not occur in a vacuum. Additionally, Bitcoin and Ethereum are seeing corrections due to macroeconomic challenges. Risk assets have lost appeal as rising U.S. Treasury rates, a surging U.S. dollar, and geopolitics in Eastern Europe cause uncertainty. Because of weaker liquidity and greater beta than Bitcoin, altcoins like XRP often show more volatility in this scenario.

XRP is in a separate class because of its special use as a cross-border payment system via RippleNet. Institutions in the Asia-Pacific area, especially in Japan and Singapore, keep experimenting with XRP as a liquidity bridge currency. These practical use cases could help ground the asset even if speculative capital is withdrawing.

XRP’s Resilience Amid Regulatory and Market

XRP’s long-term fundamentals remain strong even with short-term bearish pressure, provided regulatory clarification is obtained. Ripple keeps broadening its alliances around the world, notably including the Bank of England’s sandbox project and the Monetary Authority of Singapore (MAS). Few other cryptocurrencies can match the value proposition that XRP provides when it is included in the payment systems of developing nations.

Still, traders and investors must tread carefully in the near future. Macroeconomic elements, market mood, and technical indications all point in a direction that would test XRP’s resiliency. Should the $2 support collapse, cascade sell-offs could follow. Conversely, a surprising settlement in the SEC lawsuit or a larger crypto movement might inspire hopeful momentum once more.

Conclusion

XRP finds a junction. The likelihood of a drop to $2 is becoming more than just a theoretical scenario as institutional inflows dry up, technical patterns become bearish, and regulatory fog thickens. Still, within the volatility there remains a chance for accumulation—especially for long-term believers in Ripple’s goal to transform world finance.

The next weeks will be critical. Investors should regularly check on-chain activities, legal changes, and worldwide economic trends. Though the XRP narrative is far from finished, caution is justified for now.