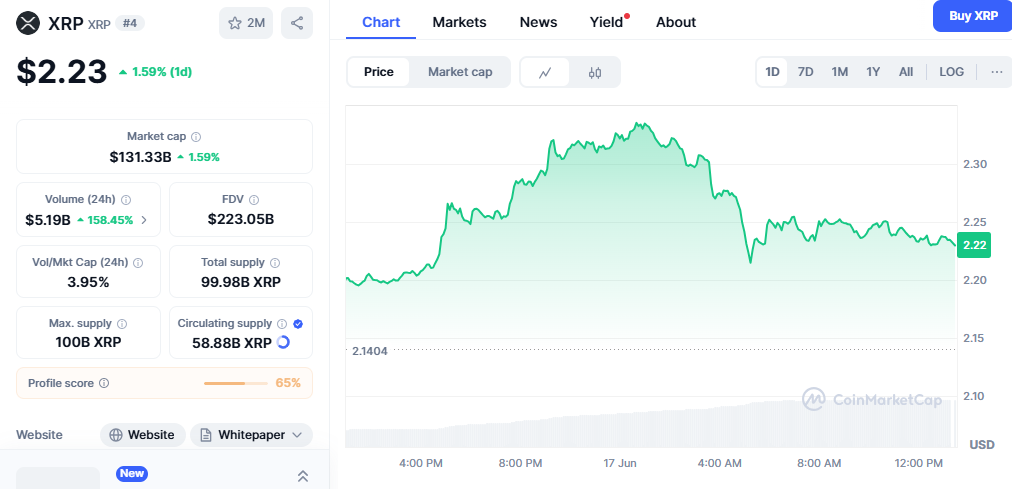

The cryptocurrency market is witnessing renewed optimism surrounding XRP Price Prediction Breakout as technical analysts and market data suggest a potential breakout toward $4.80, with ambitious targets reaching $8 in the near term. XRP climbs to $2.23 after a 2.76% daily gain, eyes breakout toward $4.80 and $8 targets, signalling a pivotal moment for Ripple’s native token amid surging network activity and institutional interest.

Current Market Dynamics Drive XRP’s Bullish Momentum

The digital asset landscape has experienced significant shifts in recent weeks, with XRP emerging as a standout performer. As of June 1, 2025, XRP is trading at $2.17, showing resilience despite the crypto market’s inherent volatility, demonstrating the token’s ability to maintain stability while positioning for upward movement.

The foundation for XRP’s bullish outlook stems from multiple converging factors that create a compelling narrative for sustained price appreciation. Market participants are closely monitoring key technical levels as the token approaches critical resistance zones that could unlock substantial upside potential.

Technical analysis reveals that XRP has successfully established support above the $2.00 psychological level, creating a solid base for further advancement. The token’s ability to maintain these levels while building momentum suggests that institutional and retail investors are positioning for a significant move higher.

Whale Accumulation Signals XRP’s Bullish Price Potential

One of the most compelling indicators supporting XRP’s bullish thesis is the notable increase in whale accumulation patterns. Whale accumulation rises, with 2,700 wallets holding 1 M+ XRP as network activity surges, indicating that large-scale investors are positioning themselves for potential price appreciation.

The concentration of XRP holdings among high-net-worth entities has reached significant levels, with data showing strategic accumulation by institutional players. Data indicates that entities holding between 10 million and 100 million XRP now possess approximately 12.1% of the total supply, up from 11.88% earlier this month, reflecting growing confidence among sophisticated market participants.

This accumulation behaviour typically precedes major price movements in cryptocurrency markets, as whales often have access to superior market intelligence and longer investment horizons. The sustained buying pressure from these large holders creates a supportive environment for price appreciation while reducing available supply in the market.

Historical patterns demonstrate that when whale accumulation reaches current levels, XRP has experienced significant price rallies. The current accumulation phase suggests that smart money is positioning for a substantial move, potentially supporting the technical targets outlined by analysts.

Network Activity Surge Validates Growing Ecosystem Adoption

Beyond price speculation, XRP’s fundamental strength is evidenced by unprecedented network activity levels. The XRP Ledger is witnessing unprecedented levels of engagement, with daily interacting addresses averaging over 295,000 in the past week—a dramatic increase from the typical 35,000 to 40,000 range observed over the last quarter.

This dramatic increase in network utilisation represents more than speculative trading activity. The sustained engagement across the XRP Ledger indicates real utility and adoption, which provides fundamental support for higher valuations. When network metrics align with positive price action, it creates a more sustainable foundation for long-term appreciation.

The correlation between network activity and price performance has historically been strong for XRP, with periods of increased transaction volume and active addresses preceding significant price movements. The current surge in daily active addresses to 295,000 represents a seven-fold increase from normal levels, suggesting that the ecosystem is experiencing genuine growth rather than temporary speculation.

Technical Analysis Points to $4.80 Breakout Potential

From a technical perspective, XRP’s chart structure reveals several bullish patterns that support the $4.80 breakout scenario. The token has been consolidating within an ascending triangle formation, with higher lows and consistent resistance around current levels creating the conditions for an explosive move higher.

Key technical indicators are aligning to support the bullish thesis. The Relative Strength Index (RSI) has been building momentum without reaching overbought conditions, suggesting that additional upside remains before technical exhaustion sets in. Meanwhile, moving average convergence and volume patterns indicate that institutional accumulation is occurring at current price levels.

The $4.80 target represents a significant technical level that corresponds to previous resistance zones from XRP’s historical trading ranges. Breaking through this level would likely trigger additional buying from both algorithmic trading systems and momentum-based strategies, potentially accelerating the move toward the $8 target.

Support levels have been well-established around the $2.00 zone, providing a solid foundation for the anticipated breakout. This risk-reward setup appeals to both conservative investors seeking defined downside protection and aggressive traders targeting the substantial upside potential.

Analyst Projections and Market Sentiment Analysis

Professional analysts across the cryptocurrency space have begun revising their XRP price targets upward as market conditions continue to improve. Given these insights, 1 XRP could realistically be worth $3–$8 by the end of 2025, though macroeconomic risks like rising U.S. yields could temper gains, according to comprehensive technical analysis from leading market research firms.

The consensus among technical analysts suggests that XRP’s current position represents an optimal entry point for investors seeking exposure to potential breakout scenarios. With technical indicators flashing green and ecosystem developments accelerating, XRP could be poised to hit $4.50 by June 2025, marking a significant rebound.

Conservative projections place XRP’s near-term targets between $3.00 and $5.00, while more aggressive scenarios envision the token reaching $8.00 or higher. If these catalysts materialise, the asset may push beyond $5, with bull scenarios reaching $8–$10+, and rare mega-bull runs eyeing up to $27 by late 2025.

Market sentiment indicators suggest that retail and institutional interest in XRP is building momentum. Social media engagement, search volume trends, and trading volume metrics all point toward increasing awareness and participation in XRP markets.

Regulatory Clarity and Institutional Adoption Catalysts

The regulatory landscape surrounding XRP has evolved significantly, with increased clarity providing a more favourable environment for institutional adoption. This regulatory progress removes previous uncertainty that had limited institutional participation, opening the door for larger capital allocations from traditional financial institutions.

Ripple’s ongoing partnerships with financial institutions worldwide continue to create tangible utility for XRP, distinguishing it from purely speculative cryptocurrency projects. These real-world use cases provide fundamental value that supports higher valuations while reducing volatility associated with speculation-driven price movements.

The potential for XRP exchange-traded fund (ETF) approval has gained traction among market participants. According to Polymarket statistics, there is a 78% likelihood of an XRP ETF in the market by the end of 2025, which could dramatically increase institutional access and investment flows.

Risk Factors and Market Considerations

While the bullish case for XRP appears compelling, investors must consider potential risks that could impact the projected price targets. Macroeconomic factors, including interest rate policies and global economic uncertainty, continue to influence cryptocurrency markets broadly.

Market volatility remains a constant factor in cryptocurrency investing, and XRP’s price could experience significant fluctuations even within an overall bullish trend. The token’s correlation with broader cryptocurrency markets means that sector-wide corrections could temporarily derail individual price projections.

Regulatory developments, while generally positive, could introduce unexpected challenges if government policies shift unfavorably toward digital assets. Investors should monitor regulatory announcements from major jurisdictions that could impact XRP’s trading and adoption prospects.

Competition within the digital payments sector continues to intensify, with central bank digital currencies (CBDCs) and other blockchain solutions vying for market share. XRP’s ability to maintain its competitive position will influence long-term valuation prospects.

Strategic Investment Considerations for XRP Holders

For investors considering XRP exposure, the current market environment presents both opportunities and challenges that require careful analysis. The technical setup supporting the $4.80 breakout target appears robust, while fundamental factors, including network growth and institutional adoption, provide additional validation.

Portfolio allocation strategies should consider XRP’s risk-reward profile within the broader cryptocurrency landscape. The token’s established market position and real-world utility differentiate it from newer, more speculative projects, potentially making it suitable for more conservative crypto allocations.

Dollar-cost averaging strategies may prove effective for investors seeking long-term XRP exposure while managing volatility risk. This approach allows participants to benefit from potential upside while mitigating the impact of short-term price fluctuations.

Risk management remains paramount, with position sizing and stop-loss strategies essential for protecting capital during periods of market uncertainty. Even the most compelling technical setups can fail, making prudent risk management crucial for long-term investment success.

Future Outlook and Price Target Validation

The path toward XRP’s $4.80 and $8.00 price targets will likely depend on continued network growth, institutional adoption, and favourable market conditions. Current momentum indicators suggest that these levels are achievable within the projected timeframes, though investors should prepare for potential volatility along the way.

Monitoring key metrics, including daily active addresses, whale accumulation patterns, and trading volume, will provide early indicators of whether the bullish thesis remains intact. Sustained growth in these fundamental metrics would support continued price appreciation toward the outlined targets.