Solana reaches $300: Driven by its promise of scalability, speed, and cost, Solana (SOL) has been among the most discussed cryptocurrencies of late. One issue still stands front and foremost, nevertheless, given market volatility and constantly changing investor mood: Can Solana once more reach $300? To respond to this, we have to investigate a multifarious study combining technical trends, macroeconomic situation, blockchain acceptance, ecosystem development, and past price movements.

Solana’s Scalable Blockchain Powering Web3 Innovation

Former Qualcomm engineer Anatoly Yakovenko created the high-performance layer-1 blockchain Solana. Thanks to its unique Proof-of-History (PoH) consensus mixed with Proof-of-Stake (PoS), launched in 2020, the platform is meant to handle distributed apps (dApps) and smart contracts with lightning-fast transaction speed. With minimal costs, these developments let Solana execute over 65,000 transactions per second, surpassing many rivals, including Ethereum and Cardano, in sheer capacity.

With uses in DeFi (Decentralised Finance), NFTs (Non-Fungible Tokens), and Web3 gaming, Solana’s practical applications have grown rather broad. Projects highlighting Solana’s expanding developer and user community include Magic Eden, Audius, and Star Atlas. If kept under control and scaled, these principles generate rich ground for the next price increases.

Solana’s Volatile Journey and Ongoing Recovery

The price history of Solana shows both the terrible pullbacks of the 2022 crypto winter and the explosive expansion of the 2021 bull run. Driven mostly by increasing developer interest, institutional acceptance, and the NFT frenzy, SOL jumped from under $5 in early 2021 to an all-time high of $259.96 in November 2021. But the fall of FTX, one of Solana’s main supporters, in late 2022 seriously undermined investor confidence and resulted in SOL’s slide below $10.

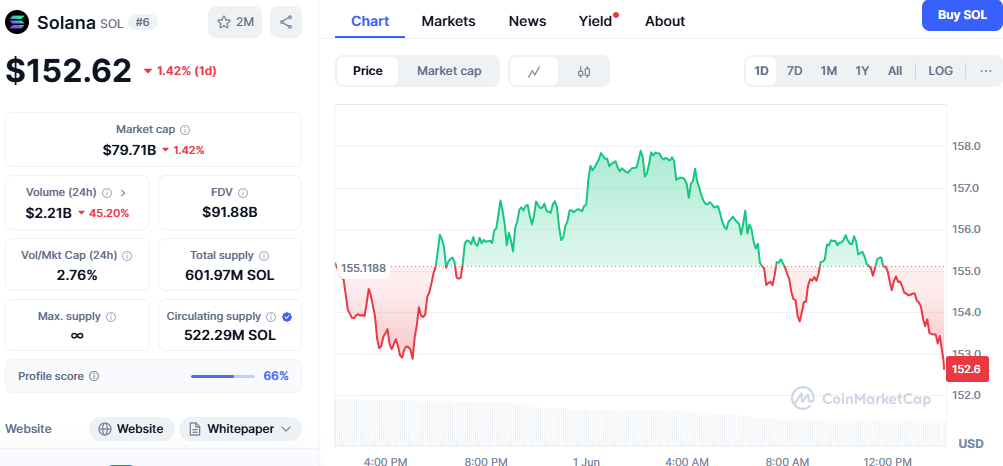

Inspired by better on-chain metrics, strong developer engagement, and growing institutional interest, Solana has shown indications of recovery in 2024 and 2025 despite these losses. Current prices range from $150 to 170, and market analysts are now debating the likelihood of a return to $300.

Solana Shows Bullish Signals Amid Technical Breakout

Looking at Solana’s present price chart, multiple technical indicators point to a positive trend developing. A major long-term indicator of upward momentum, the token has lately exceeded its 200-day moving average. Additionally, a cup-and-handle pattern looks to be emerging, which traditionally predicts upward breakthroughs in crypto markets.

The immediate resistance rests around the $180 mark. A successful breach over that level could provide the route to the psychological barrier of $200. To hit $300, though, Solana reaches $300 must not only exceed prior resistance zones but also show consistent volume and great market confidence. Should market conditions reflect those of past optimistic cycles, especially about Ethereum’s transitions and Bitcoin’s halvings, Solana may find a fresh speculative interest guiding it toward that aim.

Macroeconomic Forces Shaping Solana’s Growth

Globally, macroeconomic variables, especially U.S. interest rate policies, inflation trends, and regulatory clarity, greatly affect crypto assets like Solana. The Federal Reserve’s dovish posture, paired with rising risk tolerance among individual and institutional investors, might attract money into cryptocurrencies with sound foundations.

Dominance of Bitcoin is another important macro element. Capital often moves into high-potential altcoins like Solana during periods when Bitcoin settles or trades sideways. Solana reaches $300 gained a lot from this rotation in the previous bull cycle, and such dynamics could resurface.

Moreover, Ethereum’s scalability problems still exist, especially regarding Layer 2 dependencies and gas prices. This keeps Solana a competitive choice for developers looking for quicker and less expensive transaction environments.

Solana’s Developer Ecosystem Fuels Long-Term Growth

The long-term value proposition of Solana is tightly related to its developer ecosystem. Based on the Developer Report from Electric Capital, Solana boasts one of the greatest active developer counts outside Ethereum. To support a thriving builder community, the Solana Foundation has also lavished funds on developer grants, hackathons, and accelerator programs.

Tokenised infrastructure, GameFi, and Real-World Assets (RWAs) are all seeing new applications developed. Designed by Jump Crypto, Firedancer is a new validator client meant to greatly increase network performance and uptime, hence solving the many outages that have previously dogged Solana. This increasing developer activity points to long-term optimistic possibilities and great confidence in the technical direction of the platform.

Key Competitors and Strengths of Solana

The main rivals of Solana are Ethereum, Avalanche, Polkadot, and Arbitrum. Although Ethereum has a first-mover advantage and general institutional support, its scalability problems and need for Layer 2 networks open space for substitutes like Solana.

Avalanche presents similar speed but suffers from ecosystem depth and liquidity. Though Polkadot has great compatibility, its popular acceptance has been delayed. Though they mostly depend on Ethereum’s base layer, Arbitrum and other Ethereum L2S gain from its security. Solana now ranks among the most feasible “Ethereum killers,” in terms of user growth, TPS, and developer activity; this helps SOL favourably in speculative and fundamental studies.

Can Solana Realistically Reach $300?

Solana’s market capitalisation must exceed $130–150 billion based on current supply inflation if it is to reach $300. Given Ethereum’s market capitalisation right now of about $400 billion, this is not improbable. Reaching a $300 valuation would mark a return to past highs rather than a speculative moonshot if Solana keeps on its growth path, driven by mass use, ecosystem expansion, and improved public opinion.

Still, there are some hazards. Especially in the United States, regulatory headwinds might limit institutional involvement and retail access. Technical dependability is another issue since earlier disruptions raise questions on the stability of the network. Maintaining such price levels will depend on overcoming these obstacles.

Future Forecast and Important Drivers

Many catalysts materialising over the next 12 to 24 months will determine the route to $300. Among these are Firedancer’s accomplishments in stabilising the network, the release of significant consumer-facing dApps, and growing Solana use in tokenised real-world assets. Furthermore, likely to increase all major altcoins, including Solana reaches $300, is a rejuvenated bull cycle in the larger crypto market driven by Bitcoin ETF inflows, world monetary easing, or geopolitical changes.

Solana Pay’s increasing popularity, integration with mobile devices like the Solana Saga phone, and the drive toward distributed social media protocols like Dialect also point to Solana’s dedication to practical applications outside of conjecture.

Growing Institutional Interest in Solana

Prominent experts such as Raoul Pal of Real Vision and Chris Burniske of Placeholder VC have already lauded Solana’s design and potential. While wary about near-term volatility, they acknowledge Solana as a cornerstone of Web3 infrastructure with the potential for exponential expansion.

Sentiment in the crypto community has also improved. On-chain measures like active wallets and total value locked (TVL) are rebounding, while institutional players like Franklin Templeton and VanEck show interest in Solana-based products and trading volume on centralised exchanges has grown.